Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 30 September 2015 00:21 - - {{hitsCtrl.values.hits}}

The Central Bank said yesterday that external sector performance improved in July 2015, year-on-year, with a lower trade deficit and strong tourist earnings.

It said the increase in the cumulative trade deficit in July was 6%, down from 15.6% recorded in June this year, due to a sharp deceleration in imports during July 2015. Net inflows to the financial account remained moderate. The deficit in the trade account in July 2015 contracted substantially by 32.3% to $ 602 million in comparison to $ 889 million in July 2014. However, on a cumulative basis, the trade deficit during the first seven months of 2015 increased by 6.0% to $ 4,688 million.

“The decision of the Central Bank to allow greater flexibility in the determination of the exchange rate from 4 September 2015 is expected to help reduce the trade deficit further while improving the country’s gross official reserves, thereby leading to greater external sector stability,” the Central Bank said.

Following is the detailed statement on the external sector performance.

Export performance

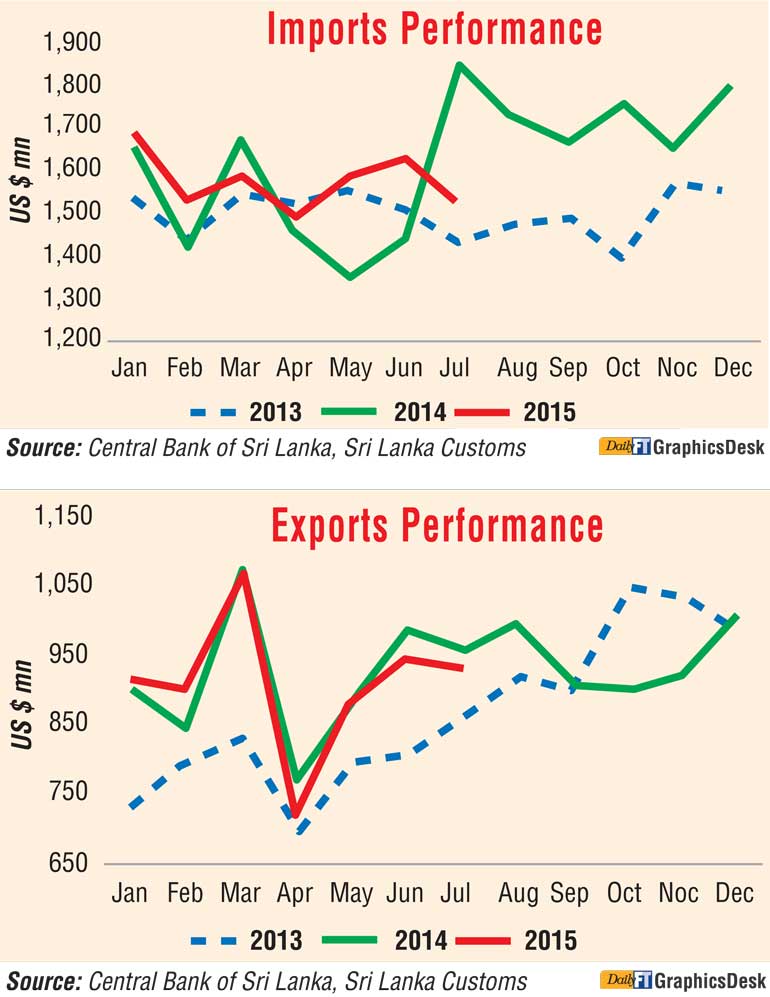

Export earnings dropped by 2.6% to $ 932 million in July 2015, reflecting a year-on-year decline in both industrial and agricultural exports. Exports of all subcategories of the industrial sector, except transport equipment, petroleum products and animal fodder, declined in July 2015, owing to weak global demand and reduction in export prices.

Among the industrial exports, the earnings from textiles and garments, which account for more than 44% of total export earnings, declined marginally by 0.3%, year-on-year, in July 2015. This was mainly due to the decline in garment exports despite a growth of 34.0% recorded in textiles exports over July 2014.

However, garments exports declined by 1.3%, reflecting a substantial reduction in garments exports to the EU market. Meanwhile, decreases in earnings from the export of rubber products, gems, diamonds and jewellery, machinery and equipment mainly contributed to the overall decline in industrial exports. Export earnings from transport equipment, petroleum products and animal fodder increased by 91.3%, 42.2% and 13.0%, respectively, in July 2015.

Earnings from agricultural exports in July 2015 declined by 2.7%, year-on-year, to $ 245 million, led by significant declines recorded in tea and seafood exports. Tea exports, which were severely affected by lower demand from Russia and the Middle East, declined in July 2015 for the 12th consecutive month, recording a drop of 14.0%, year-on-year, reflecting declines in both export volume and export prices. Export earnings from seafood continued to decline owing to restrictions on market access to the EU market. Accordingly, seafood exports to the EU dropped by 71.0%, recording an overall decline of 32.5% in the seafood category, year-on-year, in July 2015. However, earnings from the exports of spices, minor agricultural products and coconut kernel products recorded a positive growth partly offsetting the overall decline in agricultural exports.

On a cumulative basis, earnings from exports declined marginally by 0.9% during the first seven months of the year mainly due to the lower performance of agricultural exports despite the positive growth in industrial exports. The leading markets for merchandise exports of Sri Lanka during this period were the US, the UK, India, Germany, Italy and China which accounted for about 55% of total exports.

Import Performance

Expenditure on imports decreased by 16.9%, year-on-year, to $ 1,534 million in July 2015 mainly due to the base effect as July 2014 recorded the highest monthly import value after November 2012. In addition, reduction in the fuel imports bill also contributed to the overall decline in import expenditure. Import expenditure on fuel imports declined by 66.1%, on a year-on-year basis, during the month. The average crude oil import price, which was $ 110.3 per barrel in July 2014, had nearly halved to $ 60.5 per barrel in July 2015. As a result, expenditure on intermediate goods imports declined by 32.8%, year-on-year, to $ 752 million in July 2015. Import expenditure on base metals, fertilisers and textile and textile articles also dropped during the month.

However, higher imports of personal motor cars in both value and volume terms and the import of vehicles such as lorries and tractors contributed mainly to the increase in consumer goods and investment goods, respectively. As a result, expenditure on consumer goods imports increased by 14.8% to $ 415 million while expenditure on investment goods imports increased marginally to $ 366 million.

However, import expenditure on consumer goods such as dairy products, clothing and accessories, sugar and confectionery and machinery and equipment declined significantly in July 2015.

On a cumulative basis, expenditure on imports during the first seven months of 2015 increased by 1.9%, year-on-year, to $ 11,035 million led chiefly by the imports of consumer goods followed by the import of investment goods despite the significant drop in expenditure on intermediate goods imports. During the first seven months of 2015, the main import originating countries were India, China, Japan, UAE and Singapore, which accounted for about 60% of the total imports.

Trade balance

The deficit in the trade account in July 2015 contracted substantially by 32.3% to $ 602 million in comparison to $ 889 million in July 2014. However, on a cumulative basis, trade deficit during the first seven months of 2015 increased by 6.0% to $ 4,688 million.

Earnings from tourism

Tourist arrivals continued its growth momentum in August 2015 with 166,610 tourist arrivals, reflecting a growth of 18.7% during the month. Tourist arrivals during the first eight months of the year totalled 1,172,465, showing a growth of 17.1% over the same period of 2014.

The top ten source countries of tourist arrivals recorded a positive growth except Russia. The arrival of Chinese and Indian tourists continued to record impressive growth rates with 76.8% and 27.9% increases, respectively, up to August this year. Earnings from tourism are estimated to have increased to $ 265.2 million in August 2015, a growth of 18.7% compared to August 20141. The cumulative earnings from tourism are estimated to increase by 17.1% to $ 1,866.5 million up to August 2015 in comparison to $ 1,762.5 million in the comparable period of 2014.

Workers’ remittances

Foreign exchange inflows from workers’ remittances at $ 599 million in July 2015 recorded a marginal decrease of 1.2% compared to $ 607 million in July 2014. On a cumulative basis, workers’ remittances up to July 2015 amounted to $ 4,032 million, registering a growth of 1.6% over the corresponding period in 2014.

Financial flows

Considerable outflows of foreign investments in government securities were witnessed during August 2015 resulting in a cumulative net outflow of $ 633.9 million during the first eight months, compared to a net inflow of $ 217.7 million during the corresponding period of 2014.

This was primarily due to the expected hike in US interest rates, which has prompted a considerable disinvestment of short-term foreign investments from emerging markets in the past few months. This effect was also felt in equity markets with the Colombo Stock Exchange recording only a net inflow of $ 6.4 million up to August 2015, which comprised net outflows of $ 24.8 million (up to August) of foreign investments from the secondary market and net inflows to the primary market amounting to $ 31.2 million (up to July).

Long-term loan inflows to the Government also remained moderate, with only a net inflow of $ 115.3 million received up to July 2015, compared to a net inflow of $ 644 million in the comparable period of 2014.

Overall balance of payments position

The overall BOP is estimated to have recorded a deficit of $ 1,205 million during the first seven months of 2015 in comparison to a surplus of $ 2,016 million recorded during the corresponding period of 2014.

International reserves and exchange rate movement

Sri Lanka’s gross official reserves stood at $ 6.8 billion as at end July 2015, equivalent to 4.2 months of imports, with total foreign assets amounting to $ 8.4 billion, equivalent to 5.2 months of imports. The Central Bank allowed greater flexibility in the determination of the exchange rate from 4 September 2015.

The Sri Lankan rupee depreciated by 4.6% against the US dollar from the date of change in the policy stance up to 29 September 2015. However, the rupee has depreciated by 7.2% during the year up to 29 September 2015. Furthermore, based on cross currency exchange rate movements, the Sri Lankan rupee appreciated against the Australian dollar by 9.5% and the euro by 0.3% while depreciating against the Japanese yen by 6.9%, the pound sterling by 4.7% and the Indian rupee by 3.0% during this period.