Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 12 October 2021 02:24 - - {{hitsCtrl.values.hits}}

The Central Bank (CBSL) yesterday indicated it had dropped the idea of an early buy-back of International Sovereign Bonds (ISBs) at discounted price following a review, saying a majority of bondholders wanted to hold until maturity.

As per the ‘Six-month Road Map for Ensuring Macroeconomic and Financial System Stability,’ presented by the CBSL on 1 October, the ISB exposure is to be gradually reduced to around 10% of Gross Domestic Product (GDP) over the next three years.

In line with this objective, having observed the discounted prices at which the upcoming January ($ 500 million) and July 2022 ($ 1 billion) ISB maturities were trading during the month of September, the Central Bank said it explored the possibility of executing a buy-back exercise in consultation with a number of international banks and lead arrangers.

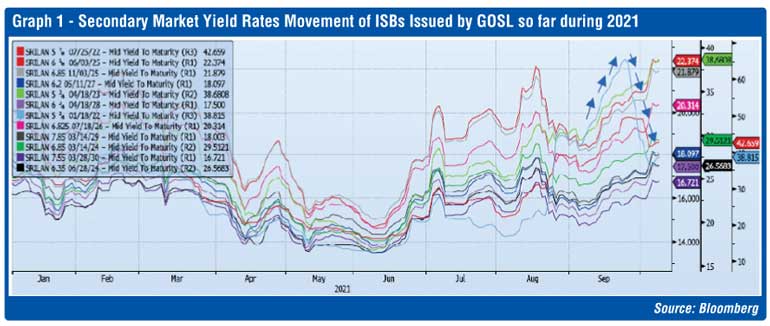

The graph highlights the secondary market yield rate movements of all outstanding ISBs issued by the Government. According to the graph, the January 2022 ISB maturity, which peaked to 69% yield levels on 24 September, gradually reduced to 47% levels on 1 October and currently trades at 40% levels (marked in arrow to depict the yield movements).

The CBSL nevertheless said, that based on market information, it was observed that there was no tangible interest from the bondholders to sell the January 2022 ISB maturities at the discounted price that prevailed during the latter part of September, thereby indicating that buying back a significant volume in order to enjoy a reasonable cost benefit to the issuer would not be possible.

“The inquiries also revealed that not even 5% of the outstanding January 2022 ISB maturity was available for sale at the discounted prices that were quoted,” the CBSL said.

Overall, the Central Bank said its observations on the attempted buy-back initiative are as follows:

• The volume of ISBs that would be sold by ISB investors at the discounted prices that prevailed towards the latter part of September is highly insignificant. Hence, any attempt by the issuer to buy the very small volume available will not be fair by the large number of ISB holders who wish to hold the ISBs to maturity

• It is clear that the large majority of ISB holders are not ready to part with the above Government ISBs unless prices are at par or closer to par. Hence, a buy-back initiative will also not result in any significant price or coupon benefit to the issuer

• The above-mentioned investor behaviour signifies the continuing confidence of the ISB holders regarding the ability of the issuer (Government) to honour its obligations and maintain its unblemished record of debt servicing. Therefore, the concerns raised by certain quarters regarding a possible vulnerability in 2022 are clearly not reflected by this investor sentiment

• The continuing investor preference seems to be to hold the above Government ISBs. Hence, the Central Bank’s initiative to proceed with a buy-back of the 2022 ISBs will not yield a successful outcome, given the appetite of ISB holders to hold the Government ISBs