Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 22 July 2021 00:29 - - {{hitsCtrl.values.hits}}

|

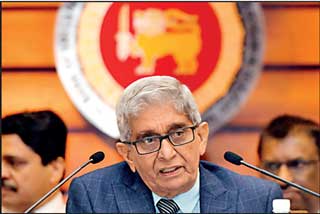

| Central Bank Governor Prof. W. D. Lakshman

|

The Monetary Board of the Central Bank of Sri Lanka (CBSL) has imposed temporary restrictions on declaration and payment of interim or full dividends for 2021 until financial statements are finalised and audited by external auditors.

This and several other restrictions on discretionary payments have been issued by the Monetary Board effective from 1 July 2021.

It said the new directives were put in place after having considered the possible adverse impact on liquidity and other key performance indicators of licensed commercial banks and licensed specialised banks due to the COVID-19 outbreak, and the importance of maintaining appropriate levels of liquidity and capital buffers in licensed banks.

Every licensed commercial bank incorporated outside Sri Lanka should refrain from repatriation of profits not already declared for financial years 2020 and 2021 until the financial statements/interim financial statements for 2021 are finalised and audited by its external auditor.

Licensed banks should give due consideration to the requirements of the Banking Act Directions No. 01 of 2016 on Capital Requirements under Basel III for Licensed Banks, expected assets growth, business expansion and the potential impact of the COVID-19 pandemic and prevailing market conditions when deciding on payments of cash dividends and profit repatriation.

Licensed banks are also required to adhere to the following until 31 December 2021.

(a) Refrain from buying back its own shares;

(b) Refrain from increasing management allowances and payments to Board of Directors;

(e) Exercise prudence and refrain to the extent possible from incurring non-essential expenditure such as advertising, business promotions, gift schemes, entertainment, sponsorships, travelling and training etc.; and

(d) Exercise extreme due diligence and prudence when incurring capital expenditure, if any.

These restrictions were previously extended till 30 June and the new directive confirms their continuity and extension till December.

In January this year, the Monetary Board directed banks to defer payment of cash dividends until financial year statements for 2020 are finalised and audited. Thereafter, several banks declared cash and scrip dividends subject to approval.