Sunday Feb 22, 2026

Sunday Feb 22, 2026

Saturday, 20 March 2021 00:30 - - {{hitsCtrl.values.hits}}

The Central Bank yesterday has increased the maximum compensation payment under the Sri Lanka Deposit Insurance and Liquidity Support Scheme (SLDILSS) by Rs. 500,000 to Rs. 1.1 million in a major relief to thousands of customers of failed finance companies.

The Central Bank yesterday has increased the maximum compensation payment under the Sri Lanka Deposit Insurance and Liquidity Support Scheme (SLDILSS) by Rs. 500,000 to Rs. 1.1 million in a major relief to thousands of customers of failed finance companies.

Central Bank said the decision by the Monetary Board has been taken to provide ‘further relief to the depositors’ of financial institutions regulated by CBSL in the event of a cancellation or suspension of the licences of such institutions.

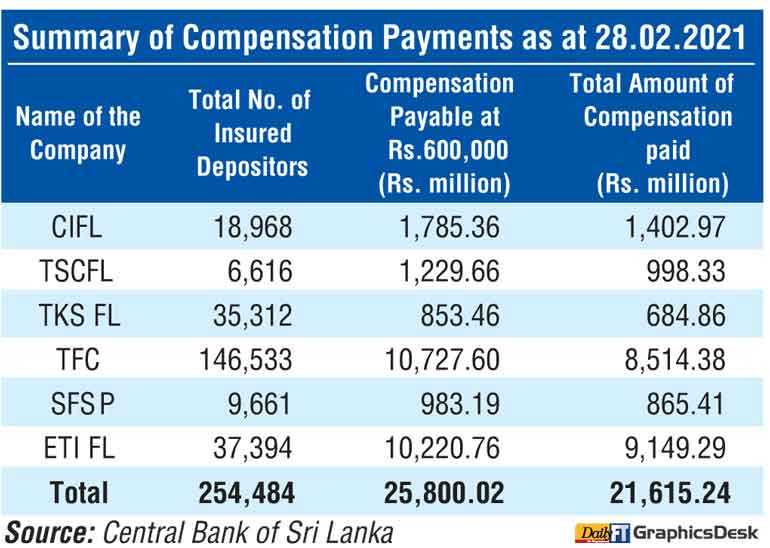

The depositors of six finance companies, namely, Central Investments and Finance PLC (CIFL), The Standard Credit Finance Ltd., (TSCFL), TKS Finance Ltd., (TKSFL), The Finance Company PLC (TFC), ETI Finance Ltd., (ETIFL) and Swarnamahal Financial Services PLC (SFSP) whose licences have been cancelled or suspended by the Monetary Board are eligible to receive the revised compensation amount.

The depositors of these companies who have yet not obtained any compensation payment have also been requested to apply for compensation under the revised maximum amount of Rs.1.1 million.

Central Bank said its Resolution and Enforcement Department is currently taking necessary measures to commence the payment of additional compensation expeditiously.

“The payment mechanism and the date of commencement of payments under the increased compensation threshold will be notified in due course,” Central Bank said in a statement.

It also said the increase of the maximum compensation payment will result in an additional payment of Rs. 9.8 billion for the depositors of the six companies, while the percentage of depositors that can be fully compensated will be increased to 94.0.

According to the Central Bank as of end February, 254,484 depositors of six companies have been paid Rs. 21.6 billion as compensation out of Rs. 25.8 billion payable.

Further details in this regard may be obtained from the Resolution and Enforcement Department via telephone numbers 0112477261 and 0112398788.

Early this week over 10,000 depositors of The Finance Company (TFC) appealed to the Government to carry out the additional payment of Rs. 500,000 from the SLDILSS as pledged earlier and pave the way for the company to be resuscitated.

Independent Organisation to Protect TFC Depositors (Guarantee) Organiser Sarath Athukorala told reporters that following several rounds of discussions with top officials, including Prime Minister Mahinda Rajapaksa and State Minister for Money, Capital Markets and State Enterprise Reforms Ajith Nivard Cabraal, the Government had agreed to pay depositors an additional Rs. 500,000 from the SLDILSS, which operates under the Central Bank. However, the funds, which were expected in March, were yet to materialise.