Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 1 November 2022 00:02 - - {{hitsCtrl.values.hits}}

The Colombo stock market yesterday ended October suffering its first decline in three months and worsening the year to date losses.

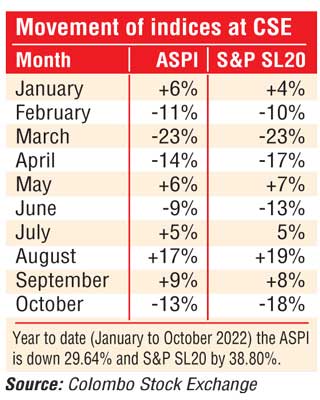

The benchmark All Share Price Index (ASPI) fell 13.4% in October and the active S&P SL20 more sharply by 18.2%. October ended the three-month commendable winning streak at the Colombo Stock Exchange (CSE). The market last suffered a loss in June.

Year to date, the ASPI is down 29.6% and S&PSL by 38.8%.

Average daily turnover in October was Rs. 2 billion, down from Rs. 4.35 billion in September.

The only silver lining in October as well as in 2022 so far is the net foreign inflows. In October it amounted to Rs. 2.48 billion increasing the year to date figure to Rs. 17.7 billion.

Yesterday the CSE remained bearish with S&PSL20 down by nearly 2% and the ASPI by 1.5%. Turnover was Rs. 1 billion involving 43 million shares.

Asia Securities said the indices remained in a sideways zone mainly due to price losses in EXPO (-6.8%), LOLC (-2.7%), LIOC (-4.0%), BIL (-4.8%), and RICH (-5.2%). Turnover was led by EXPO (Rs. 369 million), LIOC (Rs. 147 million), and BIL (Rs. 58 million).

“Overall retail and HNI activity in the market remained lacklustre resulting in lower volumes as investors continued on a ‘wait-and-see’ mode ahead of the Budget,” Asia said. EXPO (-20 points), RICH (-12 points), and LIOC (-10 points) ended as the major laggards on the ASPI. Overall, 39 stocks ended with price gains while 137 settled with losses.

Foreigners recorded a net inflow of Rs. 47.4 million. Net foreign buying topped in GUAR at Rs. 12.7 million and selling topped in JKH at Rs. 9 million.

First Capital said the Bourse deteriorated further as selling pressure extended mainly on retail heavy weights (LIOC, EXPO and RCL) where LIOC pulled down further on the speculation on downward fuel price revision. Moreover, EXPO witnessed a ballooning selling spree as the YoY and QoQ earnings witnessed a steep dip amidst the decline in freight rates. As a result, the index displayed a continuous downfall and closed lower at 8,602, losing 126 points.

NDB Securities said high net worth and institutional investor participation was noted in John Keells Holdings. Mixed interest was observed in Expolanka Holdings, Lanka IOC and Hemas Holdings whilst retail interest was noted in Browns Investments, LOLC Finance and Muller & Phipps.

Transportation sector was the top contributor to the market turnover (due to Expolanka Holdings) whilst the sector index lost 6.81%. The share price of Expolanka Holdings decreased by Rs. 11 (6.82%) to close at Rs. 150.25.

The Capital Goods sector was the second highest contributor to the market turnover (due to Hemas Holdings) whilst the sector index decreased by 1.55%. The share price of Hemas Holdings appreciated by one Rupee (1.85%) to close at Rs. 55.10.

Lanka IOC, Browns Investments and LOLC Finance were also included amongst the top turnover contributors. The share price of Lanka IOC lost Rs. 7.75 (4.05%) to close at Rs. 183.75.

The share price of Browns Investments moved down by 30 cents (4.76%) to close at Rs. 6. The share price of LOLC Finance closed flat at Rs. 6.90.