Monday Feb 16, 2026

Monday Feb 16, 2026

Saturday, 2 July 2016 00:28 - - {{hitsCtrl.values.hits}}

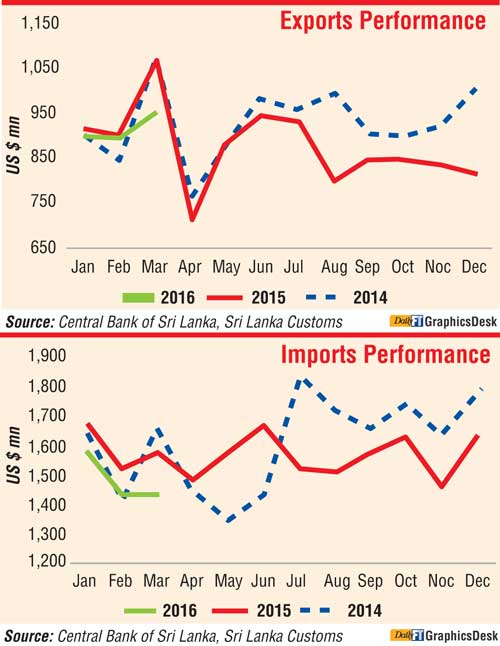

Sri Lanka’s trade deficit ballooned by 20% in March despite modest external trade performance whilst country continues to suffer declining exports.

Central Bank said yesterday the deficit in the trade account in March expanded by 20.2%, on a year-on-year basis, in March 2016 amounting to $ 621 million compared to $ 516. However, cumulative trade deficit during the first three months of 2016 contracted by 2.2% to $ 1.85 billion.

Slower exports that dropped 5.4% and imports down by 4.1% contributed.

From January to March 2016 exports dropped from $ 2.8 billion to $2.7 billion while imports declined from $4.7 billion to $4.5 billion when compared to the first quarter of 2015. The deficit in the trade account expanded by 20.2%, on a year-on-year basis, in March 2016 amounting to $621 million compared to $516 million in March 2015.

Earnings from exports declined by 11.2%, year-on-year, to $945 million in March 2016 from $ 1,065 million recorded in March 2015, the highest monthly earnings in 2015. The largest contribution for this decline came from transport equipment followed by exports of spices. Earnings from transport Economic Research Department equipment declined by 76.6%, year-on-year, mainly due to significantly higher level of exports recorded in the corresponding month of 2015 owing to export of a dredger vessel which was imported in 2014 for the use of the Port City Development Project.

Continuing the declining trend observed from the latter part of 2015, export earnings from spices decreased by 37.7%, year-on-year, in March 2016, reflecting substantial reduction in cloves and pepper exports due to lower harvest. Reflecting continuous decline in demand from major tea importers, especially Russia and the Middle East, earnings from tea exports declined marginally by 0.6% in March 2016. However, earnings from textiles and garments exports, which accounted for 46.7% of total export earnings, increased by 3.2%, year-on-year, to $442 million in March 2016, reflecting growth in exports to the USA and non-traditional markets.

On a cumulative basis, exports earnings during the first three months of 2016 declined by 5.4%, year-on-year, to $2,728 million reflecting a lower performance in exports of transport equipment and petroleum products. The leading markets for merchandise exports of Sri Lanka during the first three months of 2016 were the USA, UK, India, Germany and Italy, accounting for about 54% of the total exports.

Expenditure on imports declined for the ninth consecutive month in March 2016, marginally by 0.9%, year-on-year, to $1,566 million. This decline was led by the reductions recorded in import expenditure on transport equipment categorised under investment goods, personal motor vehicles categorised under consumer goods and wheat and maize categorised under intermediate goods.

Import expenditure on transport equipment and personal motor vehicles decreased by 61.6% and 39.4%, respectively, year-on-year, reflecting the impact of the policy measures adopted by the Government to curtail vehicle imports.

Accordingly, importation of motor vehicles, such as motor cars, motor cycles, commercial cabs, buses, lorries and auto-trishaws, declined significantly during the month. Despite a growth recorded in the average import prices, import expenditure on wheat and maize decreased substantially by 97.6% due to non-importation of wheat by Prima Ceylon (Pvt.) Ltd during the month of March 2016. Further, import expenditure on gold, fertiliser, unmanufactured tobacco and rice also declined significantly during the month. However, import expenditure on machinery and equipment, building materials and textile and textile articles increased significantly by 43.2%, 47.4% and 25.7%, respectively, year-on-year, indicating the possible expansion in future economic activities.

Meanwhile, reversing the year-on-year declining trend continued from November 2014, expenditure on fuel imports increased by 4.2% in March 2016 mainly due to non-importation of crude oil in March 2015 together with higher expenditure on coal imports which increased by 4.8%, on a year-on-year basis. Further, import expenditure on seafood, medical and pharmaceuticals, home appliances and telecommunication devices also increased during the month.

On a cumulative basis, expenditure on imports during the first three months of 2016 decreased by 4.1% to $4,594 million, mainly driven by the decline recorded in fuel imports. The non-fuel import expenditure during this period increased by 0.6% to $ 4,109 million. During the first three months of 2016, main import origins were China, India, Japan, Singapore and UAE, accounting for about 57% of total imports.

The cumulative earnings from tourism increased to $1,195.3 million during the first four months of 2016 compared to the $996.2 million recorded during the same period in 2015.

Tourist arrivals continued its growth momentum recording a growth of 11.6%, year-on year, in April 2016, with 136,367 tourists arriving during the month.

Tourism...

Accordingly, the cumulative tourist arrivals in the first four months in 2016 increased by 20.0% to 721,185 compared to the corresponding period of 2015.

The top five sources of tourist arrivals in April 2016 were India, China, UK, Germany and France, accounting for 53.1% of the total tourist arrivals during the month.

Workers’ remittances increased by 4.9%, year-on-year, to $675.7 million in March 2016 from $644.3 million recorded in March 2015. The cumulative inflow from workers’ remittances increased by 6.8% to $1,793.4 million during the first quarter of 2016, in comparison to the corresponding period of 2015.

Total FDI inflows with foreign loans to BOI companies in the first quarter of 2016 amounted to $ 164.5 million compared to $346.4 million in the corresponding period of 2015.

Meanwhile, foreign investments in the Colombo Stock Exchange (CSE) up to the end March 2016 recorded a net outflow of $12.5 million, including net outflows to the secondary market amounting to $13.8 million and inflows to the primary market amounting to $1.3 million.

Foreign investments in the government securities market recorded a net outflow of $572.3 million during the first quarter of 2016 compared to a net outflow of $15.4 million during the corresponding period of 2015. During the first quarter of 2016, long term loans to the Government recorded a net outflow of $116.1 million, compared to a net inflow of $4.5 million during the first quarter of 2015.

The $ 1,100 million swap arrangement with the Reserve Bank of India (RBI) was settled on 8 March 2016. However, Sri Lanka received $400 million under the SAARCFINANCE currency swap agreement on 8 March 2016 and received $ 700 million from another currency swap agreement with the RBI by end March 2016 which was subsequently settled in June 2016.

The overall Balance of Payments Position During the first quarter of 2016 - the overall BOP is estimated to have recorded a deficit of $ 720.2 million, compared to a deficit of $1,016.8 million recorded during the corresponding period of 2015.

International Reserves and Exchange Rate Movements Sri Lanka’s gross official reserves as at end March 2016 amounted to $6.2 billion, equivalent to 4.0 months of imports while total foreign assets amounted to $ 8.2 billion, equivalent to 5.3 months of imports.

The rupee recorded a modest depreciation of 0.8% against the US dollar during the period from end 2015 through 30 June 2016. Furthermore, reflecting the cross currency movements, the rupee also depreciated against the euro by 2.5%, the Japanese yen by 15.4%, the Canadian dollar by 7.4% and the Australian dollar by 2.8% during this period while appreciating against the pound sterling by 9.6% and the Indian rupee by 0.7%.