Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 8 August 2022 04:16 - - {{hitsCtrl.values.hits}}

The Colombo stock market last week kicked off August on the up keeping with the welcome rebound in July.

The Colombo stock market last week kicked off August on the up keeping with the welcome rebound in July.

Last week the market gained sharply with the benchmark All Share Price Index (ASPI) up 8% and the active S&P SL20 higher by 11%. The market’s value rose by Rs. 321 billion or 10% to Rs. 3.64 trillion.

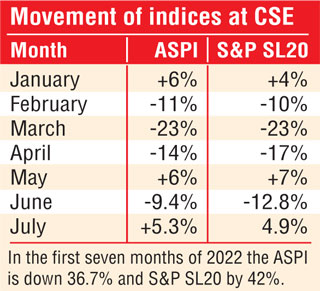

The positive start in August was on top of July closing with a gain of 5.3% and 5% respectively, a welcome change as against the dip in June.

Year to date (by end last week) however ASPI is down 32% and S&P SL20 by 35.5% and recent gains have managed to reduce the losses to some extent.

The gain on Friday would have been higher if not for the expected profit taking on some of the counters that gained earlier in the week. Impressive corporate earnings have boosted investor sentiment along with few of the announcements by the Government.

Turnover last week improved considerably to average Rs. 2.9 billion for the day as opposed to monthly average of Rs. 1.3 billion. Lanka IOC was the highest contributor to the week’s turnover value, contributing Rs. 2.96 billion or 20.53% of the total. Expolanka followed suit, accounting for 18.14% of turnover (Rs. 2.62 billion) while Melstacorp contributed Rs. 0.86 billion to account for 5.97% of the week’s turnover.

However foreign selling intensified last week with a net outflow of Rs. 475 million thereby increasing the year date figure to Rs. 859 million. July saw net foreign inflow of around Rs. 784 million. According to Acuity Stockbrokers, the biggest foreign selling during the week was in Melstacorp (Rs. 415 million), followed by Expolanka (Rs. 62.2 million), and Windforce (Rs. 16 million) while net buying was seen in Richard Pieris (Rs. 25 million), JKH (Rs. 21 million) and Hayleys (Rs. 14 million).

SC Securities said the daily Relative Strength Index (RSI) of ASPI closed at 75.57 which is overbought

for the trading week ended 5 August 2022.

“After successfully breaking the previous psychological area of 8,000 the ASPI is now heading towards the daily resistance 8,450-8,500 and 50EMA. If the index manages to cross above 50EMA the next psychological area would be tested. However, rejections from the 50EMA could pull back the index,” SC Securities said.

“The index is trading above 18 and 8 EMAs' therefore, this indicates short-term bullish momentum. However, the index is still trading below the 50EMA,” it added.