Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 21 November 2017 00:00 - - {{hitsCtrl.values.hits}}

By Himal Kotelawala

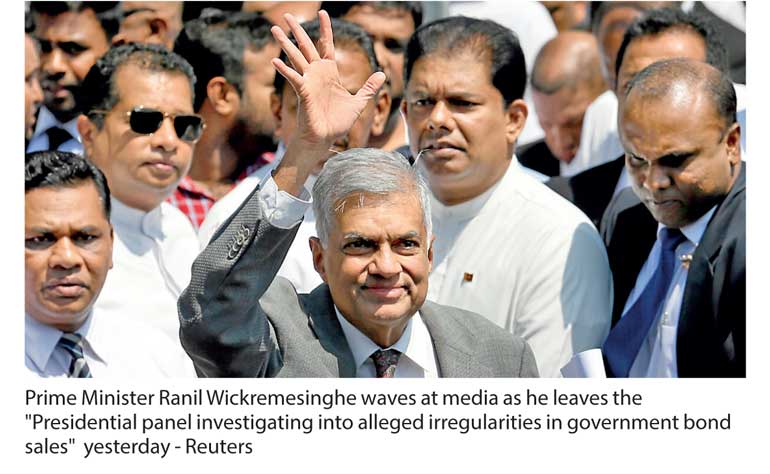

The proceedings of the Presidential Commission of Inquiry on the controversial bond issuance formally concluded yesterday with Prime Minister Ranil Wickremesinghe appearing before the Commission amidst an unusually large crowd of lawyers, journalists and a sizable gathering of senior parliamentarians representing the ruling United National Party (UNP).

Making history as the country’s first sitting Prime Minister to appear before a Presidential Commission of Inquiry, Wickremesinghe provided clarifications on the two affidavits he had previously submitted to the tribunal containing detailed responses to a total of 48 questions directed at him. Among those in attend ance at the hearing were Finance Minister Mangala Samaraweera, State Minister of Finance Eran Wickramaratne, State Minister of Defence Ruwan Wijewardene, Petroleum Minister Arjuna Ranatunga, Health Minister Rajitha Senaratne, Housing Minister Sajith Premadasa, Ministers Malik Samarawickrama and Kabir Hashim, both of whom had previously testified before the Commission, and former Colombo District UNP MP Rosy Senanayake whose son’s name came up in the proceedings some months ago.

Issuing a statement, the Commission thanked the Prime Minister for appearing and assisting the Commission, adding that the affidavits will be annexed, along with all other proceedings and documents, to the Commission’s final report.

“We also wish to make it clear that this Commission of Inquiry requested the Hon. Prime Minister to appear before us today and the Hon. Prime Minister readily agreed to do so. The question of a need to compel the Hon. Prime Minister to appear before us did not arise,” Commission Chairman Justice K. T. Chitrasiri said.

Recounting some of the responses provided by the Premier in the two affidavits, Justice Chitrasiri said that Wickremesinghe had stated that he had relied on assurances given to him repeatedly by Former Governor of the Central Bank of Sri Lanka (CBSL) Arjuna Mahendran that the latter’s son-in-law and Former Director of Perpetual Treasuries Ltd. (PTL) Arjun Aloysius would not under any circumstances play any role in the business activities of the controversial primary dealer.

Seeking clarification on this statement, the Commissioner asked the Prime Minister if he was aware at the time that the holding companies of PTL were Perpetual Capital Holdings Ltd. and Perpetual Capital Ltd. and that Aloysius continued to be a director and shareholder of those two holding companies even after January 2015.

Wickremesinghe responded that he was unaware of the shareholding structure of the company but he did know that Aloysius owned shares in PTL either in his name or through another entity. However, Aloysius had asked, he said, for more time to dispose of his shares of PTL as he wanted to get a good price.

In his response in the affidavit to the question asking whether he had instructed Mahendran on 24 February 2015 to immediately stop the practice of the CBSL accepting private placements of Treasury bonds, Wickremesinghe, according to Justice Chitarsiri, had said that he advocated the use of public auctions as the private placement system lacked transparency and that, ideally, market forces ought to determine interest rates and exchange rates.

The Premier had then directed Mahendran to consider going for public auctions in accordance with the economic policy of the Government, expecting the latter to comply with the due proceedings.

With this in mind, Justice Chitrasiri asked Wickremesinghe if he was aware that, as clearly specified in the Monetary Law Act, it is the Monetary Board that’s vested with the sole authority to determine the policies and measures of CBSL.

Wickremesinghe responded that he was indeed aware of it but his Government operated on the premise that, as per the Constitution, the Cabinet of Minsters has the authority to determine policy that applies to all state institutions.

The decision on transparency had to be implemented by all, he said, adding that, on the basis of the Constitution, the control of public funds must lie with Parliament.

This, he said, was an important issue what with the CBSL, the Treasury and other institutes acting without answering to Parliament. Wickremesinghe told the Commission that all such bodies had to be made answerable to the legislature while strengthening the powers of the Auditor General.

Responding to questions by Commissioner Justice Prasanna Jayawardena about institutes executing an order by following the due procedure, Prime Minister Wickremesinghe said that though he was unaware of how the members of the Monetary Board would have proceeded internally, they knew of the decision as they had attended the meetings leading up to it.

“I don’t micromanage institutes,” he said.

Justice Jayawardena again asked if Wickremesinghe had expected the standard CBSL procedures that apply when making major policy changes to have been followed. Wickremesinghe replied that he would expect that, harking back to his stint in the Cabinet of 1977 when the Treasury, the Central Bank and other institutes of that time fell in line with the then J. R. Jayawardena Government’s decision to liberalise.

Justice Chitrasiri then proceeded to seek further clarification from the Prime Minister on matters pertaining to the function of the CBSL Governor and the Monetary Board.

Wickremesinghe told the Commission that he was aware the role of the Governor is primarily to execute the policies and measures determined by the Monetary Board and to exercise and perform other such powers or duties as the Board may confer upon it.

He added, however, that the Government wanted to restore this as, in previous years, the Governor had only informed the Monetary Board of what had happened.

“We were committed to ensuring there should be a way in which the Monetary Board should act, subject to overall Government policy,” he said.

The Prime Minister went on to say that though he was aware that up to February 2015 an overwhelming majority of treasury bonds had been issued by way of private placements, there had been no specific authority on that method. Both Mahendran and incumbent Governor Dr. Indrajit Coomaraswamy had only been able to produce copies of private placements up to the year 2008, highlighting what Wickremesinghe called a big grey area.

“Virtually trillions of rupees had been taken in without authority,” he said.

Justice Chitrasiri pressed on about the role played by the Monetary Board with regard to major decisions taken by the Central Bank relating to policies and measures that can affect economic stability.

The Premier agreed that the Board had previously followed a system of directing relevant CBSL departments to study the issue at hand and submit a detailed board paper, after which it would consider the paper and only then reach a final decision on any policy changes.

The Chairman of the Commission at this point asked Wickremesinghe if he expected Mahendran to comply with the due procedures and take appropriate steps, proceeded by discussions with the Monetary Board.

“I advised him to go ahead,” said Wickremesinghe, adding that he thought Mahendran would follow the procedures that he ought to have followed at the time. He further said that he did not give Mahendran directions to discuss with the Board on how to proceed with the proposed shift from private placements to public auctions, having apparently only informed him of Government policy.

Attention was then drawn to funds said to have been required by the Government for road construction work, as mentioned on previous hearings of the Commission.

Wickremesinghe agreed that the requirement of Rs. 13.55 billion on 2 March 2015 as computed by the Department of Treasury Operations on or before 20 February was not connected to the requirement of additional funds amounting to Rs. 15 billion urgently required as determined at meetings held on 24 and 26 February that year. These, he said, were two separate transactions.

Explaining the need for the additional Rs. 15 billion, the Prime Minister said that provision for all government expenditures must be made through the Budget. In the previous years, he said, a number of approved projects had not appeared in the appropriation bill for those years.

He attributed this to an agreement with the IMF on certain limits, which was worked around by “not putting it out on the books.”

Once the money was collected, he said, it was paid off. However, there was a problem. According to Wickremesinghe, the Government had two streams of payments to make: what is in the appropriation bill and what’s outside of it.

For highways, he said, there were mentions of including land compensation from Rs. 25 billion to Rs. 100 billion. A letter from a Singaporean company had arrived just last week, seeking payment for working on part of the Northern Expressway in 2013 or 2014.

“No one knew about it till we got the letter last week. Even now we have various claims coming in.”

Referring to the call logs as testified by a sub-inspector of the CID last week, Wickremesinghe clarified that the Former Governor had indeed called him on the day of the auction (27 February 2015) that Rs. 10 billion had been place. This was preceded by a call the previous day telling the Prime Minister that at least a portion of the additional funds required for roadwork could be raised at the next day’s auction.

The senior AG Department officials assisting the Commission, who had until now grilled all witnesses, took a backseat yesterday, making way for Attorney General Jayantha Jayasuriya to question the Prime Minister reportedly in view of his high office, on the invitation of the Commission.

AG Jayasuriya’s line of questioning focused on a change in system that took place this year at CBSL regarding Treasury bonds.

The Prime Minister had said his affidavit, according the AG, following past experience and expert advice the current modified auction system was devised by the Monetary Board after the reviving the working of the ongoing auction based system.

Jayasuriya asked Wickremesinghe if he was informed at any point that a similar exercise had been carried out when Mahendran affected a change to the system in 2015.

Wickremesinghe explained that the Government still didn’t know the extent of the country’s debt and that Sri Lanka was in danger of becoming an indebted state like Greece. While CBSL was sorting this out, he said, the Government had developed a growth strategy. Governor Dr. Coomaraswamy then took over, he said, adding that a “big discussion” took place, and that it was continued after Mahendran had resigned.

A specialist brought down from the US Treasury, said Wickremesinghe, introduced the Government to this system.

“We had to go ahead with macroeconomic liberliastion to get integrated into the global economy,” he said.

Agreements with IMF and other documents were furnished by the Premier to the Commission to show the economic policy of the Government.

The Attorney General, at this point, stated that an extensive study had been conducted on the suitability of this system in 2017, and asked Wickremesinghe if he was aware that a similar study had been conducted in 2015.

The Prime Minister responded that no such exercise could be conducted as the figures had not been available at the time.

“It took us the whole of 2015 and part of 2016 to dig up the figures,” he said, adding that the new change was carried out as a result of the decisions made in 2015 and the resultant transparency. The US Treasury and the IMF had also come in, he said, and it was simply not possible to have done it in 2015.

With regard to the question of conflict of interest in the appointment of Mahendran as Governor, AG Jayasuriya asked if there had been any opportunity to verify his repeated assurances.

Wickremesinghe responded that he was told in January 2015 that Aloysius would be resigning from PTL - which he proceeded to do - and that he was going to spend his time developing the Mendis distilleries business.

“That was all I knew. Other than that, I didn’t know his affairs,” he said.

He then went on to say that the conflict of interest was something they, the Government, had raised, referring to Former Governor Ajith Nivard Cabraal’s sister’s alleged directorship in PTL.

The Gamini Pitipana Committee, which the Prime Minister had appointed to look into the bond issue, had found nothing against Mahendran.

“I had no information that he in fact deliberately misled me,” he said.

Neither the Pitipana Committee nor the COPE report, he said, had any information to that effect.

Once the Pitipana Committee carried out its mandate, the Premier went on to state, it was in the hands of the Parliament, after which he did not intend to interfere. He added that he wanted it to be handled by Parliament as it maintained control over finance, a principle the Government had wanted to establish.

Thus the Parliamentary Finance Committee was established, he said, and legislation is now being passed to equip it with a budget office, and the proposed new Monetary Law will contain provision to get information from CBSL to prevent a recurrence of this type of incident.

The AG pointed to serious concerns in the Pitipana report about PTL securing 50% of the accepted bid and the need for a high level of integrity in the conduct of CBSL officials including deputy governors and the governor. The report, according to the AG, requests the Prime Minister to take remedial measures.

Asked if he took any steps other than what’s already mentioned in the two affidavits, Wickremesinghe said that Mahendran’s continuation as Governor depended on the findings of the Parliament, and that the Pitipana Committee had been unable to give a reason as to why he should resign.

The Committee had, however, requested to look into the relationship between PTL and Bank of Ceylon, said the Premier.

The questions that moved on to the breakfast meetings said to have taken place in the Finance Ministry premises where the chairmen of the three state banks were allegedly told to bid at low yield rates at the 29 and 31 March 2016 auctions.

Asked if he was aware of a policy decision for state banks to bid low, Wickremesinghe said there was no such decision, but the banks were told not to get into speculative bidding.

The principle was, he said, to let the markets determine the rates as far as possible.

Wickremesinghe also said that he was unaware of the 28 March 2016 meeting, adding that Former Finance Minister Ravi Karunanayake held regular meetings with various officials.

The Premier was also unable to shed light on the alleged presence of his adviser R. Paskaralingam at the meeting.

Paskaralingam has an office at the Finance Ministry, he said, and has attended multiple meetings at the Ministry and does not always report to the PM on particulars of said meetings unless required.

The Commission has now terminated the reception of evidence and is expected to work focus its attention solely on its report which is due on 8 December.