Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 30 September 2019 00:30 - - {{hitsCtrl.values.hits}}

Moody’s Investors Service has warned the Central Bank’s decision to cap lending rates will compress net interest margins of banks and add to their existing profitability challenges. Last Tuesday the Central Bank of Sri Lanka (CBSL) mandated commercial banks to cut lending rates on all Sri Lankan rupee-denominated loans by at least 200 basis points beginning 15 October from rates set on 30 April 2019.

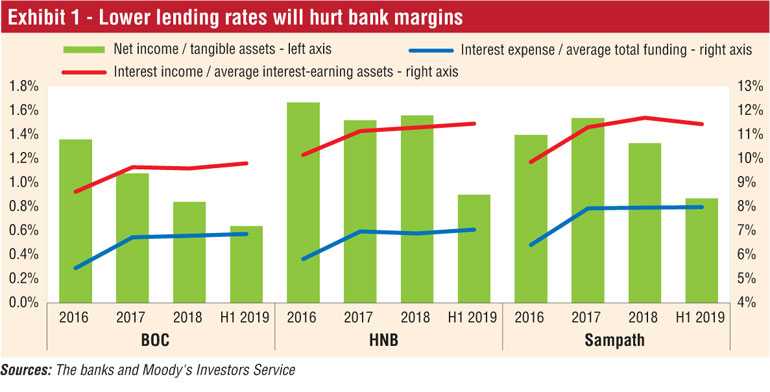

“The lower lending rates will compress Sri Lankan banks’ net interest margins (NIMs) and add to their existing profitability challenges. We expect banks’ NIMs to narrow after the lending rate cut since the cut’s immediate effect more than offsets a more gradual decline in funding costs because of the time lag in the re-pricing of time deposits. Narrower margins will strain bank profitability, which is already weakened because of rising credit costs and a higher effective tax rate,” Moody’s said in a short sector commentary.

Among the three rated banks in Sri Lanka – Bank of Ceylon (BOC, B2 stable, b21 ), Hatton National Bank Ltd. (HNB, B2 stable, b2) and Sampath Bank PLC (B2 stable, b2) – Moody’s expects the negative effect on margins and profitability will be more pronounced for BOC because its asset yields are lower than those of the other two banks (see graph). Furthermore, a modest NIM reflects BOC’s already weak profitability, while its poor asset quality has contributed to high credit costs.

The report points out that Sri Lankan banks’ credit costs have increased substantially since 2018 because of system-wide deterioration in asset quality amid weaknesses in the agriculture and construction sectors.

The country’s weak operating conditions following a constitutional crisis and the 2019 Easter Sunday terrorist bombings that killed 259 people exacerbated banks’ profitability challenges. In addition, the government introduced a temporary debt repayment levy in October 2018 that raised banks’ effective tax rate to more than 50% from 2019-’21, further weighing on the banks’ bottom line.

“With the lending rate cut, the Central Bank aims to stimulate economic activity and boost credit growth, which the country’s weak economy has dampened. The Central Bank’s move comes amid an accommodative monetary policy in the past year, which did not lead to a reduction in lending rates,” it added. Since late 2018, the CBSL has adopted several measures to lower lending rates through a combination of lower reserve requirements, policy rate cuts and the introduction of a cap on deposit rates, which the CBSL removed shortly after the lending rate cut.

The CBSL also mandated that banks reduce the average weighted prime lending rate by 250 basis points by 27 December 2019 from rates as of 26 April 2019. The CBSL also introduced several other measures to curb lending rates, including a ceiling on rates charged on credit card advances, prearranged temporary overdrafts and penalty interest rates.