Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Saturday, 18 June 2022 00:22 - - {{hitsCtrl.values.hits}}

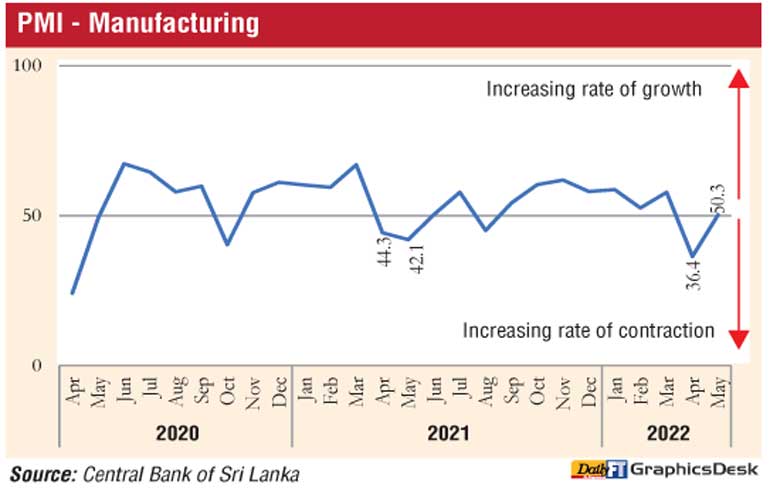

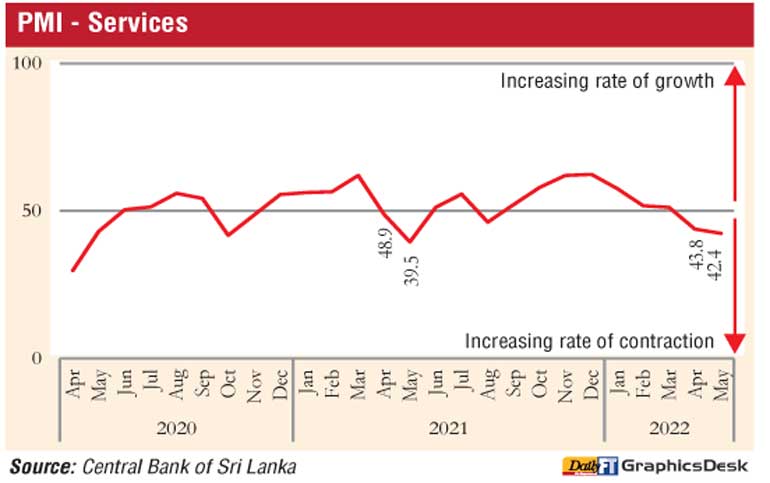

The country’s manufacturing and services sectors reported mixed results in May but the duo’s outlook remains bleak as per the latest Purchasing Managers Index (PMI).

The Manufacturing PMI recorded an index value of 50.3 in May 2022, with an increase of 13.9 index points from the seasonally low value in the month of April.

“The slight edging up of the PMI was mainly due to the recovery of Employment and the lengthening of Suppliers’ Delivery Time,” Central Bank said.

It said even though the lengthening of Suppliers’ Delivery Time generally reflects the expansion in the manufacturing activities, in this instance it was primarily due to supply side impediments arising from clearance delays of imported goods and fuel shortage.

Moreover, Employment edged up during the month, particularly in the manufacture of textiles and apparel sector, partly due to cross-industry employee movements.

CBSL said New Orders, Production and Stock of Purchases remained contracted on a month-on-a-month basis, yet at a slower pace, indicating subdued performance in manufacturing activities in May 2022.

“The subdued performance in Production and New Orders were particularly witnessed in the manufacture of food and beverage sector. The contraction in the New Orders was partly due to the ending of the festive month,” CBSL said.

Further, some respondents mentioned that deterioration of purchasing power due to high inflation together with cautious consumer spending amidst prolonged uncertainty over economic woes resulted in the decline in demand, particularly for the goods in non-essential nature. Moreover, production process of the manufacturing sector has severely hit by numerous supply-side constraints, including a shortage of materials and the ongoing power outages.

The Stock of Purchases declined mainly due to the unavailability of required quantities in the domestic market and difficulties in opening letters of credit for importing materials, forcing many producers to significantly slow down their production.

“For the next three months, the overall expectations for manufacturing activities continued to deteriorate compared to the previous month due to the prevailing uncertain economic environment in the country,” CBSL said.

Services PMI dropped marginally to an index value of 42.4 in May 2022 indicating a contraction in services activities for the second consecutive month.

“This was due to the declines in New Businesses, Business Activities, Employment and Expectations for Activity sub-indices,” CBSL said.

New Businesses declined further in May 2022 compared to April 2022, particularly with the decreases observed in accommodation, food and beverage, wholesale and retail trade, real estate, and education sub-sectors.

CBSL said decline observed in Business Activities in May was mainly due to supply-side constraints including, prolonged power outages and energy shortage. In addition, subdued demand attributable to rising prices and uncertainties in the country also contributed to the decline in business activities.

The civil unrest occurred at the beginning of the month also had a negative effect on the business activities. Accordingly, wholesale and retail trade, other personal activities and transportation sub-sectors recorded major declines during the month. In addition, business activities of accommodation, food and beverage sub-sector was also affected by the continued drop in tourist arrivals.

Employment continued to decline in May due to terminations in line with the decline in business activities, retirements and resignations. Power outages, supply shortages and transportation difficulties led backlogs of work to increase further during the month.

“Expectations for business activities for the next three months deteriorated further in May due to supply-side constraints, inflationary pressure, and economic and political uncertainties in the country,” CBSL said adding “some respondents were also concerned over increase in interest rates and taxes, whereas some were optimistic on the progress made on IMF discussions and exchange rate stabilisation.”