Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 3 February 2020 01:25 - - {{hitsCtrl.values.hits}}

Dr. Harsha de Silva

UNP MP and economist Dr. Harsha de Silva yesterday declared that the expert forensic audits on irregularities of Bond auctions and EPF stock market investments have exposed the nexus between two Central Bank Governors Ajith Nivard Cabraal and Arjuna Mahendran with the controversial Arjun Aloysius.

Armed with the copies of the five forensic audits which was released by the Speaker to Parliament, Dr. de Silva yesterday told the media that the loss to the Government over irregularities on Bond auctions under former Central Bank Governor Arjuna Mahendran between February 2015 and March 2016 ranged from a minimum of Rs. 6.6 billion to maximum of Rs. 9.6 billion. The loss from direct placements of Treasury Bonds prior to 2015 was Rs. 10.47 billion.

The prominent primary dealer who bought these Bonds and then sold them in secondary markets was Arjun Aloysius of Perpetual Treasuries fame.

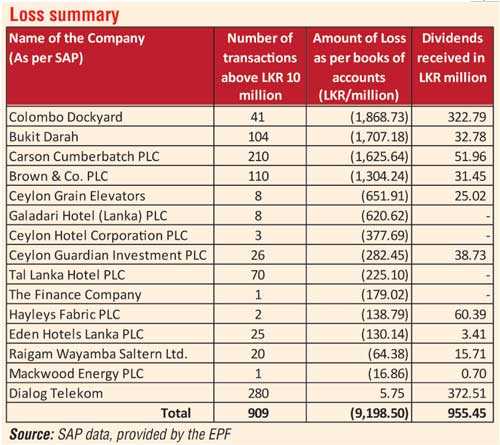

At the same time, the booked losses to the Employees Provident Fund (EPF) under then-Central Bank Governor Ajith Nivard Cabraal via questionable stock market investments during 2010 and 2011 was Rs. 9.4 billion. Most of the EPF purchases of stocks at highly inflated prices were from Perpetual Capital, also owned by Aloysius.

“The findings of the forensic audits expose that during the Central Bank Governorship tenures of Cabraal and Mahendran, the common beneficiary in both cases was Aloysius,” said Dr. de Silva, who has been a vocal critic of corruption in Parliament, be it in Opposition and in Government. He said the forensic audits were done by foreign offices, and experts of globally respected firms chartered accountancy firms KPMG and BDO.

“Despite some digital devices or computers of Mahendran and Cabraal not being available for investigation, nor did they come forward for face to face interviews or responded to written questionnaires, the audits are comprehensive,” Dr. de Silva said. “After reading the forensic audits today, I realised that when we were questioning the irregularities in Parliament, we didn’t have much information. However today the reports confirm it is an open and shut case (of irregularities),” he added.

KPMG and BDO had sought and provided evidence as per the Evidence Ordinance, and the UNP MP said parties concerned had price sensitive information prior to the market getting to know.

“What happened to the ill-gotten gains or undue profits, and who were the ultimate beneficiaries, or who were others involved indirectly to these scams, we do not know, nor was it part of the Terms of Reference. However, the CID must initiate necessary action based on the findings of the forensic audits,” Dr. de Silva pointed out. When it comes to stock market deals, the Securities and Exchange Commission must take action.

He said that EPF investments in to shares of listed companies had violated many EPF, Monetary Board/Central Bank as well as Investment Committee rules and regulations.

It was alleged that Perpetual, having milked the stock market in 2010/11, later on shifted the focus onto the Bond market. Original primary dealership application was rejected in December 2012, and it was re-applied and time given for fulfilling of conditions, after which the licence was granted in October 2013.