Monday Feb 23, 2026

Monday Feb 23, 2026

Saturday, 4 September 2021 00:25 - - {{hitsCtrl.values.hits}}

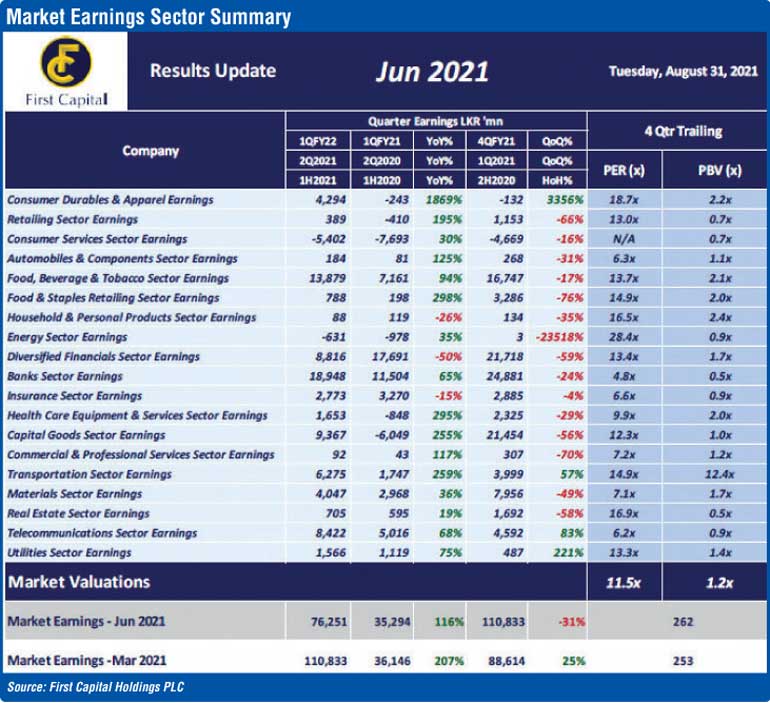

June 2021 quarter earnings have surged by 116% YoY to Rs. 76.3 billion despite the new COVID waves of disruption in the country.

First Capital said impressive earnings were led by Capital Goods (255% YoY), Banks (65% YoY), Food, Beverage and Tobacco (94% YoY), Consumer Durable and Apparel (1869% YoY), Transportation (259% YoY) and Telecommunication (68% YoY) sectors.

However, it added that sluggish performance was witnessed in Diversified Financials (-50% YoY) and Insurance sector (-15% YoY) earnings.

“Most of the listed sectors saw a surge in profitability, due to lower base effect in the previous year equivalent quarter amidst the negative impact by the initial COVID-19 triggered lockdowns and also due to the rebound in economy in Jun 2021 quarter as normalcy recovers,” First Capital said.

It also said in June 2021 quarter, Capital Goods, Banks, Food, Beverage and Tobacco, Consumer Durable and Apparel, Transportation sector and Telecommunication sectors witnessed exceptional results.

Capital Goods recorded an impressive growth of 255% YoY owing to the rebound in performance in many counters.

JKH witnessed a surge in earnings by Rs. 3.2 billion led by all segments except for Consumer Foods while the handover process of the residential apartment units at ‘Cinnamon Life’ commenced, causing the recognition of revenue and profits from sales for the first time in the project resulting in property segment EBITDA increasing by 1978% YoY.

HAYL’s profitability rose by Rs. 2.5 billion mainly led by the improvement in revenue by 46.4% YoY across strong performance in most of the sectors and reduction in net finance cost by 21.7% YoY to Rs. 2.4 billion.

In the Banking sector, the three largest banks, COMB, HNB and SAMP, registered enhanced profitability due to improved Net Interest Income despite increase in impairment provision and conservative loan book growth.

Food, Beverage and Tobacco earnings recorded an increase led by the rebound in consumer recovery while Consumer Durable and Apparel sector profitability surge was led by GREG due to the capital gain from the sale of South Asia Textiles.

Transportation sector earnings improved dominated by EXPO while Telecommunication sector earnings rose with the strong performance in DIAL and SLTL due to robust performance in data segment with the working from home arrangements.

First Capital said diversified Financials sector earnings recorded a decline of 50% YoY led by LOLC due to the higher base effect in 1QFY21 as a result of gain of Rs. 42.9 billion with the disposal of 49% stake in PRASAC Microfinance in Cambodia. “Moreover, insurance sector earnings declined by 15% YoY led by higher provision to Life insurance fund amidst prevailed lower interest rate environment,” First Capital added.