Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 28 January 2021 02:02 - - {{hitsCtrl.values.hits}}

|

JKH Chairman Krishan Balendra

|

Premier blue chip John Keells Holdings PLC (JKH) has continued to improve its performance in the third quarter despite its core sector, Leisure, lagging on account of the COVID-19 pandemic.

JKH reported a group revenue of Rs. 35.59 billion for the third quarter (3Q) which was a decrease of 5% from a year earlier. Group revenue excluding the Leisure industry group stood at Rs. 34.23 billion up 5%.

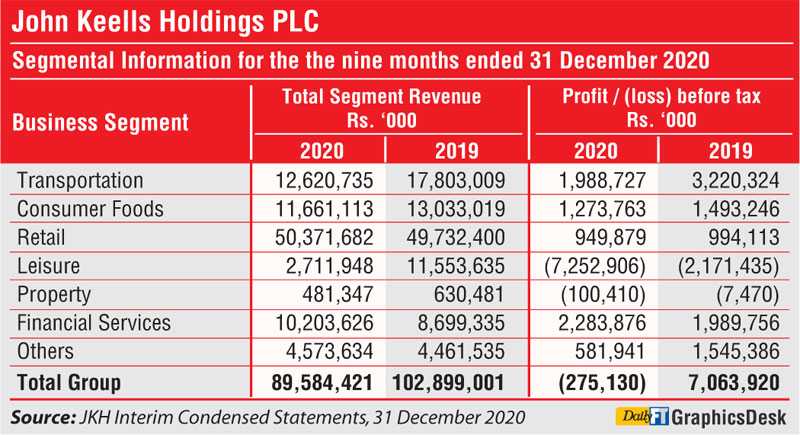

Cumulative group revenue for the first nine months of FY21 was down by 13% to Rs .89.58 billion.

Group earnings before interest expense, tax, depreciation and amortisation (EBITDA) is down 25% to Rs. 4.21 billion in the 3Q. Group EBITDA excluding the Leisure industry group stood at Rs. 5.22 billion in 3Q, up 5%.

Cumulative group EBITDA for the first nine months at Rs. 8.33 billion was down 37% from a year earlier.

Group profit before tax (PBT) at Rs. 1.52 billion in 3Q was down 51% whilst Group PBT excluding the Leisure industry group was Rs. 3.68 billion, up 5%.

Cumulative group PBT for the first nine months of the financial year 2020/21 was a negative Rs. 275 million as against PBT of Rs. 7.06 billion recorded in the corresponding period of the previous financial year. Profit attributable to equity holders of the parent at Rs. 992 million in the quarter under review is a 59% decrease against the comparative quarter [2019/20 Q3: Rs. 2.40 billion]. On a cumulative basis, profit attributable to equity holders of the parent at Rs. 15 million, is a 100% decrease against the comparative period.

The JKH Board declared a third interim dividend of Rs. 0.50 per share, to be paid on or before 2 March. The company paid a first interim dividend and a second interim dividend of Rs. 0.50 per share, each, in August and December 2020, respectively, for the financial year 2020/21.

During the quarter, the Holding Company drew down the final remainder of $ 75 million of its total $ 175 million long-term loan facility from the International Finance Corporation (IFC). There was no impact on net debt due to the drawdown of the IFC loan, since the cash balance was also retained at the Holding Company level. The Holding Company had a strong net cash position of Rs. 17.91 billion, which primarily consists of a US Dollar position. Group net debt excluding lease liabilities as at 31 December 2020 was at Rs. 42.18 billion, a 6% increase against 30 September 2020 [2020/21 Q2: Rs. 39.77 billion].

JKH Chairman Krishan Balendra said while the COVID-19 pandemic was contained in the country throughout the second quarter of the financial year, the outbreak of a cluster in early October 2020 led to an increase in the number of COVID-19 cases within the country, which prompted isolation measures in some areas. These isolation measures prevailed across the country mainly in the month of October, with an easing of these measures thereafter.

“The resultant curtailing of movement, however, caused a slowdown in business activity and dampened consumer sentiment resulting in a slower pace of recovery through the months of October and November, exerting pressure on group performance in the quarter under review. However, it is encouraging to note that the impact of the isolation measures on business was notably less severe than originally witnessed during the lockdown which was imposed in the first quarter of 2020/21,” he added.

Balendra said activity demonstrated near normal levels in many businesses of the group in the month of December, with the exception of Leisure where domestic travel was yet to show signs of recovery given a certain degree of caution relating to travel and entertainment by customers.

He said: “JKH Group continues to take all necessary measures to ensure our customers, employees

and all other stakeholders are safeguarded when doing business. Proactive action is taken on a day-to-day basis to mitigate the risk of a spread of COVID-19, in compliance with the guidelines and regulations stipulated by the health authorities, whilst we continue to rollout additional voluntary and precautionary measures. The Group continues to reinforce and evaluate its safety protocols applicable to its multitude of stakeholders and has taken all possible steps to protect its supply chains in

the current environment.

“I wish to recognise the contribution and tremendous efforts made by my colleagues who continue to serve in the front lines, and thank them for their commitment, dedication and positive attitude throughout these challenging times,” Chairman Balendra added.

Some of the highlights in 3Q were the obtaining of the Certificates of Conformity (COC) for the Cinnamon Life office tower and ‘The Suites’ residential tower, which will enable hand-over of the residential apartments and office tower to commence, on a staggered basis, from the fourth quarter of 2020/21 onwards.

The Supermarket business continued its positive momentum with overall revenue and EBITDA recording growth over the previous year driven by the contribution from new outlets, despite the closure or limited operations of outlets in certain isolated areas.

The Insurance business continued its recovery momentum recording encouraging growth in all its channels of distribution, amidst a challenging environment.

The year-on-year comparison of the Transportation industry group is distorted, primarily since the comparative quarter of the previous year had above-average profitability in the Bunkering business on account of a transition to low sulphur fuel oil (LSFO), well ahead of competition.

The pace of construction at ‘Cinnamon Life’ continued to gain momentum during the latter part of the quarter despite the disruptions due to the second wave. The business continues to closely monitor the evolving ground situation and resultant impacts on the overall timelines of the hotel and the shopping mall.

The overall performance and volumes in the Frozen Confectionery, Beverage and Convenience Foods businesses demonstrated a pick-up towards December once activity in the country returned to more normalised levels, although the performance for the quarter was hampered due to the onset of the second wave of COVID-19.

The Maldivian Resorts segment demonstrated an encouraging performance following the opening of the airport in the Maldives in mid-July, with occupancy increasing to 53 per cent in the month of December, resulting in the segment recording a positive EBITDA for the quarter.

The Leisure businesses in Sri Lanka continued to be impacted by the pandemic due to the closure of the airport and lower revenue from dining and banqueting due to the outbreak of the second wave. The airports in Sri Lanka were opened on 21 January for tourist arrivals under stringent health and safety protocols.