Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 18 January 2022 01:43 - - {{hitsCtrl.values.hits}}

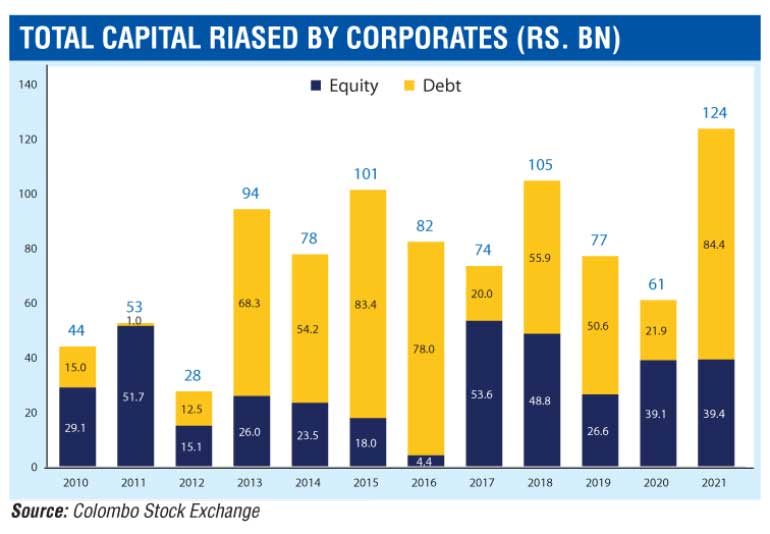

A buoyant Colombo Stock Exchange (CSE), in 2021, saw capital raising soar to a record Rs. 124 billion.

The previous highest in a 10-year time span was in 2018, amounting to Rs. 105 billion.

Last year, of the capital raised, a record Rs. 84.4 billion was via debt and Rs. 39.4 billion in equity.

The CSE also saw 28 new listings, including 14 debt IPOs and 13 equity IPOs.

In 2021, the market had its best year in terms of ASPI gaining 80.5% and the S&P SL20 improving by 60.5%. Market capitalisation also reached a 10-year high of 36.7% of GDP or Rs. 5.5 trillion from 19.7% in 2020 or Rs. 2.96 trillion and 34.5% in 2010 or Rs. 2.2 trillion.

CSE Chairman Dumith Fernando said the original goal was to increase market capitalisation to 30% and the industry outperformed.

Thanks to proactive efforts by both the CSE and the Securities and Exchange Commission (SEC), especially digitisation initiatives, the Colombo stock market saw active local investor participation. Active investor base rose to 63,000 as opposed to the target of 50,000, whilst the number of new accounts was 37,000, higher from 2020 but fell short of target of 50,000.

Fernando also said the CSE more than doubled turnover to Rs. 4.9 billion per day.