Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 20 August 2020 03:37 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe

Research and rating agencies were leaning towards another rate cut by the Central Bank yesterday, which would be a record fifth round of relaxation by the monetary authority this year, as it grapples to push demand, boost private sector credit and spark persistently sluggish growth.

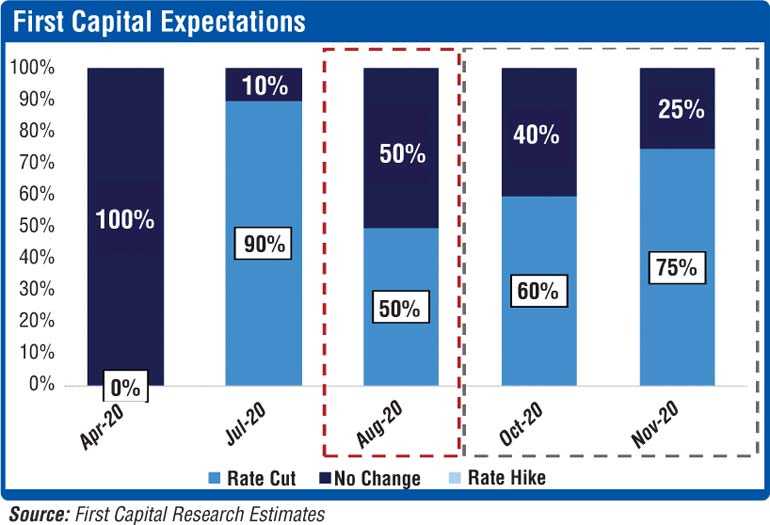

ICRA Lanka Head of Research Lalinda Sugathadasa said yet another rate cut of 50 basis points was a possibility. First Capital Research also predicted there was a 50% likelihood of another round of relaxation, especially given the lacklustre performance of the first quarter which saw Sri Lanka’s growth contract by 1.6%.

“The first quarter contraction was far higher than what was expected. In the first quarter the economy faced only about 10 to 15 days of the COVID-19 curfew but growth was still far lower than what was projected. In the second quarter the contraction could well be in double digits and the Monetary Board will be aware of this so it is possible they will further reduce interest rates to spur growth. After negative growth in two quarters it is essential that the third quarter register positive growth,” he told the Daily FT.

He also pointed out that lower overnight rates, excess liquidity in the money markets and limited pick-up in private sector credit growth despite four previous rounds of easing were other signals of a possible rate cut. Sugathadasa opined that it could well be the Central Bank’s thinking to increase liquidity over a period of time so banks have a liquidity cushion to increase their lending.

Echoing these views, First Capital Research noted that the possibility of a steeper contraction in the second quarter along with a decline in global demand for exports and delays in raw material procurement, and no tourist arrivals due to travel restrictions further heightens the risk of lacklustre GDP growth concerns in 2020.

“Despite continuous reduction in market interest rates, by 198bps from 9.38% on 6 March to 7.40% in 7 August, credit extended to the private sector contracted significantly in May (Rs. 70 b) and June (Rs. 54 b) due to the impact of COVID-19 while YTD credit growth remains muted at 0.62%.”

“However, we expect private credit to gradually pick up only towards 4Q 2020 amidst the reluctance to lend due to sluggish economic conditions. Nevertheless, a further rate cut is likely to induce a support for a quick recovery by accelerating credit which is believed to be the Government’s current need of the hour.”

Despite the improved liquidity position, yields in the secondary market witnessed a slight increase with moderated activities as market participants followed a wait and see approach amidst the upcoming policy review. Weighted average yields at the weekly T-bill auction on 5 August were seen increasing, with the 1-year maturity rising by 8bps to 4.94%, for the first time in 21 weeks.

“We believe a further policy cut would be required to sustain the yields at current levels in line with the low interest rate environment,” First Capital Research said in their pre-policy analysis.

However, there were also arguments against further relaxation of monetary policy with analysts warning of inflationary pressures, and a call for the Central Bank to reserve its policy space to adjust rates at a later point depending on growth performance in the second half.

“With the reduction of SRR by 300bps and further money printing by the Central Bank, the liquidity position reached Rs. 182 billion, which is nearly a one-and-a-half months’ high. However, despite the significant SRR cuts since the onset of COVID-19, credit growth has been deteriorating thus inquiring the ability of further easing policy rates to stimulate the demand.”