Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 20 May 2015 00:56 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

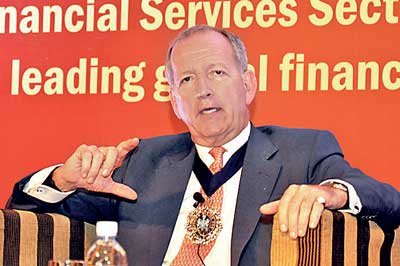

The Lord Mayor of the City of London Alderman Alan Yarrow yesterday shared a raft of key measures Sri Lanka should prioritise if it is keen on becoming a competitive financial centre in the region.

Speaking at a CEO’s Forum organised by the Institute of Chartered  Accountants of Sri Lanka (CA Sri Lanka) and the Chartered Institute for Securities and Investment (CISI), Yarrow spoke on key factors such as innovation, legal structure, skills, product development, English, geography, ethics, infrastructure and hard work, which Sri Lanka should focus on in order to become a major financial hub.

Accountants of Sri Lanka (CA Sri Lanka) and the Chartered Institute for Securities and Investment (CISI), Yarrow spoke on key factors such as innovation, legal structure, skills, product development, English, geography, ethics, infrastructure and hard work, which Sri Lanka should focus on in order to become a major financial hub.

Pointing out that Sri Lanka had more qualifications per capita than any other emerging economy, he emphasised that becoming competitive in terms of skills was not sufficient to earn the status of being a respected financial player within the region.

“You have to be creative, innovative and well disciplined,” said the Lord Mayor at the Forum.

Revealing how the City of London became a competitive financial centre, Mayor Yarrow said that the combination of innovation and trust in the traditional foundation of the City of London and structural markets were helpful in attracting many international banks to the city.

“Innovation is critically important. It is about what customers really want and trying to put the transaction in place where value is delivered to the customer. But innovation alone cannot deliver value to the customer. We want the right cluster of lawyers and the right cluster of professionals and also the right cluster of banking services. Basically, it is about a combination of everything being in one place,” he added.

Yarrow also cautioned against over-regulation, saying it could kill innovation. Noting that markets were always ahead of regulation, the Mayor of City of London it was up to individual countries to decide whether to embrace a model of single super regulator or multiple regulators.

Outlining how Singapore had become successful, he said that although it did not have the luxury of agriculture or skills like Sri Lanka, it thrived by being competitive and open-minded.

“They are focused on doing the best they can do and it is a necessity. I think Sri Lanka has got to have that necessity as well. Singapore is being highly-competitive and hardworking,” the Lord Mayor told the Forum, which included a panel discussion involving industry experts HNB Managing Director Rajendra Theagarajah, First Capital CEO Dilshan Wirasekara and Copal Amba Country Head Chanakya Dissanayake.

“We all have a role to play in building the future of our global industry and we in the CISI and the UK want to support the development of the Sri Lankan financial services industry,” emphasised Yarrow, who completed a three-day visit yesterday – the first by a Mayor of City of London in over 30 years.

Acknowledging the significance of professional behaviour for development, the Mayor said: “We as the City of London get judged on how we treat people. Thus, the people have to be disciplined.”

The UK is the world’s leading exporter of financial and professional services with a trade surplus of £71 billion in 2013. It also accounted for 41% of global foreign exchange trading. Financial and related professional services contributed £174 billion to the UK economy in 2012 and represents 12.6% of UK economic output.

Commenting on Sri Lanka’s political framework, he said that the country had positioned itself strongly by using a democratic approach, which worked really well during the recent election. He stressed that keeping expectations in line with improvements in governance and delivery would help Sri Lanka going forward.