Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 7 June 2018 00:00 - - {{hitsCtrl.values.hits}}

Premier blue chip John Keells Holdings Plc (JKH) which posted its best-ever results in FY18 is bracing for next wave of growth following the completion of a new five-year strategy.

During FY18, in liaison with international industry experts, where applicable, the JKH group underwent a comprehensive strategy session for the medium term which focuses on the ensuing five years.

Stemming from JKH’s vision of “Building businesses that are leaders in the Region,” and garnered by the governing principles, each business unit developed a five-year strategy and business plan, which was approved by the Group Executive Committee and the Board.

Consequent to this exercise, key investments were identified and earmarked for implementation over the next few years across key growth businesses, particularly in the Leisure, Consumer Foods and Retail, Financial Services and Property industry groups.

“Given our strong balance sheet and anticipated cash generation, the Group will continue to deploy a significant quantum of cash to fund its investment pipeline,” JKH Chairman Susantha Ratnayake said in his Review in JKH’s 2017/18 Annual Report released last week.

In the Group Consolidated Review in the 2018 Annual Report, JKH said the Group expects to deploy over $ 600 million over the next few years to fund the Group’s investment pipeline, including Cinnamon Life, expansion of its Retail store network and distribution, route to market investments in the Consumer Foods sector and expansion of rooms under management by investing in minority stakes in new hotel ventures, amongst others.

“Given the gestation period of some of these investments, the realisation of benefits is expected to accrue in the medium term. Although these investments will impact performance in the short term, the Group is confident that it can leverage on such investments to drive the next phase of growth, whilst also achieving a better portfolio balance,” Ratnayake told JKH shareholders in the Chairman’s Review.

He said the Group is acutely mindful of the need to manage the balance between capital deployed and the resultant impact to the overall returns of the Group portfolio.

However, Ratnayake told shareholders, “The deployment of investments envisaged in the five-year strategic plans will be assessed periodically based on the macro-environment and market conditions prevailing at the time such investment decisions are made.”

As part of this next growth strategy, the JKH Group strengthened its land bank in FY18 through the acquisition of a few strategic land assets.

“Although the Group’s land banking strategy is expected to exert pressure on ROCE in the short term, it will facilitate the development and monetisation of a robust pipeline of projects that will have a positive impact on revenue and profit recognition, and, resultantly, on the ROCE of the industry group over the medium term,” the JKH Chairman added.

Given the increase in demand for residential and commercial space arising from increasing urbanisation, JKH Group will seek to establish a continuum of projects. In this light, land parcels in the city and the suburbs have been identified and earmarked for development.

In FY18 the JKH Group acquired a parcel of prime land in Vauxhall Street, Colombo. This, along with an existing plot of land owned by the Group, and an adjacent land held by Finlays Colombo Limited, was amalgamated to form a joint venture, with the Group owning approximately 60%. This combined parcel of 9.38 acres of prime land in proximity to the Beira Lake, is one of the largest privately held land banks in central Colombo.

Master planning for development of this land has commenced. Further, the Property industry group is in the process of finalising the acquisition of another 100 perches of land located in central Colombo, for a niche residential development which is expected to be launched in the second half of 2018/19.

Master planning of an 18-acre suburban site north of Colombo is also currently underway.

JKH Property industry group also announced the launch of its latest residential development, Tri-Zen, an 891 apartment joint venture residential development project. The construction of the project will commence by the second half of 2018/19 with expected completion in 2022/23.

Whilst preliminary planning clearance for the project has been obtained and schematic designs have been completed, the tender documents have been issued to pre-qualified contractors. This unique development will target a broader section of the market with apartments offered at attractive price points. “Pre-sales have commenced, and initial bookings are encouraging,” Ratnayake said.

The construction of the $ 850 million Cinnamon Life project, JKH’s biggest investment to date, is progressing with encouraging momentum with the completion of the super structure of the buildings expected in the second half of 2018/19, Ratnayake said.

The installation of the façade of the hotel has commenced whilst the six-lane bridge; which is the main access point of the hotel, will be completed towards the latter half of the year.

“Pre-sales for residential spaces continue to be encouraging with approximately 60% of the floor area being sold as at 31 March 2018. The project is slated for completion in the calendar year 2020 with the residential apartments and office complex ready for hand over and occupation by early 2020,” JKH Chairman said.

The Property industry group in FY18 reported revenues of Rs. 1.23 billion and a PAT of Rs. 1.05 billion, contributing 1% and 5% to Group revenue and PAT respectively. The 2017/18 PAT increased by 69% over the previous year. The improved performance is mainly on account of the recognition of deferred revenue arising from the reassessment of the revenue recognition policy at Rajawella Holdings Ltd. on the sale of lease hold rights, and fair value gains on investment property. Excluding the impact on RHL mentioned above, the 2017/18 recurring PAT decreased by 19% over the previous year.

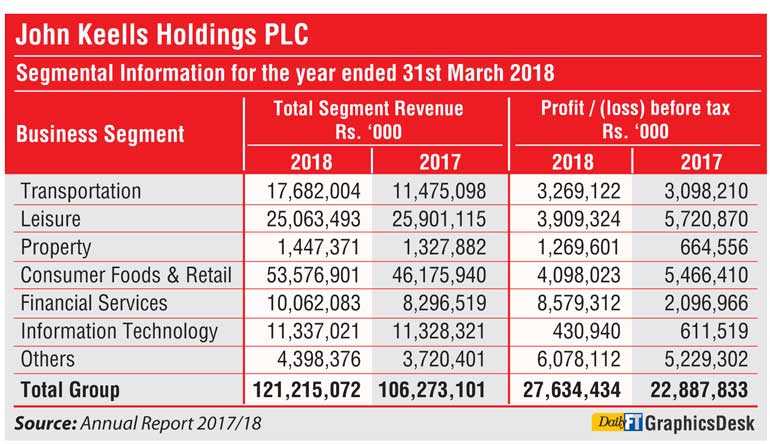

Overall JKH Group profit before tax (PBT) increased by 21% to Rs. 27.63 billion for the financial year ended 31 March 2018. The profit attributable to equity holders of the parent was Rs.21.02 billion, representing an increase of 29% over the Rs. 16.28 billion recorded in the previous year.

JKH Chairman described Group’s performance as “satisfactory” despite the challenging operating environment in the year under review, where economic growth was muted amidst pressures emanating from the external environment in addition to domestic macro-economic pressures.

Following are excerpts from JKH Chairman’s Review in the 2017/18 Annual Report:

Transportation Industry Group

The Transportation industry group reported revenue, including the share of revenue from the equity accounted investees, of Rs. 25.62 billion and a PAT of Rs. 3.08 billion, contributing 19% and 13% to Group revenue and PAT respectively. The 2017/18 PAT increased by 4% over the previous year. During the year under review, profits were impacted by an impairment provision for doubtful debt and a cumulative deferred tax charge at South Asia Gateway Terminals (SAGT). Excluding these impacts, the 2017/18 recurring PAT increased by 34% over the previous year.

During the financial year, volumes at the Port of Colombo witnessed a year-on-year growth of 8% whilst SAGT recorded an encouraging throughput increase of 10%. You will be pleased to note that the Port of Colombo was ranked amongst the ‘World’s 30 Best Ports,’ as per Alphaliner Rankings 2017 whilst SAGT was recognised as the ‘Best Terminal in South Asia’ by the Global Ports Forum, in March 2018, for the second consecutive year.

Since the expansion of capacity with the commissioning of the South Container Terminal, the overall capacity utilisation of the Port of Colombo is now in excess of 80%, demonstrating the strong potential for capacity led growth. In this context, timely development of the deep-draft East Container Terminal (ECT) is critical to ensure that capacity continues to be enhanced towards attracting further volumes and sustain continued growth at the Port.

Revenue and profitability of the Group’s Bunkering business improved as a result of the growth in volumes and an increase in base fuel prices during the year. The Logistics business recorded a strong performance due to an increase in throughput in its warehouse facilities while DHL Keells improved its market leadership position in the year under review.

Leisure Industry Group

The Leisure Industry Group reported revenues, including share of revenues from equity accounted investees, of Rs. 25.30 billion and a PAT of Rs. 3.34 billion, contributing 18% and 14% to Group revenue and PAT respectively. The 2017/18 PAT decreased by 33% over the previous year. The Bentota Beach by Cinnamon was closed for the reconstruction of a new hotel whilst Ellaidhoo Maldives by Cinnamon and Cinnamon Dhonveli Maldives were partially closed for refurbishment during the first half of 2017/18.

During the calendar year 2017, arrivals to Sri Lanka reached 2,116,407, representing a subdued year-on-year growth of 3%, primarily due to the partial closure of the airport for resurfacing of the runway and impacts due to flooding and the outbreak of dengue fever in the months of June and July 2017. The Western European and East Asian regions were the two largest source markets contributing towards overall arrivals growth, each demonstrating growth of 6% and 5% respectively. In keeping with the present growth opportunities within the sector and the 4.5 million tourist arrival target for 2020 set by the Sri Lanka Tourism Development Authority, better physical infrastructure such as enhanced connectivity through road networks and the expansion of the passenger handling capacity of the airport by expediting the planned new terminal, is a priority.

The increased room inventory arising out of entrants into the 3-5-star segments of the market, and the resultant competitive pricing, exerted pressure on the city sector’s average room rates during the period under review. However, it is heartening to note that the total number of room nights occupied in the city increased by 14%, underscoring the steady absorption of new room capacity within the sector. With new capacity expected to come on stream over the next few years, especially into the city, it is important for the country to improve its overall tourism offering, including its product and entertainment offering to attract the higher spending tourists.

Despite the increasingly competitive operating environment, the City Hotels sector increased its fair share of available rooms in the 5-star category in the year under review.

The Sri Lankan Resorts segment recorded an overall improvement in occupancy, despite the increase in competition within the sector, particularly in the coastal areas of the island.

Tourist arrivals to the Maldives displayed signs of a recovery with an increase of 8% for the calendar year 2017. Despite increased activity in the informal sector, the Maldivian Resorts segment recorded an improvement in its average room rates, whilst occupancies were well above the industry average. Cinnamon Hakuraa Huraa Maldives is currently closed for refurbishment, with expected completion in December 2019.

Considering the long-term growth prospects for tourism in the country, the Leisure industry group is currently evaluating several investments to expand its portfolio of hotels whilst being conscious of the impact on the effective capital deployed in the context of the JKH Group portfolio.

The model for expansion will primarily be on an asset-light investment model where the Group will seek partners for select hotel investments to manage its effective capital deployed in the industry group whilst increasing its rooms under management.

Consumer Foods and Retail Industry Group

The Consumer Foods and Retail Industry Group recorded revenues of Rs. 53.21 billion and a PAT of Rs. 2.89 billion, contributing 39% and 13% to Group revenue and PAT respectively. The 2017/18 PAT decreased by 26% over the previous year. The decline in profits is on account of the Consumer Foods sector and to a lesser extent the retail sector.

The Beverage and Frozen Confectionery businesses recorded a decline in volumes as a result of continued tapering of demand arising from subdued consumer discretionary spending. The volume decline in the Beverage business was further exacerbated by the implementation of a sugar tax from November 2017, which resulted in substantial price increases across the industry. Whilst over the years we have taken measures to reduce and replace calorific sugar content in the carbonated soft drinks (CSD), the sudden introduction of regulatory action in this regard in the absence of systematic engagement with the industry, negatively impacted CCS and other industry participants. As a continuing part of our beverage portfolio strategy, we will continue to aggressively expand our sugar free and low sugar product range by accelerating the launch of such new products whilst also launching more non-carbonated beverages to broaden our offering.

CCS invested Rs. 4.20 billion in a new state-of-the-art frozen confectionery manufacturing facility in the Seethawaka BOI zone. The construction of this facility was completed in the fourth quarter of 2017/18, as planned, with trial production underway and commercial operations commencing in the first quarter of 2018/19. This facility will allow the business to enhance its impulse offering whilst expanding the production capacity of the business and creating further economies of scale and operational efficiencies.

Whilst Keells Food Products PLC recorded a higher volume growth compared to the previous year, profitability was impacted by an increase in marketing and promotional costs pertaining to the rebranding of ‘Keells’ to ‘Krest’.

The Retail sector continued to outperform market growth, driven by the rapid expansion of new stores underscoring the value created by the brand and the service offering. However, the rate of growth and the margins of the Retail sector were impacted by the slowdown in consumer discretionary spending as previously mentioned. The tightening monetary conditions coupled with price ceilings imposed on some essential goods negatively impacted the average basket value and the gross margins of the business.

The penetration of modern Fast Moving Consumer Goods (FMCG) retail in the country remains low, compared to more developed regional countries, and presents a significant opportunity for growth. The sector will continue to strategically expand its store network and distribution capabilities in gaining market share. The expansion of our outlet footprint will continue its momentum with the planned opening of 40 outlets in 2018/19. The centralised distribution centre is expected to be operational by the second half of 2019/20, further enhancing operational processes, and in particular, strengthening the “fresh” supply chain of the business.

During the year under review, 23 new outlets were opened, bringing the total store count to 80 as at 31 March 2018. The stores opened during the quarter featured the new branding which will be rolled out to the existing stores as well by end December 2018. The branding initiative encompasses new elements to the store in line with evolving consumer needs which we are confident will drive footfall. The new format and offering has been very well received.

The Nexus Mobile loyalty program, which enables the business to identify key trends in customers and shopping lifestyles using data analytics, proved to be a key tool in retaining and attracting customers and in enhancing customer experience. During the year under review, the loyalty programme membership exceeded the 900,000 mark.

Financial Services Industry Group

The Financial Services Industry Group recorded revenues, including the share of revenues from associate companies, of Rs. 17.22 billion and a PAT of Rs. 8.58 billion, contributing 13% and 37% to Group revenue and PAT. The 2017/18 PAT increased significantly over the previous year, mainly on account of the Life Insurance business, Union Assurance PLC (UA).

Whilst recording an encouraging growth of 22% in Gross Written Premiums (GWP), well above the industry growth of 13%, UA recorded an annual life insurance surplus of Rs. 3.64 billion [2016/17: Rs. 1.10 billion] and a one-off surplus of Rs. 3.38 billion during the year under review. The significant increase is due to a policy change across the industry in keeping with international norms for computation of insurance contract liabilities as per the directive and guidelines issued by the Insurance Regulatory Commission of Sri Lanka (IRCSL). It should be noted that the life insurance surplus of Rs. 3.64 billion [2016/17: Rs. 1.10 billion] was the optimum value transfer for 2017 as indicated by the independent actuary. The one-off surplus of Rs. 3.38 billion is attributable to non-participating and non-unit fund of unit linked business transferred from the life policyholder fund to the life shareholder fund.

The banking industry recorded healthy growth driven mainly by the strong credit demand stemming from both the private and public sectors. Despite the marginal contraction in net interest margins, Nations Trust Bank (NTB) recorded a double-digit growth in both deposits and advances, which trended above the industry average.

The growth in loans and advances was primarily driven by the Retail, SME and Corporate segments. During the year under review, the bank launched FriMi, the country’s first digital bank, which enables the opening of a bank account through a smart device. FriMi is a next generation bank account, payment system and e-wallet that will offer convenience, speed and added value to users on one integrated digital platform.

During the year, your Group invested Rs. 1.45 billion in NTB, subscribing to its entitlement of rights and applying for additional rights, in a Rights Issue of Ordinary Non-Voting Convertible Shares, that concluded in February 2018. The Director of Bank Supervision of the Central Bank of Sri Lanka (CBSL), by letter dated 12 October 2017, informed the bank that the Monetary Board of the CBSL has permitted the Group to retain its current voting shareholdings in the Bank till 31 December 2020, and to reduce it to 15%, with effect from that date. The Monetary Board has also required the bank to limit the voting rights of the Group to 10% with effect from 31 March 2018. The Group’s effective economic interest in NTB now stands at 32.16%.

Information Technology Industry Group

The Information Technology industry group recorded revenues of Rs. 11.07 billion and a PAT of Rs. 360 million, contributing 8% and 2% to Group revenue and PAT respectively. The 2017/18 PAT decreased by 23% over the previous year. In September 2017, the Group divested its stake in its subsidiary, John Keells BPO Solutions India Ltd. The Office Automation business recorded volume declines across its product categories on account of a general tapering of demand and a slowdown in consumer discretionary spending.

Other including plantation services

The Plantation Services sector recorded revenues of Rs. 3.28 billion and a PAT of Rs. 475 million, contributing 2% each to Group revenue and PAT. The 2017/18 PAT increased significantly over the previous year.

The Plantation Services sector recorded an improvement in profitability as a result of improved tea prices and other operational efficiencies.

Others, comprising of the Holding Company and other investments, and the Plantation Services sector, together, recorded revenues of Rs. 3.44 billion and a PAT of Rs. 3.82 billion for 2017/18, contributing 3% and 17% to Group revenue and PAT respectively.

The 2017/18 PAT increased by 23% over the previous year. The increased PAT is mainly

attributable to the interest income generated on the Group’s Rupee and US Dollar portfolios and exchange gains recorded at the Company on its foreign currency denominated cash holdings.

Research and Innovation

John Keells Research (JKR), the research and development arm of the Group, following the patenting of a novel energy storage material in 2016/17, is actively evaluating opportunities for building a prototype energy storage device which would utilise the patented technology to enhance the Technology Readiness Level (TRL) of the said intellectual property.

The year under review marked a significant milestone as JKR’s own research laboratory commenced operations. This facility will be instrumental in enhancing JKR’s capabilities in conducting in-house projects, thus ensuring sole ownership of Intellectual Property by JKH.

Eight research projects are currently being conducted in-house.

During the year under review, the Group continued its concerted effort to drive a culture of disruptive innovation amongst our employees and businesses. An award on Disruptive Innovation was presented for the second time at the JKH Chairman’s Awards 2017, to recognise businesses which have made disruptive innovation an integral part of their operating culture and have formulated successful responses to address current, and emerging, business disruption.

The second phase of ‘John Keells X: An Open Innovation Challenge’ was launched in May 2017, with six selected participants winning entry to the six-month John Keells X Accelerator Programme, enabling a conducive ecosystem for young entrepreneurs to thrive, and to encourage businesses at JKH to engage, in a model of open sourced innovation.

Dividends and new leadership

For FY18, JKH Board declared a third and final dividend of Rs. 2.00 per share to be paid on 18 June 2018. The first and second interim dividends for the year of Rs. 2.00 per share, each, were paid in November 2017 and February 2018, respectively. The total dividend pay-out in the year under review was Rs. 8.32 billion compared to the Rs. 7.28 billion in the previous financial year.

Ratnayake in the Chairman’s Review placed on record our deep appreciation for the invaluable contribution made by Ajit Gunewardene, Deputy Chairman, and Ronnie Peiris, Group Finance Director, who retired with effect from 31 December 2017. As announced in the Group’s succession plan Krishan Balendra and Gihan Cooray assumed office as the Deputy Chairman and the Group Finance Director respectively, effective from 1 January 2018. Further, Balendra will take over as Chairman and Cooray as Deputy Chairman/Group Finance Director upon Ratnayake’s retirement at the end of this year.