Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 10 February 2023 00:28 - - {{hitsCtrl.values.hits}}

|

Group CEO Kasturi C. Wilson

|

Hemas Holdings PLC said yesterday it has delivered a commendable performance in the first nine months of the financial year 2023.

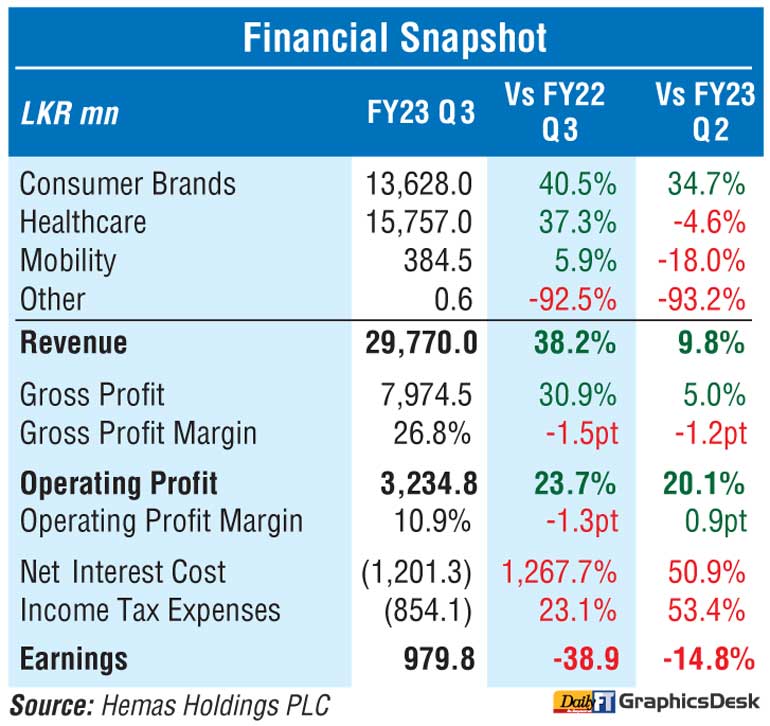

Notwithstanding the volatile economic conditions, the Group posted a cumulative revenue of Rs. 81.7 billion, a 41.6% growth over last year. Despite the 51.5% growth in Group operating profits, reported earnings for the period remained flat at Rs. 3.2 billion amidst the escalating interest rates.

Hemas said while the prolonged effects of the economic crisis continued to impact the operating dynamics and the consumption habits, the Group posted a revenue of Rs. 29.8 billion for the quarter, a growth of 38.2% over same period last year.

“Increased resilience in the backdrop of successive crises coupled with future focused business strategies on optimising working capital, internationalisation and customer centricity resulted in a stronger recovery in business activities.

“The positive momentum of declining global commodity prices and improved exchange availability was not reflected in the earnings due to inflationary pressure and elevated borrowing costs,” said Hemas Holdings Group CEO Kasturi C. Wilson.

Commenting on the outlook, she said challenges surrounding the domestic economic crisis including soaring inflation, elevated interest rates, adverse impact of all time high tax rates on disposable income, together with global economic pressure will present even greater challenges to businesses and communities.

“Against this backdrop, implementation of timely liquidity and working capital management initiatives will be prioritised as the Group continues to invest on growth and new markets. Hemas will build on the foundations put in place over the last seven decades to future-proof the Group and remain resilient, contributing to the economy with continuous employment opportunities and product offerings,” Wilson added.

She also said ongoing focus will be placed on strengthening the core portfolio while investing in research and development capabilities to cater to the ever-evolving needs of the customers.

“The Group will invest in opportunities for value addition through our ecosystem partnerships in the Consumer and Healthcare spaces while maintaining an optimum risk profile to deliver balanced growth. Internationalisation and expanding the export portfolio will remain a key priority as the Group seeks to increase long-term value creation while empowering families to live a better tomorrow,” she added.

Hemas’ Consumer Sector reported a 44.3% growth in cumulative revenue to reach Rs. 32.5 billion for the first nine months of the year. Increased focus on the International and exports segments, notably on personal care and learning verticals positively contributed to the revenue growth.

Despite the growth in operating profit, the dual impact of increase in interest rates and the widened working capital base restricted the earnings to Rs. 1.9 billion as against Rs. 1.6 billion reported last year.

Despite the growth in operating profit, the dual impact of increase in interest rates and the widened working capital base restricted the earnings to Rs. 1.9 billion as against Rs. 1.6 billion reported last year.

The Sector reported a revenue of Rs. 13.6 billion for the quarter, supported by the improved performance of both the Home and Personal Care and Learning Segments. Prudent efforts to identify challenges and implement appropriate pricing and cost management strategies along with dynamic supply chain solutions allowed the Sector to achieve an operating profit of Rs 1.8 billion during the quarter.

In the Healthcare Sector the cumulative revenue for the period stood at Rs. 48.0 billion, a growth of 42.5% over same period last year resulting from the National Medicines Regulatory Authority (NMRA) approved price adjustments made to partially compensate for the steep currency devaluation. In line with the growth in revenue, operating profit for the period improved to Rs. 3.8 billion while the escalating finance costs resulted in a de-growth in earnings of 8.5%.

The Healthcare Sector achieved a revenue of Rs. 15.8 billion for the quarter, a growth of 37.3% over last year. During the quarter, the Sector delivered operating profit and earnings of Rs. 1.3 billion and Rs. 412.3 million respectively.