Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 22 October 2020 02:37 - - {{hitsCtrl.values.hits}}

Amid a global pandemic with its significant impact on business in 2020, Interbrand has announced the brands that have fared best in its 2020 Best Global Brands ranking.

Amid a global pandemic with its significant impact on business in 2020, Interbrand has announced the brands that have fared best in its 2020 Best Global Brands ranking.

As expected, social media and communication brands have fared well in the past 12 months, with Instagram (#19), YouTube (#30) and Zoom (#100) entering the rankings for the first time. Tesla has also re-entered the rankings at #40 with a brand value of $12,785 m, having last appeared in the Best Global Brands table in 2017.

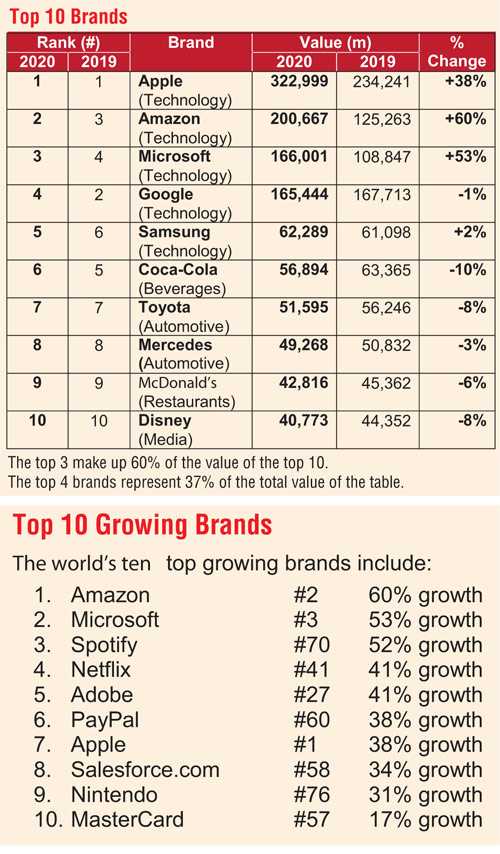

Other top performers include Amazon, ranking #2, increasing brand value by 60%, with a valuation of $ 200,667 m. Media companies have also seen success among the turmoil created by COVID. Spotify (#70), saw brand value increase by 52% to $ 8,389 m – jumping 22 places in the ranking, while Netflix rose to #41 with a 41% increase to $12,665 m. Business models have played a role in this success, with 62% of double-digit risers relying on significant subscription model businesses.

The Top 10

While Apple retained its top spot in the table, Microsoft’s increase in value this year ($ 166,001 m) means it has overtaken Google (#4) to reach the number three spot. Google has moved out of the top three for the first time since 2012. Meanwhile Samsung #5 ($ 62,289 m) has broken into the top five for the first time ever.

The remainder of the Top 10 comprises: Coca-Cola #6 ($ 56,894 m), Toyota #7 ($ 51,595 m), Mercedes-Benz #8 ($ 49,268 m), McDonald’s #9 ($ 42,816 m) and Disney #10 ($ 40,773 m). The top ten brands accounts for 50% of the total table value this year.

The COVID effect

The 2020 Best Global Brands ranking also saw the ‘COVID effect’, with global shop closures causing the brand values of Zara (#35) and H&M (#37) to fall 13% and 14% respectively, with both dropping at least six places in this year’s ranking. After two years as the top growing sector, luxury brands took a hit in 2020, with all but one brand value falling between 1-9%.

Other brands and industries have benefitted from the ‘COVID effect’, notably logistics which saw an average of 5% growth – UPS (#24), FedEx (#75) and DHL (#81) all saw positive brand valuation growth, as the logistics sector as a whole became more central to our lives in lockdown.

PayPal (#60), Visa (#45) and Mastercard (#57) have also risen in the rankings, 12, 10 and five places respectively. The pandemic has seen the sudden shift to electronic as the primary payment method and the swift roll out of programs to support local business during pandemic lockdown, benefitting these trusted brands, who provide access to capital in times of economic uncertainty.

The table value

The overall value of the table has increased to $ 2,336,491 m (up 9% from 2019). Driving growth of the table is big tech. Average brand value growth among all growing brands was 14%. Average growth of technology and tech platform brands was 20%. Technology and tech platform brands now represent 48% of total table value versus only 17% in 2010. The top three brands in the table (all tech) represent 30% of the value of the entire table versus only 16% in 2010.

The 21st edition of Interbrand’s annual brand valuation report features a series of individual sector reports which delve deeper into the technology, media, automotive, and retail industries.

Key learnings

During the analysis of BGB 2020, one key question emerged – how can brands build economic resilience, individual confidence and make good on the possibility of a better future for us all? Our analysis revealed a chain of three fundamental priorities:

For the complete Top 100 ranking and the report with comprehensive analysis of growth, sector, and industry trends, visit www.bestglobalbrands.com.

Report and methodology

Interbrand’s 21st annual report, ‘The Decade of Possibility,’ analyses how the world’s leading companies are successfully navigating a rapidly changing business landscape.

Interbrand has over 30 years of experience delivering brand valuation analysis, having designed and led the world’s first brand valuation in 1988. Interbrand was the first company to have its brand valuation methodology certified as compliant with the requirements of ISO 10668 (requirements for monetary brand valuation) and played a key role in the development of the standard itself.

There are three key pieces of analysis that form the basis of Interbrand’s valuation methodology:

1.The financial performance of the branded products or services

2.The role the brand plays in purchase decisions

3.The brand’s competitive strength and its ability to create loyalty and, therefore, sustainable demand and profit into the future

The research covers the period between 1 July 2019 and 30 June 2020, analysis was undertaken between June and September. Interbrand reserves the right to make amendments based on significant events impacting a brand after these dates.

Criteria for inclusion in best global brands

To be included in Best Global Brands, a brand must be truly global, having successfully transcended geographic and cultural boundaries. It will have expanded across the established economic centres of the world and entered the major growth markets. In specific terms, this requires that:

These requirements—that a brand be global, profitable, visible, and relatively transparent with financial results—explains the exclusion of some well-known brands that might otherwise be expected to appear in the ranking.