Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 24 February 2023 00:54 - - {{hitsCtrl.values.hits}}

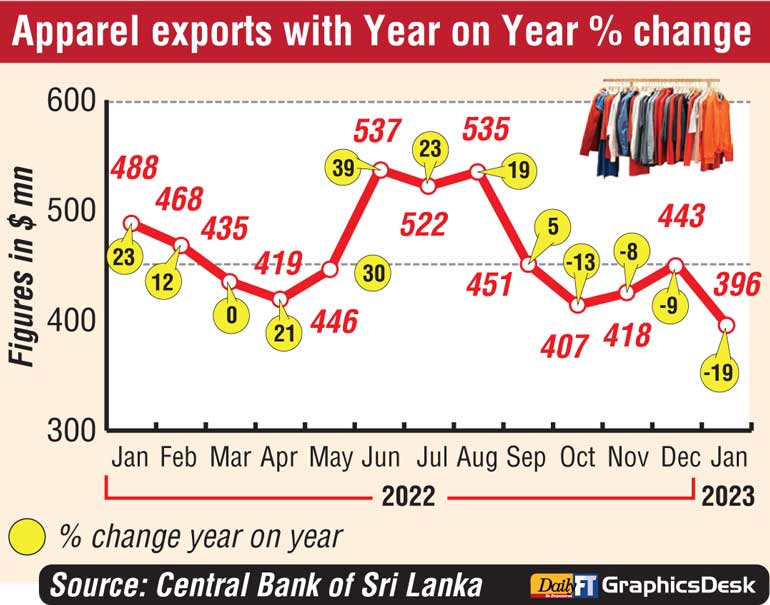

Apparel exports in January had sunk to lowest for the month in the past five years, reiterating industry’s concerns that 2023 will be very challenging.

Apparel exports in January had sunk to lowest for the month in the past five years, reiterating industry’s concerns that 2023 will be very challenging.

Exports in January amounted to $ 396.6 million, down sharply by 18.6% from the previous year. The 2023 January performance dipped beyond the previous lowest of $ 397.61 million in 2021.

The best January performance of $ 452 million was in 2019 in which year exports hit a record $ 5.3 billion before being overtaken last year.

Exports in January 2023 to the US were down by 24% to $ 162 million from a year earlier and to the EU by 19% to $ 113 million. Shipments to the UK were down by 8% to $ 56.3 million and other markets down by 10% to % 65 million.

The 2023 January performance marked the fourth consecutive year-on-year monthly decline though month-on-month it had been a bit erratic.

Apparel exports in 2022 managed to grow by 10.7 % to a record $ 5.4 billion largely aided by stellar performance in the early part of the year. Overall textile and garments exports grew by 9.5% to $ 5.95 billion.

One reason for negative growth in recent months is higher inventories both at store-level and with consumers. High inflation in key markets is another factor. In the 4Q of 2022 the apparel industry experienced a 15-20% decline in orders

Due to these factors industry analysts said Sri Lanka’s apparel exports could continue to be lower YoY basis until the first half of 2023 or beyond.

In the short- to medium-term, if exports were to increase new markets or greater access to emerging or high potential markets is key. In this regard, early finalisation of proposed Free Trade Agreements proposed by the President Ranil Wickremesinghe-led Government is paramount, analysts stressed.

The other stimulant will be Sri Lanka manufacturers and exporters managing to keep their costs down for which the country’s macroeconomic fundamentals and indicators as well as ease of doing business need to improve.

Last week the apparel industry fumed against the 66% increase in electricity tariff by the Government warning it was a severe blow to its competitiveness.

“The current increase is a further 31% with an overall increase of 165% since June 2022. This translates to an increase in manufacturing costs of close to 5% just on electricity,” the Joint Apparel Association Forum said.

With last year’s electricity tariff increases, Sri Lanka stood on par in dollar terms with regional giants like India, Bangladesh, Vietnam, Indonesia and Thailand offering $ 9 to10 cents per kWh. African countries including Benin and Togo which are aggressively pushing for foreign investments offer a much lower rate of $ 8 cents per kWh.

With the increases that have gone through, this will leave Sri Lanka with a tariff of around 12 cents per kWh, which will undoubtedly make Sri Lanka uncompetitive and unattractive to investors.