Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 27 January 2022 00:58 - - {{hitsCtrl.values.hits}}

For the 11th consecutive year, MTI Consulting (via their Corporate Finance practice), in partnership with Daily FT, Daily Mirror and Sunday Times, has concluded the MTI CEO Business Outlook Study, collectively outlining the Sri Lankan business community’s perception for the state of business in 2022.

Supplemented by MTI’s experience as a thought leadership-oriented organisation, the annual survey collated and analysed the perceptions of over 100 Sri Lankan business leaders about their business’ past and expected performance, their predictions regarding the state of the local and global economy in 2022, and the main challenges that they believe Sri Lanka and Sri Lankan companies will face in 2022.

The results of the survey, including its supplementary analysis, will assist organisations in streamlining their strategic decision-making for 2022, effectively enabling them to gear their operations in accordance with the economic sentiments of their peers – especially in the face of unprecedented challenges and uncertainty that prevailed in 2021.

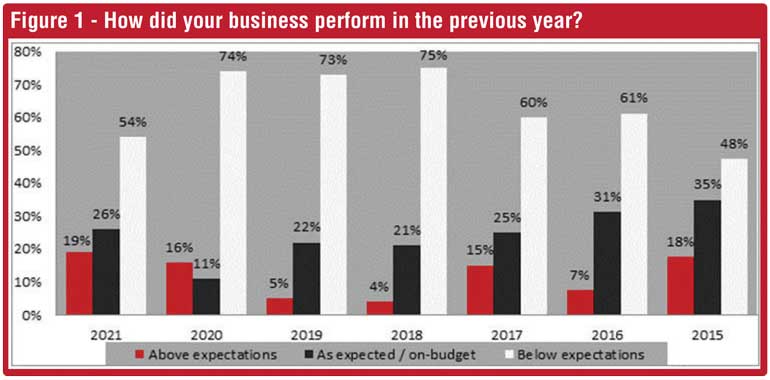

In 2021, businesses continue to perform below expectations

54% of the surveyed CEOs responded that their businesses performed below expectations in 2021. However, there is a significant reduction in this sentiment from 74% in 2020 to 54% in 2021 which is largely attributable to the fact that businesses started to show signs of recovery, amidst the COVID-19 pandemic.

It is significant to note that 19% of the surveyed CEOs indicate that their businesses performed above expectations in 2021. This is the highest optimistic outlook recorded since 2015 – signifying that some industries weathered the storm and performed well, despite a challenging macro environment in 2021.

Macroeconomic performance

To supplement the CEO perceptions in 2021, MTI has analysed the key macroeconomic indicators of Sri Lanka.

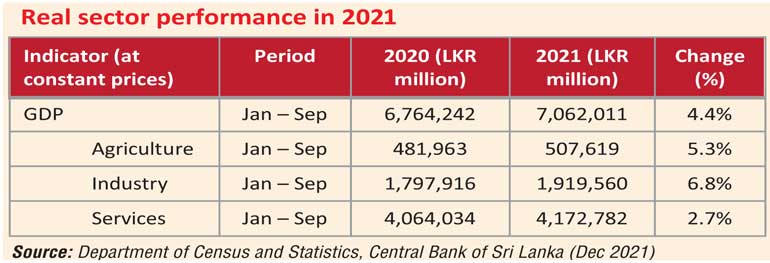

GDP for the first nine months of 2021 increased by 4.4% in comparison to the same period in 2020 owing to the slow recovery from the COVID-19 pandemic. The Industry sub sector recorded the highest growth in GDP (6.8%) and started to rebound, with the end of the extended lockdown period in Sri Lanka after the third COVID-19 wave. Progress of Sri Lanka’s vaccination program was a key contributory factor in business operations steadily returning to the new normal by the end of 2021.

The Trade Deficit further widened from $ 4,846 million during the first 10 months of 2020 to $ 6,498 million during the same period in 2021, to record a 34% increase. Key contributory factors include the drop in exporting plastics ($ 85.1 million) and significant increase in imports of fuel ($ 853.2 million), textiles ($ 588.1 million), machinery and equipment ($ 490.1 million), base metals ($ 270.4 million) and chemical products ($ 219.3 million).

Total Official Reserve Assets declined from $ 5,555 million as at 30 November 2020 to $ 1,588 million in 2021. According to CBSL, the November 2021 figure does not include the swap facility signed with the People’s Bank of China (PBoC) of RMB 10 billion (equivalent to approximately $ 1.5 billion). By July 2021, Reserves dropped to $ 2,334 million due to the International Sovereign Bond (ISB) settlement of $ 1 billion and further reduced to $ 2,704 million by September 2021 due to the resulting impact from the drop in Tourism Earnings.

Foreign Currency Reserves saw a significant drop (80%) from $ 5,101 million as at November 2021 to $ 1,015 million as at November 2020. The CBSL has undertaken several key measures to ensure foreign currency receipts continue to flow via the introduction of rules related to the repatriation and conversion of export proceeds and an incentive scheme for workers’ remittances (to name a few) to improve the foreign exchange position of the country.

Expected FDI inflows to major infrastructure projects which include the Colombo Port City, techno parks, Special Development Projects such as the Eravur Fabric Processing Park and pharma and export processing zones will be instrumental in easing forex pressures and expand the level of economic activity in Sri Lanka in the next few years. In January 2022, the Colombo Port City Economic Commission released 6 out of 31 plots on a 99-year lease basis, to generate $ 200 million in sales revenue with a combined investment commitment of $ 600 million.

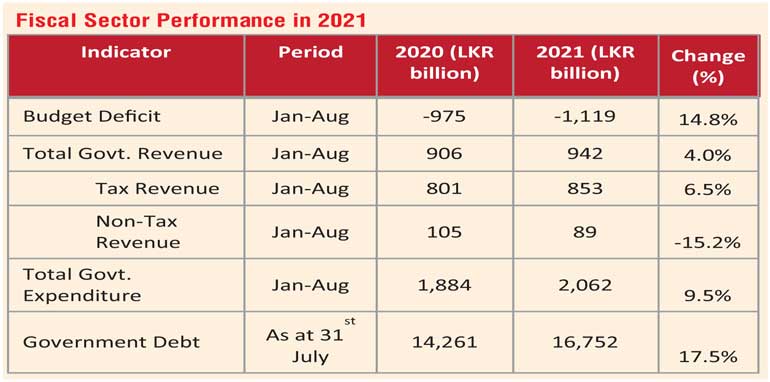

Following a similar trend to the previous year, the Budget Deficit expanded to Rs. 1.1 billion from Rs. 975 billion, to record a 14.8% expansion in the first eight months of 2021. Total Government revenue increased by 4.0% during Jan-Aug 2021 compared to the same period in 2020. This is a slight improvement compared to 2020 as the total Government revenue declined by 24.8% in the previous Jan-Aug period.

Increased expenditure on salaries, interest payments, pension and COVID-19-related expenditures including vaccinations resulted in an increase in the recurrent expenditure from Rs. 1.7 billion in the first eight months in 2020 to Rs. 1.8 billion in the first eight months of 2021 (7.9% increase).

Government Debt increased to Rs. 16,752 billion (17.5% increase) at the end of July 2021 compared to July 2020. Government Debt to GDP ratio was 101.0 in 2020 and it is revised-estimated to be 102.8 in 2021.

In order to address the imbalance in the external trading sector and to avoid inflation over the medium term, the Monetary Board of the Central Bank of Sri Lanka decided to make changes to the Monetary Sector in August 2021. The Standing Deposit Facility Rate (SDFR) was increased to 5% from 4.5% and the Standing Lending Facility Rate (SLFR) was increased to 6% from 5.5%. Applicable on all rupee deposit liabilities of licensed commercial banks, the Statutory Reserve Ratio (SRR) was increased to 4% from 2% with effect from the reserve maintenance period commencing 1 September 2021.

Average Weighted Prime Lending Rate of Commercial Banks also increased from 5.81% to 8.61% by 31 December 2021, compared to the same period in 2020. Overall Domestic Credit has increased by 25.7% in the first half of 2021 compared to 2020, following the same trend as in the previous years.

How have the major industries performed?

nBanking – The banking sector showed signs of expansion in terms of key indicators, despite restricted economic activity in the local and global economies owing to the COVID-19 pandemic. Total assets of the banking sector expanded by 12.1% from Rs. 1.8 trillion to Rs. 16.4 trillion during the eight months ending August 2021 compared to Rs. 1.3 trillion in last year. Y-O-Y credit growth which declined to 5.6% as at end 2019, increased to 11.9% as at end 2020 and further picked up during the eight months ending August 2021 and reached to 18.0%. Investments of the banking sector increased by Rs. 253.9 billion (6.0%) during the eight months ending August 2021.

nTea – On a Y-O-Y basis, tea production grew by 17.9% during the period from January to August 2021 in all three elevations: high grown, medium grown, and low grown. Cumulative tea production for the period January to October 2021 shows an increase of 15% respectively against 2020. Tea Exports for the month of October 2021 totalled 24.34 million kg, showing an increase of 1.22 million kg vis-à-vis 23.12 million kg of October 2020. Sri Lanka’s plan to aggressively promote organic farming by banning imports of chemical fertilisers took a toll on tea production in early July 2021.

nTourism – For the year 2021, 104,989 international tourists visited Sri Lanka as of 30 November. Tourist numbers represent a 79.3% decrease from previous year, when 507,311 tourists visited the country between January and March 2020. Furthermore, Tourism earnings decreased by 92.5% from Jan. to Sep. in 2021 compared to the same period in 2020. The tourist sector received substantial assistance from the Central Bank, the Government, and tourism authorities to weather the pandemic’s impact. This included debt moratoria, working capital loans, waivers of license fees, facilities for new tourism trends, such as ‘digital nomadism’, promotional campaigns in target markets, development of mobile apps for tourists, improvements to hard and soft tourism infrastructure.

n Construction – The cement market was further subjected to volatilities as the government excluded the construction material-cement of all types from the list of “specified goods” and the price limit. The Budget of 2021 includes some proposals to boost construction in Sri Lanka. It offers to give contractors a 10-year full tax break on selected recycling materials to encourage recycling of waste in the construction sector. It is also proposed to exempt all import duties on new technologies and machinery required for the construction sector.

n Apparel – Sri Lanka’s earnings from textiles and garments exports increased by 21.9% Y-O-Y to $ 2.941 billion during the first seven months of 2021. Expenditure on textiles and textile articles increased by 27.4% Y-O-Y to $ 251.2 million, while clothing and accessories imports were up 10.8% to $ 14.9 million. In March 2021, the Index of Industrial Production (IIP) reached its highest value since its inception. The manufacturing of garments and the manufacture of textiles categories in the IIP were the key contributors to the upward trajectory of the index during this period.

Sri Lankan stocks (listed in the Colombo Stock Exchange) gained by nearly 80% in 2021 and recorded the second highest number of IPOs in history, with 28 debt and equity IPOs. In January 2022, the All-Share Price Index reached an all-time high of 13,462.39.

In November 2021, the Finance Minister announced a 25% retrospective tax surcharge on firms that earned over Rs. 2 billion in 2020/21 and a 3% increase on VAT for banks, insurance, and financing firms. Brokers and Investors sold stocks that would get affected from these changes and held on to stronger and more stable stock. By the year-end the market showed signs of recovery which was reflected positively in turnover recorded in 2021.

In line with global trends, Sri Lanka experienced high level of corporate M&A activities in 2021 as a result of the following market activity:

n Large foreign investors entering Sri Lanka. For example: India’s Adani Group is planning to jointly develop Colombo West International Container Terminal (CWICT), with John Keells Holdings and Sri Lanka Ports Authority (via a $ 700 million investment).

n Large international organisations investing in leading Sri Lankan corporates. For example: ADB entered into an agreement to invest up to $ 80 million (in Sri Lanka rupee equivalent) in John Keells Holdings PLC. IFC’s $ 5 million investment into Sunshine Consumer Lanka Ltd., a subsidiary of Sunshine Holdings PLC.

n Local companies making significant investments to expand their international footprint. For example: LOLC is expanding its global footprint in microfinance with three parallel investments being made in Tajikistan in Central Asia as well as Malawi and Tanzania in East Africa. Expolanka Holdings PLC invested over $ 18 million to acquire multiple logistics companies based in the USA and Central America.

Global Economy and Trade | 2021

In the backdrop of economic uncertainty fuelled by a global pandemic, World Real GDP was projected to be at 5.6% by the World Bank and 5.9% by IMF in 2021. The economy is recovering slowly from COVID-19 recording an actual growth rate of 5.88% in the year.

Emerging market and developing economies were expected to have a growth rate of 6.5% while the United States and China were expecting growth rates of 6% and 8% respectively. Oil prices have recovered in 2021 from 2020’s decline due to the increasing demands and continued restraints on production among OPEC+ (Averaged Oil price in June 2021: $60/bbl).

World in 2022

The IMF has predicted that the global growth will be 4.9% in 2022 while Emerging and Developing Economies will have growth of 5.1%. Advanced Economies are expected to have a growth of 4.5% and 90% of the countries are expected to recover the pre pandemic per capita income. Global trade is forecasted to grow by 6.3% in 2022 by the World Bank. The countries in the Euro Area are expected to pick up the growth in 2022 by 4.4%. Goods prices are expected to stabilise in 2022 as investments are expected to increase the goods supply. However, oil prices are projected to increase further in 2022 by the World Bank.

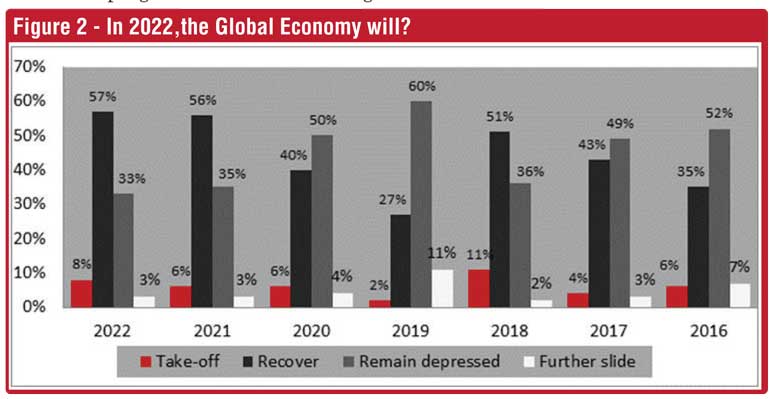

57% of the surveyed CEOs are of the view that 2022 will be a year of recovery with 8% believing that it will take off – displaying an overall optimistic sentiment regarding the future outlook for the Global Economy.

On the contrary, only 33% of the surveyed CEOs believed that the Global Economy would remain depressed, a marginal reduction compared to 35% of CEOs believing so in 2021 and a further reduction from 50% of CEOs believing so in 2019. 3% of CEOs expect 2022 to have a further slide from the current state of the global economy.

In 2022, Sri Lankan economy is likely to encounter major challenges

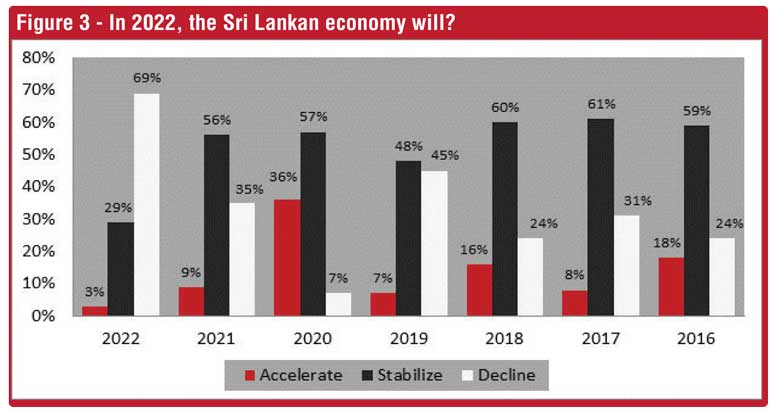

While there is much optimism for recovery of the global economy, more than half of the surveyed CEOs (69%) feel that the Sri Lankan economy will decline in 2022. This is the highest recorded survey response about the decline of the local economy since the 2015 CEO survey, demonstrating the surveyed CEOs worry and concern over the state of operating businesses in Sri Lanka.

When compared to the survey responses last year, the majority of the surveyed CEOs (56%) were hopeful that the Sri Lankan economy would stabilise. However, it is evident that this expectation has not yet been met due to the significant drop in this sentiment in 2021 as only 29% of the surveyed CEOs expressed that the Sri Lankan economy will stabilise in the 2022 – echoing continued concerns over the future economic outlook of Sri Lanka in the new year.

Sri Lanka in 2022

The ongoing pandemic will need to be managed in an efficient manner to ensure strong recovery for key economic sectors of Sri Lankan in 2022. With new COVID variations and complications to continue in the new year, Sri Lanka’s tourism industry may undergo another downward trend, resulting in a further deterioration of the country’s foreign reserves.

The depletion of dollars to conduct foreign transactions and lack of capital to invest in production is an ongoing challenge faced by Sri Lanka. Due to this situation all sectors including industries, agriculture, transport, construction which depend on imported inputs and materials will continue to have an unfavourable impact on their production.

Development of value added and high-tech export sectors (E.g., value added agriculture, software services, etc.) and import substitution sectors (E.g., fabric, pharmaceutical, etc.) will be essential to mitigate the impact of forex challenges. As such, continued efforts to attract Foreign Direct Investments will play a crucial role to stabilise the local economy and ensure economic growth in the next few months.

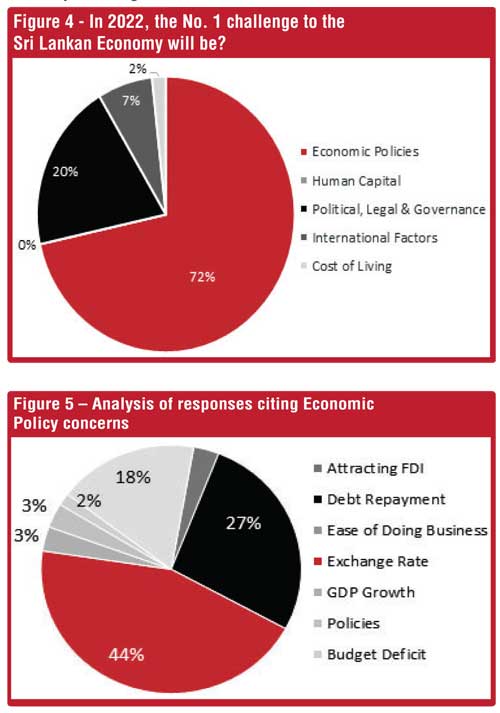

72% of the surveyed CEOs expressed that Economic Policies will be the biggest challenge to their businesses in 2022, followed by Political, Legal and Governance issues – which accounted for 20% of the respondents. These concerns follow a consistent trend in comparison to the previous year’s survey, implying that CEOs have not yet seen significant progress in areas connected to Economic Policies and Political, Legal, and Governance issues. Less than 10% of the surveyed CEOs expressed concerns over cost of living and implications from international factors being the top challenge for their businesses in 2022.

A further deep dive of the surveyed CEO responses citing economic policies as the key challenge in 2022 reveal that the underlying concern and most pressing challenge for their businesses is related to exchange rates. In the previous year, the majority of responses (45%) related to concerns over debt repayment – indicating a shift from debt to forex concerns in the new year.

Nearly 44% of the surveyed CEOs believed Forex to be the No. 1 challenge to the Sri Lankan economy given that the country’s Foreign Exchange Reserves recorded the lowest levels in a decade at $ 1.6 billion. This is a significant increase from the figures in the 2021 outlook where only 15% believed that the Exchange Rates will be the most prominent challenge in that year.

Sluggish business outlook for 2022

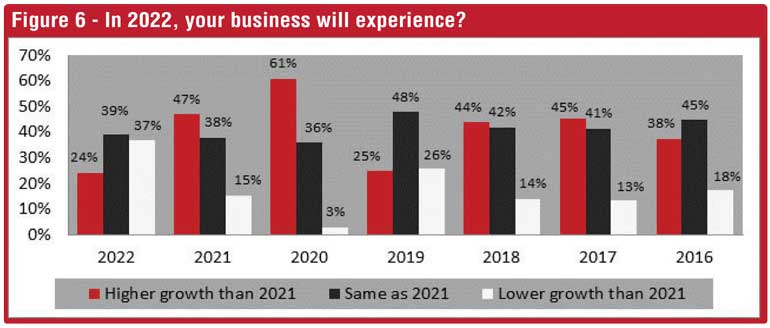

Given the implications of the pandemic and the resulting economic concerns, only 24% of the CEOs believe that their businesses would have higher growth than 2021. This is a significant drop in CEO confidence in the local economy where, three years ago, a record high 61% believed to have better prospects for the new year.

39% of the CEOs believe 2022 to have a similar growth trend compared to that of 2021 whereas 37% of the CEOs expected the year 2022 to have a lower growth than the previous year.

External challenges dominate

Based on the analysis of survey responses, 85% of the surveyed CEOs believe that the most prominent challenges to their business will be from external challenges. This is in line with the 2021 CEO survey, where a similar trend was seen with 70% CEOs stating external factors will be the key business challenge. Among the respondents, only 15% of surveyed CEOs believed that the prominent challenges in 2022 will be internal, which is a decline from the previous year of 30%.

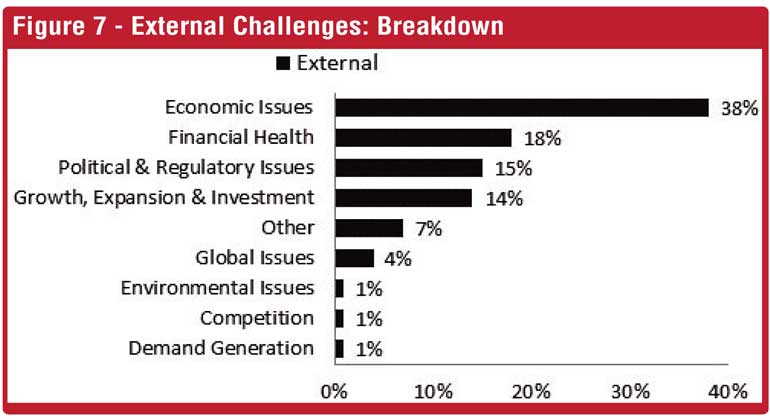

38% of the CEOs believe that economic issues will be the most prominent external challenge in 2022. The major underlying trends were related to the Forex crisis, worsening economic conditions, and rising inflation. This is a different perspective from the 2021 outlook, where political issues were believed to be the prominent challenge.

Financial Health was the second highest mentioned challenge with 18% of the CEOs sharing the same sentiment followed by Political & Regulatory Issues challenges at 15%. Competition, Demand Generation, Environmental issues were the least mentioned concerns noted by CEOs in terms of the most prominent External Challenges for their businesses in 2022.

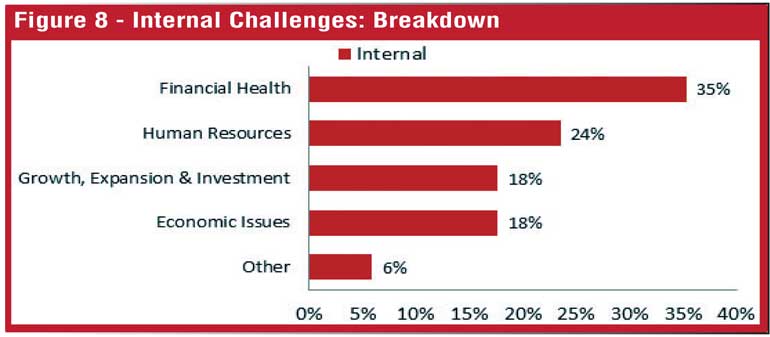

The most pressing Internal challenge for 2022 is predicted to be Financial Health as expressed by 35% of the CEOs. Main reasons highlighted in this regard were cash flow considerations and liquidity challenges. Challenges associated with Human Resources were believed to be the second most pressing internal challenge by 24% of the surveyed CEOs. This is mainly associated with keeping the existing staff motivated and retention challenges, which have increased in the backdrop of the global pandemic for many businesses.

Conclusion

The long-term trend (since 2012) of the business environment performing below expectations continued this year where nearly half of the surveyed CEOs expressed concern over the performance of their businesses in 2021. CEOs attributed the lacklustre performance to Economic concerns fuelled by forex challenges prevalent during 2021.

External challenges (outside the control of businesses) were perceived to be the biggest challenge for CEOs in operating their businesses in 2022. However, as businesses across the world step into the third year of operating against the backdrop of a global pandemic, it is imperative that CEOs take leadership and work with the Government to chart the way forward.

Proactive efforts to increase value added exports, increasing FDIs and the revival of tourism via strategic country positioning and campaigns, supported by efficient COVID-19 related protocols and processes will play a key role in addressing vital forex challenges while ensuring revival and long-term stability of the Sri Lankan economy.

Improvements to both private and public sector productivity via technology infusions (to support digitalisation of manual processes, increased online presence, facilitation of work from home, virtual interactions) will be essential to ensure uninterrupted business operations under the new normal. Significant investments in skills development via education and training will undoubtedly support such digital transformation initiatives and ensure operational efficiency in the long run.

MTI’s Thought Leadership team comprises (from left): MTI Consulting CEO Hilmy Cader, Director – Pacific Region Dr. Jason Cordier, Business Analyst Rivisarani Karunanayaka, and Business Analyst Saarankan Kusalakumaran

MTI Corporate Finance

MTI Corporate Finance is the corporate finance arm of MTI Consulting, a boutique strategy consultancy with a network of associates across Asia, Africa and the Middle East. MTI Corporate Finance provides a comprehensive range of services, including due diligence, feasibility studies, funding new businesses or capitalisation of existing ones – from IPOs to private placement facilitation, M&A facilitation, and advisory on governance, compliances and risk management.