Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 9 February 2021 01:28 - - {{hitsCtrl.values.hits}}

The Government has suspended the surcharge on import of fuel as relief to loss-incurring Ceylon Petroleum Corporation (CPC) and the listed Lanka IOC PLC, though there won’t be a change in prices at retail level.

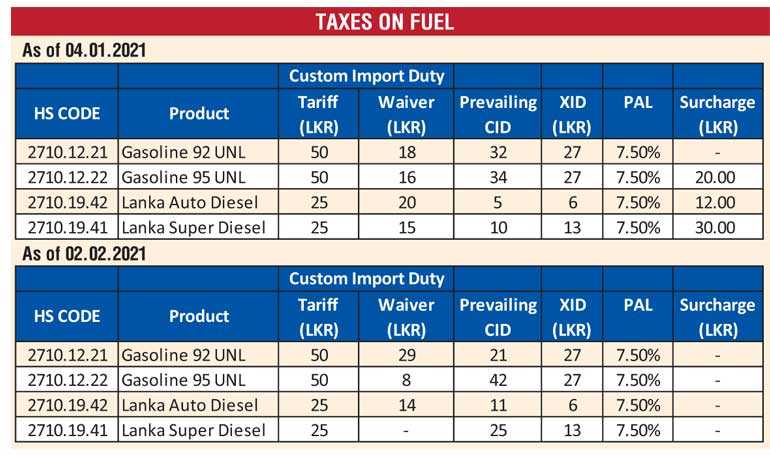

Surcharges applicable were Rs. 20 per litre of Petrol 95, 12 per litre of Auto Diesel and Rs. 30 per litre of Super Diesel. (See chart).

The suspension has been ordered by Finance Minister Mahinda Rajapaksa and will be applicable between 2 and 28 February. The Ministry will revisit the matter thereafter to assess whether the suspension needs to be continued or not.

The surcharge was originally imposed for three months till November 2020 and extended till 1 February as oil prices were lower. However the two oil companies have complained about cost rise in their procurement (whilst retail prices have remained unchanged) hence taxes or duties must be revised or removed to reduce losses.

The removal of surcharge comes hot on the heels of Finance Minister Rajapaksa granting an enhanced duty waiver on customs duty on the import of petrol and diesel. Effective from 1 January, the new waiver ranged from a low of Rs. 11 per litre to a high of Rs. 17 per litre.

For example, the duty on Petrol having Octane 92 was at Rs. 50 per litre and there was an existing duty waiver of Rs. 7 per litre. From 1 January, a new duty waiver of Rs. 11 per litre has been granted bringing the full waiver to Rs. 18. Recoverable Customs Import duty on this Octane 92 is now reduced to Rs. 32 per litre.

On Octane 95, as opposed to the prevailing Rs. 50 per litre import duty, the new rate is Rs. 34 per litre. This is after granting a Rs. 10 per litre waiver to the existing Rs. 6 per litre. On Super Diesel that contains Sulphur not exceeding 10 mg/kg (ppm), import duty, which was Rs. 25 per litre, has been reduced to Rs. 10 per litre, and other Diesel that contains Sulphur exceeding 10 mg/kg (ppm) but not exceeding 500 mg/kg (ppm) reduced from Rs. 25 per litre to Rs. 5 per litre.

The Finance Minister didn’t grant a waiver on category of “Diesel Other” and duty remains at Rs. 25 per litre.

Lanka IOC (LIOC) last week announced a loss of Rs. 91 million for the nine months of FY21 as against a profit of Rs. 768 million, on account of under recoveries on sale of petrol and diesel.

LIOC said the retail selling prices of Auto fuels were last revised in October 2019. The international prices remained highly volatile and increased from bottom of $ 18/bbl in April 2020 to $ 58/bbl in January 2021. However, during this period, import duties in the form of custom duty and surcharges were increased considerably and these higher taxes have not been passed on to customers. LIOC has contributed over Rs. 17 billion to the Government exchequer in form of duties and taxes during the year.

“Based on the prevailing international prices of petroleum products, oil companies in Sri Lanka are losing substantially on sales of LAD and LP 92. The recent depreciation in currency has further added to the exchange losses. However, company has performed well in all business segments despite headwinds from COVID-19 pandemic,” LIOC said in a statement.

However in the third quarter, LIOC made a pre-tax profit of Rs. 810 million, up from Rs. 570 million a year earlier. This was despite revenue dropping from Rs. 19.8 billion to Rs. 16.5 billion. Gross profit showed a marginal improvement to Rs. 1.39 billion from Rs. 1.32 billion in 3Q of last financial year. Lower selling and distribution expenses among other factors helped to post an operating profit of Rs. 626 million in 3Q up from Rs. 463 million a year ago. Higher finance income helped to compensate for an increase in finance expenses as well.

In the wake of sharp rises in world fuel prices, State Minister of Energy Udaya Gammanpila recently disclosed that the CPC was incurring a loss of Rs. 10 for a litre of diesel and Rs. 17 for a litre of petrol.

The CPC in January told the Parliament Committee on Public Enterprisers (COPE) that it saved $ 300 million in foreign exchange in 2020 due to the drop in world crude oil prices.

CPC Chairman Sumith Wijesinghe said that the Government was able to take advantage of the fall in the price of crude oil last year due to the outbreak of the coronavirus as well as several other reasons.