Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 23 July 2018 00:48 - - {{hitsCtrl.values.hits}}

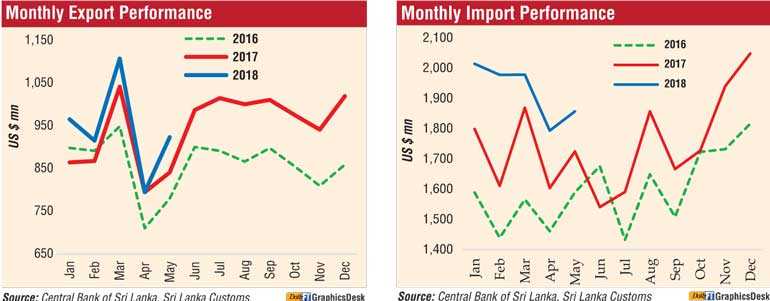

Exports growth in May outpaced that of imports, though the latter weighed heavily in the cumulative first five months performance, widening the trade deficit further.

Exports in May were up 9.8% to $ 924 million and in the first five months, the figure rose 6.7% to 4.7 billion. Imports in May grew by only 7.7% to $ 1.85 billion, bringing the Jan-May figure to $ 9.6 billion, up by 12% from a year earlier.

Although the deficit in the trade account continued to expand in May, the rate of expansion decelerated as export growth outpaced that of imports. The cumulative trade deficit expanded during the first five months to $ 4.9 billion from $ 4.2 billion a year earlier.

Central Bank said on Friday Sri Lanka’s external sector demonstrated a modest performance in May. The deficit in the trade account continued to expand at a comparatively slower rate in May, as export growth outpaced import growth.

Tourist earnings continued to increase while workers’ remittances declined during the month. Inflows to the financial account of the balance of payments (BOP) moderated with net outflows from the government securities market and a reduction in net inflows to the Colombo Stock Exchange (CSE).

The country’s level of gross official reserves at the end May stood at $ 8.8 billion. Meanwhile, reflecting the developments in the domestic and global foreign exchange markets, the rupee depreciated by 3.3% against the dollar by end May and by 4.5% so far during the year up to 20 July.

Earnings from merchandise exports increased to $ 924 million in May, mainly driven by industrial exports, despite a reduction recorded in agricultural exports. Under industrial exports, earnings from textiles and garment exports increased significantly due to the higher demand from the EU and the USA, while exports to non-traditional markets also increased moderately. Export earnings from petroleum products increased significantly in May due to the combined effect of high exported volumes of bunker and aviation fuel together with increased export prices. Earnings from food, beverages and tobacco exports also increased notably during the month owing to the increase in manufactured tobacco and coconut-related products. Further, earnings from all other main categories under industrial exports, except wood and paper products, and leather, travel goods and footwear, contributed towards the increase in industrial exports in May. However, earnings from agricultural exports declined in May due to poor performance in almost all categories except spice and seafood exports. Benefiting from the positive impact of the removal of the ban on fisheries exports to the EU and the restoration of GSP+ facility, earnings from seafood exports increased significantly during the month due to higher prices and volumes of seafood exported. In addition, export earnings from spices increased in May owing to the combined impact of higher prices and volumes of cinnamon and pepper exports. However, export earnings from tea declined due to the reduction recorded in both volumes and prices of tea exported. Leading markets for merchandise exports of Sri Lanka in May were the USA, the UK, India, Germany and Italy, accounting for about 49% of total exports.

Expenditure on merchandise imports rose to $ 1.857 billion in May due to high expenditure incurred on fuel and vehicle imports. Expenditure on non-fuel imports declined marginally indicating the higher contribution of fuel expenses to import growth. Expenditure on fuel imports categorised under intermediate goods increased considerably in May owing to higher import prices and volumes of crude oil and refined petroleum products. In addition, expenditure on textiles and textile articles imports increased, reflecting higher expenses on all sub categories, particularly fabric imports. Expenditure on chemical products, base metals and plastics and articles thereof contributed towards the increase in intermediate goods imports. Import expenditure on personal vehicles, under consumer goods, rose significantly by 120% to $ 149 million. This was owing to substantial increase in the import of small engine capacity vehicles, hybrid and electric vehicles.

In the context of investment goods, building materials imports rose, led by higher imports of cement and aluminium articles. Expenditure on gold imports, which rose considerably since early 2016, declined notably to $ 0.1 million. Import expenditure on machinery equipment and transport equipment also declined.

Under consumer goods, rice, sugar, dairy products, seafood, clothing and accessories, and telecommunication devices contributed largely towards mitigating the pressure on the overall import expenditure in May. China, India, the UAE, Japan and Singapore were the main import origins in May, accounting for 60% of total imports.