Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 2 April 2018 00:34 - - {{hitsCtrl.values.hits}}

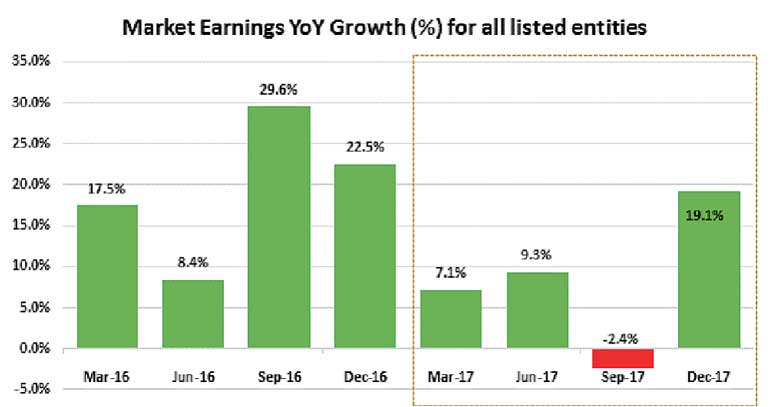

December quarter earnings of 279 listed companies have spiked 19% year-on-year to Rs. 86 billion, turning around from a dip of 2% year-on-year in September 2017, according to First Capital Research.

It said the main drivers of earnings were Insurance (219%YoY) and Real Estate (255%YoY) overcoming the negative effect of Food, Beverage and Tobacco (-37%YoY) and Capital Goods (-21%YoY). The Insurance sector saw a phenomenal earnings growth of 219%YoY to Rs. 17.6 billion (20% of total December 2017 earnings) driven by CTCE (+2199%YoY) and CINS (+102%YoY).

CTCE profits were up as change in contractual liability increased to Rs. 5.8 billion while CINS profits increased given the absence of the decline in the insurance fund of Rs. 1.7 billion in December 2016.

The Real Estate sector saw a profit growth of 255% YoY to Rs. 6.3 billion (7% of total December 2017 earnings) driven by RIL (3874%YoY) and CLND (4843%YoY).

First Capital Research said RIL’s profits were boosted due to one-off gains of Rs. 1 billion and profits of Rs. 1.5 billion of equity accounted investee arising from its acquisition of 30% stake in UML while CLND’s profits were up given the fair value gains on its land property in Pettah.

The Food, Beverage and Tobacco sector saw earnings dipping by 37% YoY to Rs. 11.7 billion (14% of total December 2017 earnings) driven by GOOD (-100%YoY) and BUKI (-97%YoY) given the absence of profits from the disposal of plantation assets in December 2016.

The Capital Goods sector’s earnings declined by 21% YoY to Rs. 9.9 billion driven by JKH (-13%YoY) and KAPI (-3201%YoY).

JKH’s earnings were affected by a higher cost of sales which eroded gross margins while KAPI saw higher finance cost (+29%YoY) coupled with declining gross margins due to a higher cost of sales.