Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 22 February 2021 00:32 - - {{hitsCtrl.values.hits}}

The annual real estate report by the Research Intelligence Unit (RIU) shows that the industry had performed with tenacity and resilience during the past year, given the economy’s extraordinary challenges.

The annual real estate report by the Research Intelligence Unit (RIU) shows that the industry had performed with tenacity and resilience during the past year, given the economy’s extraordinary challenges.

The report concluded that within the next two to three years, Sri Lanka would face an undersupply of apartments and other real estate assets due to a combination of variables which would essentially navigate it towards establishing a sellers’ market.

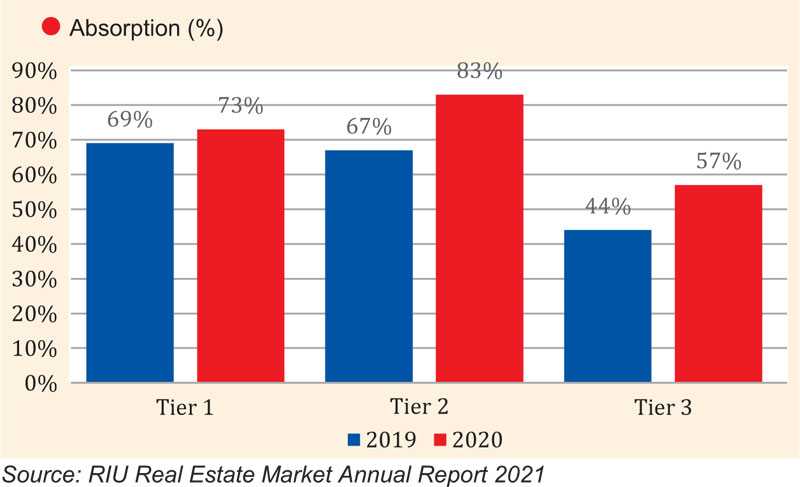

An eminent recommendation from the report was that the present time is exceptionally propitious for investment. In 2020, low-interest rates stimulated the market to enhance the absorption rates of the prevailing stock of apartments in Colombo.

Simultaneously, combined with the diaspora’s interest levels remaining at an all-time high and with airports opening, the influx of buyers will be significant. The market is more appealing than ever before to persons earning within the greenback, British pound, and most other currencies due to the weakening rupee.

The amalgam of these variables and the novel reality faced by developers, whose costs have spiked due to the new import restrictions and subsequently the overall currency depreciation effect, indicates that developers will be pressurised to supply the following generation apartment projects at prices that tally with the present market. Therefore, the likelihood of an undersupply is substantial.

The annual report was premiered at the RIU webinar titled ‘Resilience to Resurgence’ on the Sri Lankan Real Estate Market, held in January in partnership with the International Chamber of Commerce (ICC) and British Sri Lanka and Maldives Forum for Business and Trade (BSLMFBT).

After an introduction and welcome address by RIU in London Associate Director William Rezel, BSLMFBT Managing Director Dr. Anil D. Priyanka Baddevithana and RIU Head of Real Estate Research Onila Wickramasinghe presented insights taken from the upcoming RIU Real Estate Market Annual Report 2021.

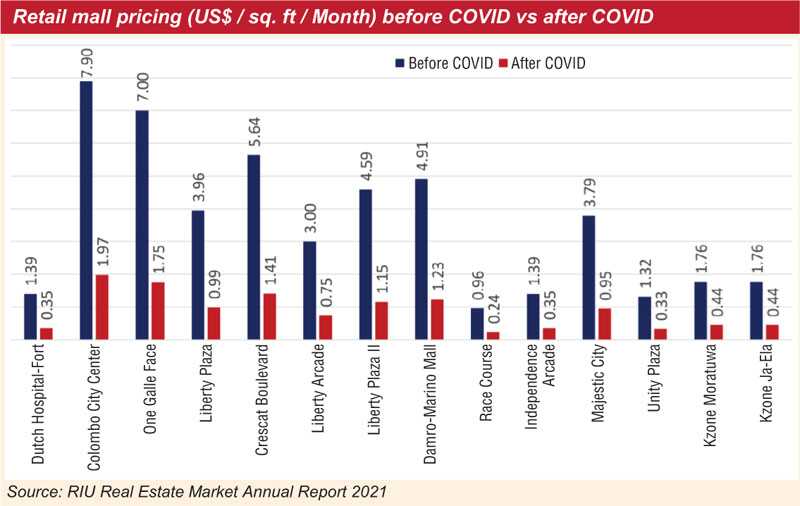

The presentation gave insights into the country’s prevalent economic conditions, investment potential in property development, fluctuations in real estate market pricing, investment potential in property development, and absorption or occupancy rates. The point of focus in the RIU market update were luxury and semi-luxury (tier 1 and 2) residential apartment properties, grade A and B commercial properties with an overview also on the retail mall market and bare land market in Colombo.

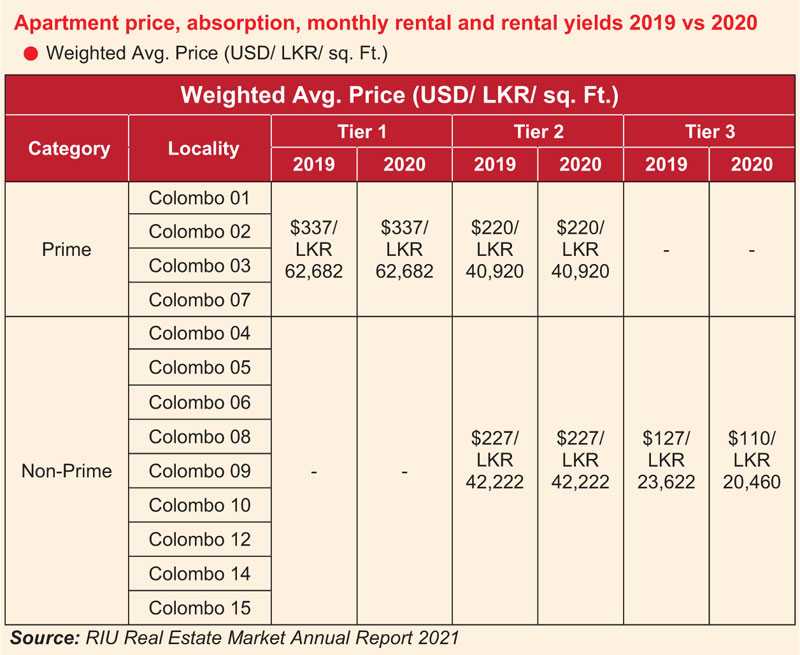

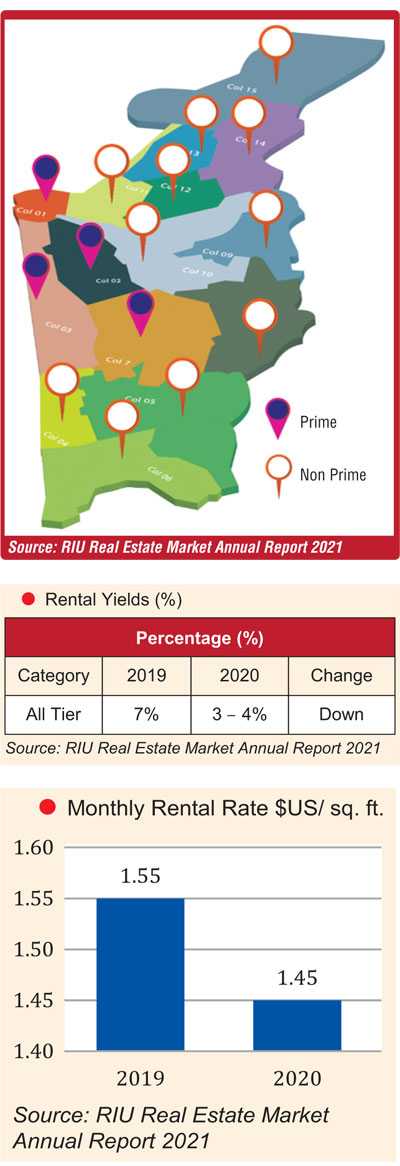

According to its respective areas based on location and price, we at RIU segregated prime and non-prime residential locations according to its respective areas. Colombo prime locations such as Colombo-1, 2, 3 and 7 fetches the highest prices in Colombo. In 2020, Luxury (tier 1) and semi Luxury (tier 2) prices remained unchanged. However, in the tier 3 market, we witnessed developers and sellers offering discounts of up to 15%.

The interest in property among buyers grew in 2020 Q3 and Q4. Reduction of housing loans by some banks to below 10% had a positive effect on the affordable and mid-range property market. Additionally, we noticed a rise in expats looking to purchase properties in Sri Lanka as their second home and investors looked for good bargains during this period.

RIU Founding Director Roshan Madawela moderated the discussion with the invited panellists. Capital Trust Holdings Director Minoli Wickramasinghe discussed the resilience in the residential property market, and Hatton National Bank Retail and SME Banking Deputy General Manager Sanjay Wijemanne provided information on the current interest rates and some insights on the steps that the Government is actioning to resuscitate the industry.

Sanken Lanka Managing Director Ranjith Gunatilleke and American Chamber of Commerce (AMCHAM) in Sri Lanka President Presantha Jayamaha discussed the implications of the Easter bombings and the pandemic on Foreign Direct Investment (FDI) for real estate. FDIs have also been at record lows over 2019 and 2020 compared to the previous seven to eight years, with countries like Bangladesh overtaking Sri Lanka in the amounts of FDI being secured.

Envartis Digital/Milanity Singapore Director Anand Swaminathan led the conversation on how rapid technological advancements gradually increase consumer expectations of smart technology integration in their daily lifestyles to make a living more comfortable and effortless.

This integration and adoption is widespread in emerging economies like China and India. However, the availability of solutions and knowledge of this technology’s execution into residential investment is unchanging due to the financial constraints and initial impacts on the property’s cost.

Sanjay Wijemanne enlightened the audience on the evolution of the banking systems regarding ease of funding of investments from the diaspora overseas with growing acceptance of credible financial documents and certification of income streamlines, and the progression in technology for sound creditworthiness evaluations, inclusive of other measures.

Minoli Wickramasinghe discussed the effects and predictions concerning the historically low-interest rates, where rational insights were shared, and forecasts were made to boost the domestic residential real estate market and enable recovery comparatively faster than commercial markets.

This phenomenon is owed to a gradual increase in demand for tangible assets and the pandemic normalising remote work where applicable. Gunatilleke also shared his views and reasoning on the forecasts for a possibility of supply constraints in the residential real estate market with the prevailing market conditions.

The panellists further shared their thoughts on potential Government regulations to revitalise the industry and policies to protect buyers from developer insolvency. The focal point was on possible tax reforms to stimulate investment volumes alongside the concerns on bureaucracy for approvals.

Overall, the panellists’ discussions set an optimistic tone for the year with ample scope for the real estate market to rebound, driven by potential acceleration in demand for residential investments. Favourable policy tools like The introduction of REITs, continual improvements in absorption rates, release of pent-up demand from the diaspora, currency depreciation, and the impending hike in construction costs are all favourable policy tools that would establish sellers’ market once again.

The RIU is the first real estate consultancy firm established in Sri Lanka and Maldives, and it values innovation, creativity, market intelligence and integrity. Its research and advisory services include market feasibility studies, environmental and social impact studies and investment appraisal. RIU has a strong track record of providing services to top world corporations, including fortune 500 companies, central and local Government institutions, and SMEs.

To watch the webinar video on YouTube: youtu.be/0oqSyLS6R3c.