Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 1 April 2022 00:23 - - {{hitsCtrl.values.hits}}

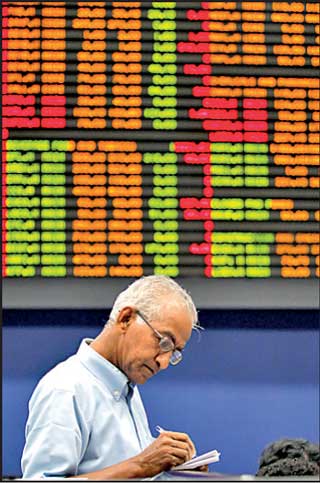

March-mayhem is apt for the Colombo stock market as it ended a disastrous month yesterday with Rs. 1.4 trillion in value wiped off as investor sentiment nosedived over the Government’s failure to resolve multiple crises.

1.4 trillion in value wiped off as investor sentiment nosedived over the Government’s failure to resolve multiple crises.

The benchmark ASPI and the more active S&P SL20 ended March down 23%.

Year to date, both indices are down by 28%. Market capitalisation was down by Rs. 1.6 trillion since end 2021 from Rs. 5.48 trillion to Rs. 3.82 trillion.

By end February the value was Rs. 5.25 trillion. In a tumultuous week, the more active S&P SL20 Index suffered a fresh setback yesterday forcing a trading halt for the fourth time whilst turnover was lower.

Asia Securities said the indices dipped in a shortened session on Thursday due to a broad-based selling pressure, mainly triggered by retail and HNI sell-off in front-line stocks EXPO, LOLC and BIL. The ASPI ended with a loss of 391.0 points (4.2%) and the S&P SL20 index declined 165 points (5.2%) during the session.

Earlier, the S&P SL20 index plunged as much as 5%, triggering a market-wide circuit breaker for a thirty-minute trade halt in the first few minutes of trading.

Turnover amounted to Rs. 2,322 million (previous session Rs. 3,297 million) supported by LOFC (Rs. 774 million), CTC (Rs. 385 million), and EXPO (Rs. 352 million).

Asia said as an outlier among the front-line stocks, LOFC recorded price gains in an otherwise negative session and cushioned the losses recorded by the indices to some extent during the session.

Overall, 51 stocks ended with price gains while 137 settled with price losses.

It also said foreigners recorded a net outflow of Rs. 37.6 million while their participation increased to 17.6% of turnover (previous day 7.1%).

Net foreign buying topped in MGT at Rs. 20 million while selling topped in CTC at Rs. 76.3 million. However, in March the CSE saw a net foreign inflow of Rs. 1.4 billion.

First Capital said the Bourse witnessed a consecutive red closing for the fourth straight day while recording an intraday loss of more than 1,500 points during the week, as a result of the rising fear over economic breakdown.

Moreover, the market trading hours were restricted to only two hours due to the prevailing power cuts.

“Then Index displayed a straight fall in the beginning and continued to drop further, as investors rushed to move away from the market while infusing selling pressure.

Thereby, the market was halted for 30 minutes within the first few minutes since the S&P SL20 index fell over 5%.

Some of the banking sector counters witnessed a huge drop which dragged the index down below 9,000 level and led the index close at 8,904, losing 391 points.

Turnover was mainly led by Diversified Financials and Food, Beverage and Tobacco sectors, accounting for a joint contribution of 62%.

NDB Securities said ASPI closed in the red as a result of price losses in counters such as Sampath Bank, Ceylon Tobacco Company, and Commercial Bank.

It said high net worth and institutional investor participation was noted in Ceylon Tobacco Company, John Keells Holdings and Hayleys.

Mixed interest was observed in Expolanka Holdings, LOLC Holdings, and Access Engineering whilst retail interest was noted in LOLC Finance, Browns Investments, and SMB Leasing.

Diversified Financials sector was the top contributor to the market turnover (due to LOLC Finance and LOLC Holdings), whilst the sector index lost 3.58%. The share price of LOLC Finance increased by Rs. 1.80 (14.52%) to close at Rs. 14.20.

The share price of LOLC Holdings recorded a loss of Rs. 47.75 (7.40%) to close at Rs. 597.50. Food, Beverage and Tobacco sector was the second highest contributor to the market turnover (due to Ceylon Tobacco Company), whilst the sector index decreased by 3.99%.

The share price of Ceylon Tobacco Company lost Rs. 120.50 (17.29%) to close at Rs. 576.25.

Expolanka Holdings and Access Engineering were also included amongst the top turnover contributors. The share price of Expolanka Holdings moved down by Rs. 15.25 (6.84%) to close at Rs. 207.75.

The share price of Access Engineering declined by Rs. 1.30 (7.98%) to close at Rs. 15.00.

Separately Singer Sri Lanka and Hayleys Fabric announced their interim dividends of 20 cents and 30 cents per share respectively.