Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 19 September 2022 02:59 - - {{hitsCtrl.values.hits}}

Parent SG Holdings is estimated to have collected 2.5% stake or nearly 50 million shares of Expolanka Holdings PLC for nearly Rs. 10 billion.

Parent SG Holdings is estimated to have collected 2.5% stake or nearly 50 million shares of Expolanka Holdings PLC for nearly Rs. 10 billion.

Its acquisition has brought in much needed foreign inflow as well as providing liquidity for local investors especially high net worth individuals.

Between early August and last Friday (16 September), SG Holdings is estimated to have acquired 49.15 million shares or nearly 2.5% at prices ranging from Rs. 200 and Rs. 230 per share involving a total investment of nearly Rs. 10 billion.

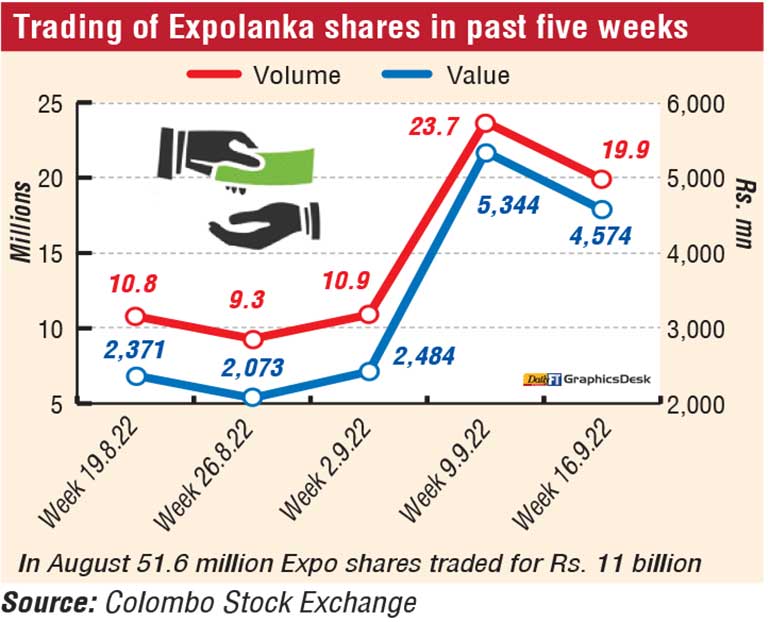

Last week 20 million Expo shares changed hands via 5,00 trades for Rs. 4.5 billion. On Friday 8.7 million shares were done at Rs. 2 billion of which Rs. 1.5 billion was foreign buying.

In August Expo saw 51.6 million of its shares change hands via 41.422 trades for Rs. 11 billion. In September to date, already 54.5 million shares had traded.

Highest price was Rs. 237.25 and the lowest was Rs. 166 before it closed at Rs. 216.75 up by Rs. 23.68 from July close of Rs. 175.25 in which month only 17.5 million traded for Rs. 3 billion. Last week it closed at Rs. 226.75, down by Rs. 10.75 with a high of Rs. 239 and a low of Rs. 224.75. Expo's 52-week highest is Rs. 405.The SG’s collection of Expo shares from willing sellers has been without destabilising the price, especially when original expectation was it will make an offer to all shareholders. Largely on speculation during the week ended on 9 September, Expo share peaked to a high of Rs. 243 and closed at Rs. 237.50.

Way back in May 2014, SG Holdings acquired 30% stake or 586 million shares of Expolanka at a mere Rs. 10.70 per share. Today Expolanka is the number listed corporate and the most profitable entity.

Apart from welcome net foreign inflow, SG move has helped investors who are exposed to margins or had been stuck with Expo after having bought at higher prices in the past. The Rs. 10 billion infusion has also helped existing investors to latch on to other recent high performers such as Lanka IOC.

Prior to its recent acquisitions, SG held 75.6% stake. It had 25,248 public shareholders with 25.25% stake.