Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 8 March 2023 01:08 - - {{hitsCtrl.values.hits}}

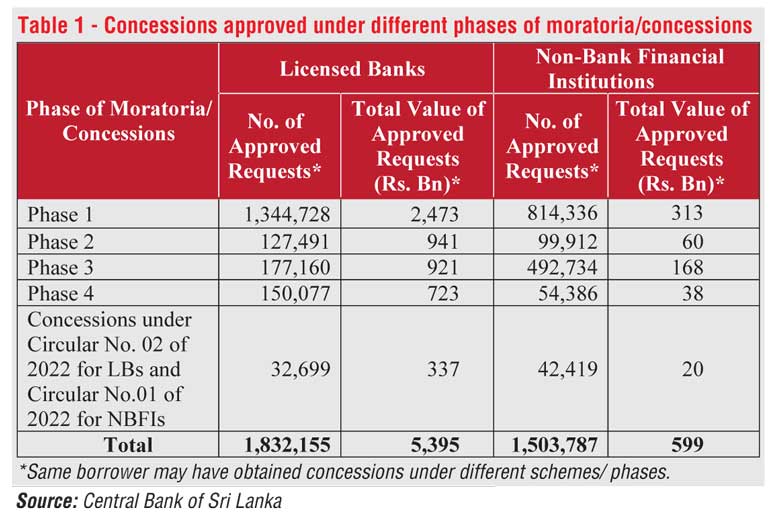

The Central Bank yesterday revealed that private sector enterprises and individuals had been given relief worth Rs. 6 trillion during the different phases of moratoria and concessions since the COVID-19 pandemic.

In a statement, CBSL said it has implemented several schemes of debt moratoria and concessions to assist the borrowers affected by the COVID-19 outbreak and subsequent macroeconomic developments, through Financial Institutions (FIs) supervised by CBSL. These schemes included extended repayment periods, concessionary rates of interest, working capital loans, debt moratoria and restructuring/rescheduling of credit facilities for affected borrowers.

“These concessions greatly assisted the small and medium enterprises of many affected sectors including tourism, apparel, plantation, information technology, logistic service providers, transportation, operators of school vans, lorries, small goods transport vehicles and buses, and private sector employees,” CBSL said.

CBSL said in July 2022, considering the need to unwind moratoria in a sustainable way, in order to prevent any elevated strain on the financial system, CBSL requested Licensed Banks (LBs) and NBFIs to provide appropriate concessions to affected borrowers in all economic sectors including MSMEs on a case-by-case basis for a period of 6 months through Circular No.02 of 2022 and Circular No.01 of 2022 issued to LBs and NBFIs, respectively, to enable such borrowers to agree on suitable repayment arrangements based on their new repayment capacity. In the meantime, CBSL has required the FIs to set up Post COVID-19 Revival Units in order to identify and assist under-performing and non-performing borrowers affected by the pandemic for the purpose of reviving viable businesses with the potential of contributing to the national economic growth.

The last phase of the moratoria granted to COVID-19 affected borrowers of the banking sector and Non-Banking Financial Institutions (NBFIs) Sector ended on 30.06.2022 and 31.03.2022, respectively.

In January 2023, subsequent to the conclusion of the last phase of concessions, several requests for further concessions were made to CBSL and Government Authorities by borrowers representing various economic sectors, to tide over the challenges on repayment of loans amidst extraordinary macroeconomic conditions.

Accordingly, with a view to encouraging MSMEs and individuals with a potential to revive their businesses/income streams to commence repayment of loans, while preventing any elevated strain on the financial sector, FIs have been requested to provide appropriate concessions to the affected borrowers including the following.

a. Concessions for credit facilities: Restructuring/rescheduling of performing and non-performing credit facilities, on a case-by-case basis, consequent to an objective assessment by FIs, on the future repayment capacity/viability of the business.

b. Suspension of recovery actions: Suspending recovery actions against credit facilities classified as non-performing on or after 01.01.2020, on a case-by-case basis, consequent to an objective assessment by FIs on the future repayment capacity/viability of businesses, upon the condition that the borrower submits an acceptable repayment plan.

c. Early settlement of facilities: LBs to consider the requests made by borrowers to settle their credit facilities early, without paying any additional fee. In the case of lease facilities, recovery of future interest also to be waived off. The NBFIs to consider early settlement of existing performing or rescheduled credit facilities, by applying a reduced rate for early settlement charges and recovery of future interest.

CBSL said it has requested the respective FIs to communicate the above requirements across their branch network to ensure effective and speedy implementation of the respective concessions to MSMEs and individual borrowers.

Accordingly, FIs are requested to provide appropriate concessions with a view to facilitating the eligible borrowers to carry on their income generating activities and gradually commence repayment of their facilities. Eligible borrowers are requested to contact the respective financial institutions with relevant information and documents to discuss and agree on repayment plans. Borrowers are expected to commence repayment as agreed with the FIs, as non-repayment of loan obligations for a longer period, would result in unwarranted strains on both FIs and on borrowers.