Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 15 July 2015 01:11 - - {{hitsCtrl.values.hits}}

By Himal Kotelawala

Former Central Bank Governor Ajith Nivard Cabraal yesterday accused the Government of downplaying the economic growth achieved during the latter part of the previous administration’s tenure.

Speaking at a media conference organised by the Vidwath Janapawura, a newly-formed forum of professionals and intellectuals, Cabraal declared that when Former President Mahinda Rajapaksa handed over the economy to the incumbent in January, this year, the economy was in an even better state than had been previously computed.

Referring to a comment made by the Deputy Minister of Policy Planning and Economic Affairs, Dr. Harsha de Silva, last week, Cabraal said that, contrary to the ongoing narrative of allegedly false statistics and a growth rate of just 4.5% last year, the Central Bank Annual Report signed off by CBSL Governor Arjuna Mahendran himself indicates that the growth rate was, in fact, at 7.4%.

“In 2014, the Sri Lanka economy showed its resilience in the face of domestic as well as external challenges,” he quoted the report as saying.

The report, dated 27 April 2015, goes on to say that real Gross Domestic Product (GDP) had grown by 7.4% in 2014, in comparison to the growth of 7.3% observed in 2013. GDP per capita had increased to $ 3,625 last year, it states, from $ 3,280 the previous year.

it states, from $ 3,280 the previous year.

To avoid highlighting any particular aspects of the rebased numbers which would seem advantageous to the previous regime, Cabraal charged, Dr. de Silva seemed to have downplayed the major improvements that were portrayed in the rebased figures in many areas. Cabraal also scoffed at government ministers making statements that he said ought to be the purview of department heads.

Commenting on the depreciation of the rupee in the much-hyped 100-day period, the former Central Bank Governor questioned the validity of Finance Minister Ravi Karunanayake’s bold prediction on 23 June that the rupee was set to climb to a two-year high of Rs. 130 per dollar in just two weeks thanks to an apparent influx in dollars coming into the country.

“No minister or even Central Bank Governor would make such statements, predicting the specific value of the rupee on a specific date,” he said.

Highlighting the dangers of making such statements, Cabraal said that it could not only damage the country’s reputation in the eyes of foreign investors but also bring into question the accuracy of statistics and data presented by the government when going abroad for aid.

When the previous regime asked for $ 1 billion in international bonds, it got bids for 10 billion, said Cabraal, adding that now it has dropped to 1.6 billion. There were 427 investors when the former president left, which has now come down to just 160.

“If this was the case in just 100 days, in five years’ time the country could’ve been in dire straits,” he warned, implying that a change in administration might be around the corner.

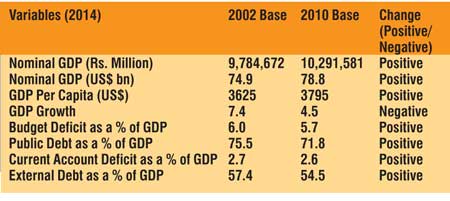

According to Cabraal, as per the rebased figures, Sri Lanka’s GDP in 2014 was not Rs. 9.8 trillion ($ 74.9 billion), but rather Rs. 10.3 trillion ($ 78.8 billion), and the GDP per capita was not $ 3,625 but USD 3,795. The debt-to-GDP ratio was not 75.5%, but stood at 71.8%.

Table 1 shows the impact of these changes:

As a result of rebasing GDP compilation from the 2002 base year to the 2010 base year, Cabraal said, several key macroeconomic variables had indicated improvements, in contrast to the current administration’s allegations of decline.

This clearly showed, he elaborated, that earlier GDP figures had been underestimated due to the non-capture of new and emerging economic activities, which were not captured earlier, such as small, household enterprises, agriculture, telecom and IT-related activities.

This revision also indicated an increase in GDP growth rates for 2011 and 2012, while the rates for 2013 and 2014 have been lower compared to earlier figures. According to these estimates, stated Cabraal, 2012 recorded the highest ever growth rate of 9.1%.

In terms of economic policy changes, however, in early 2012, monetary policy was tightened sharply by raising interest rates and imposing a credit ceiling to curtail private sector credit growth.

Both imports and exports declined and recorded negative growth rates due to tight monetary policy. Therefore, he said in a media release, the highest ever real economic growth recorded in 2012 did not appear consistent with such tight demand management policies implemented during 2012.

Hence it appears that the growth rate for 2012 had been artificially increased, Vidwath Janapawura charged, to increase the base value so that the growth rates for the following two years could be made much lower than earlier estimates.

Political interference in the compilation of national statistics would seriously damage the credibility of data among international investors, reiterated Cabraal.

“It would negate the benefits of the significant improvements in data collection, collation and presentation that had been put in place by the previous administration,” he added.