Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Saturday, 21 October 2017 00:00 - - {{hitsCtrl.values.hits}}

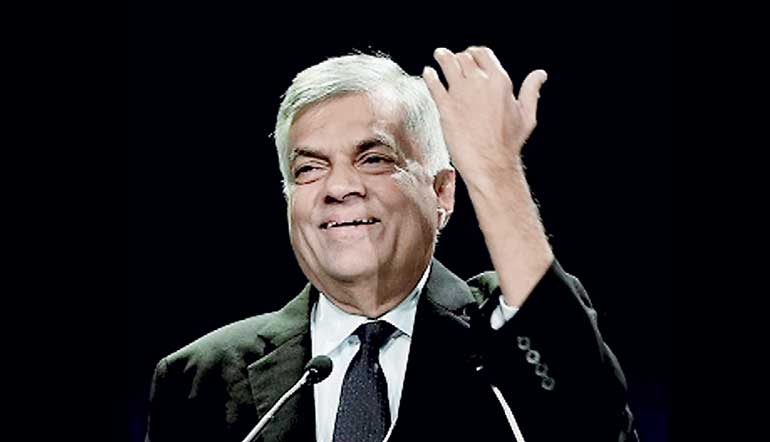

Prime Minister Ranil Wickremesinghe

Prime Minister Ranil Wickremesinghe in his pre-budget economic policy statement to Parliament yesterday outlined plans to initiate a fresh debt management strategy to cope with high debt repayment needs over the next few years.

The Prime Minister’s statement follows calls from the International Monetary Fund (IMF), which earlier this month called for stronger debt management from the Government as it heads to a bunching of debt from 2019-2022. Moody’s rating agency in August estimated that $13.8 billion would have to be repaid during this period with high levels of domestic debt earmarked for 2018. The Government is expected to roll over some debt to make the timeline for comfortable, analysts have said.

In his statement, Wickremesinghe pointed out the domestic debt portfolio mainly consists of Treasury Bonds. Around 30% of the Treasury Bonds will mature by 2019. Similarly, Sri Lanka Development Bonds, which is a USD denominated domestic debt instrument, worth of over USD 2.3 billion will mature by 2018.

In addition, the composition of the foreign debt portfolio was also changed considerably, he said.

“This change occurred mainly due to the increase of mobilising commercial loans such as the issuance of International Sovereign Bonds. We have to pay $1.5 billion in 2019 for maturities of International Sovereign Bonds. Further, we have to pay annually thereafter.

“When considering the public debt service payments based on the outstanding debt as at end of August 2017, we have to pay Rs. 1,974 billion in 2018. We will have to pay Rs. 1,515 billion in 2019. It means we have to pay more than Rs. 3, 489 billion in 2018 and 2019 for debt servicing,” he added.

In order to overcome these unprecedented challenges, the Government has initiated a prudent debt management strategy, the Prime Minister said, adding that its traditional approach to debt management will have to change to cope with new risks and structural and regulatory changes.

“Our policies will be targeted on forward-looking liability management strategies. Accordingly, the funds required by the Government will be raised with transparency and predictability. Under the medium-term debt management strategy, the detailed strategies of Government borrowings will be known in advance to the domestic and foreign debt portfolios. In addition, we will introduce a comprehensive secondary market trading platform and a liability management fund. These reforms and future reforms will come into effect under the new Fiscal Liability Management Act that provides legal framework for a prudent debt management strategy,” he said.

The changes the Government has made by introducing the new Inland Revenue Act has been commended by the international community as well as domestic economic actors, he recalled.

With the reforms such as the new Inland Revenue Act, Foreign Exchange Act, Fiscal Liability Management Act, Corporate Intents of the State Owned Enterprises and close monetary-fiscal coordination, the Government expects to steer the country towards “robust and judicious management of our financial resources and fiscal framework.”

“We inherited the challenge of high debt with deficits in our current account balance and the Government budget. Years of low Government revenue paired with rigid expenditure flows led to financing the budget deficit from domestic and foreign borrowings.”

The Prime Minister went onto say that in 2015, 90.6% of the Government’s total revenue was spent for debt servicing. This amounted to 80% in 2016. “It is an urgent need to draw our attention on spending more than the revenue. We have initiated a process of fiscal consolidation based on revenue generation by passing the Inland Revenue Act, which is already yielding returns.”

Wickremesinghe stressed that public finances have been strengthened and revenue has increased as a percentage of GDP during the past two years. The ratio of revenue to GDP in 2016 increased to 14.2% from 11.4% in 2014. For the first six months of 2017, revenue to GDP now stands at 6.7% of GDP from 6% in the corresponding period in 2016. It is expected to reduce the current debt which is 79.3% of the GDP to 70% of GDP by 2020.

“We expect to maintain the budget deficit below 3.5% by then. We will strengthen the Fiscal Management Responsibility Act affirming our commitment towards fiscal consolidation. In the midst of all these, we have many other challenges in 2018 and 2019 in terms of public debt management and fiscal consolidation.”

The Prime Minister also spoke in detail about other challenges such as expanding the economy, maintaining low inflation, promoting education, and improving trade. He stressed that the Government would push ahead with its plans to ink new free trade agreements and increase competitiveness through reforms.

“To ensure a smooth transition for these companies, the Government will be formulating a trade adjustment package. We have already taken steps in that regard, enacting the Inland Revenue Act and the Foreign Exchange Act, and moving forward with the Anti-Dumping Bill. We are also formulating a new National Export Strategy and a new National Trade Policy. The Government is also establishing a National Single Window for Trade facilitation, and creating a new development bank for development financing with an export-import window,” he said.