Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 25 June 2019 00:32 - - {{hitsCtrl.values.hits}}

Fitch Ratings yesterday said ratings of Sri Lanka’s Small and Mid-sized Banks (SMBs) were driven mainly by their high risk appetite and modest loss-absorption buffers, warning that could exert pressure on the sector.

Releasing a dashboard update, Fitch Ratings said other features of SMBs were a small franchise, as reflected in a combined market share of 7% of total assets at end-2018 compared with 82% for the nine larger Fitch-rated banks in the country.

Ratings on Nations Trust Bank (NTB), Pan Asia Banking Corporation (PABC), Union Bank (UB), Sanasa Development Bank (SDB), Housing Development Finance Corporation Bank (HDFC) and Amana reflect their standalone strength, while Cargills Bank Ltd (CBL)’s rating captures Fitch’s expectation of extraordinary support from its ultimate parent.

Fitch also said the SMBs’ capital buffers were likely to remain thin from aggressive loan growth, muted earnings and lingering credit risks.

“The median Fitch Core Capital ratio has remained higher than that of larger rated banks, although we view capital buffers as not being commensurate with the high risk appetite. Capital-raising is likely to continue across most SMBs. PABC, HDFC, Amana and CBL need to raise equity capital to meet enhanced regulatory capital requirements by end-2020.”

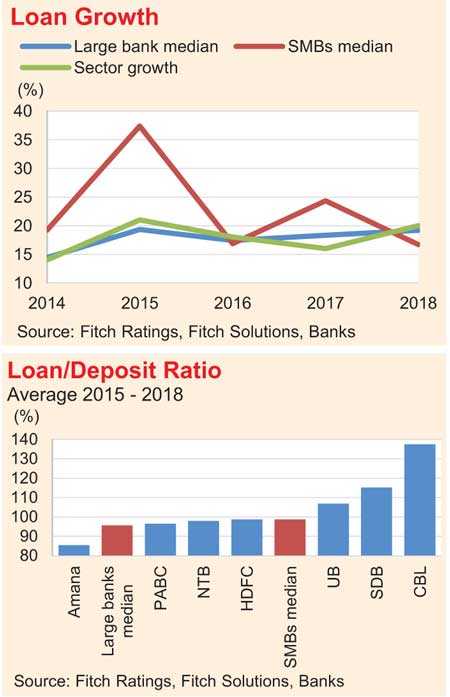

SMBs’ predominant exposure is to the retail and SME segments, which Fitch believes are more vulnerable to economic cycles. Loan growth at these banks has also been above the sector average, which could continue in the medium term as they pursue scale.

SMBs’ relatively high risk appetite, against a backdrop of a more challenging operating environment, exposes these banks to greater asset-quality pressure than their larger counterparts. SMBs’ median impaired loans/gross loan ratio (based on SLFRS 9 stage 2 loans) of 7.4% was significantly higher than 3.4% for the larger banks’ at end-2018.

“SMBs’ profitability is likely to remain subdued in the medium term, similar to the banking sector, due to rising credit costs. SMBs’ lower median risk-adjusted profitability ratio than that of the larger banks reflects SMBs’ higher operating cost structures.”

SMBs’ relatively weak deposit franchises exert pressure on their funding and liquidity profiles. SMBs’ median loan/deposit ratio is likely to remain higher versus the larger banks, while their share of CASA remains low at 18.3%, Fitch said.

It its update released last month Fitch said it expected credit risks to linger in 2019 due to the banks’ exposure to the more susceptible customer segments at a time when the country is facing domestic and external challenges. The banks' profitability metrics are likely to remain weak owing to high impairment losses and effective taxes.