Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 10 November 2017 00:00 - - {{hitsCtrl.values.hits}}

By the FT News Desk

Delivering on his promise to keep the Budget speech concise, Finance Minister Mangala Samaraweera yesterday unveiled a slew of proposals to liberalise restrictive laws, promote exports, expand tourism, maintain fiscal consolidation, foster start-ups and open Sri Lanka to investment to achieve 5% growth in 2018.

Keeping the traditional political and feel good statements short, Minister Samaraweera gave a short recap of economic ills that had beset Sri Lanka since Independence, highlighting short-sighted protectionist policies as one of the biggest hurdles to overcome. He also limited pot-shots at the previous Government headed by former President Mahinda Rajapaksa, who with his supporters rode a bicycle to parliament to protest the fuel shortage, but only received a wayward comment from the Finance Minister. “I am happy to see that the Opposition has already started greening their modes of transport,” he quipped while announcing plans to phase out all fossil fuel vehicles by 2040.

Taking a cue from the V2025 policy statement, the proposals captured the need for capital market reform, cement land ownership, reduced protectionism and labour reform.

The Budget also aimed to achieve medium-term targets such as per capita income of $ 5,000, one million new jobs, FDI inflows of $ 5 billion and doubling exports to $ 20 billion, as outlined in V2025. The Excise and Customs Ordinance, Rent Act, Paddy Lands Act, Agriculture Lands Act, Shop and Office Employees Act and bankruptcy laws were among the list of laws the Government plans to either repeal or amend.

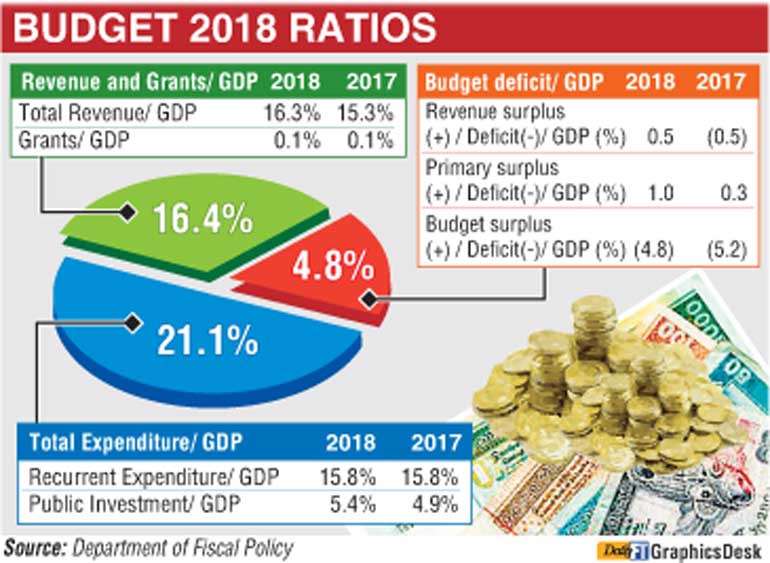

“In 2018, we envisage GDP growth of 5%, inflation of around 6%, and we hope to achieve for the first time in almost six decades primary surplus of 1% of GDP and a Budget deficit of 4.5% of GDP,” Samaraweera said before launching into proposals for a “Blue-Green” economy that plans to introduce environmental safeguards.

On vehicle imports the Budget proposed to phase out all fossil fuel vehicles by 2040, encourage imports of electric buses and three-wheelers, slash prices on electric vehicles by at least Rs. 1 million, establish charging stations, introduce a carbon tax, excise duty of Rs. 10 per kilo of plastic and Rs. 3 billion to fast track the Aruwakkalu waste disposal site.

An allocation of Rs. 3 billion was proposed to set up an insurance scheme for farmers. During a natural disaster a minimum of Rs. 40,000 per acre for six crops including, paddy, maize, soya, big onion, potato, and chilli, will be paid under the propose scheme. This will be a contributory scheme with the premium being borne by both the farmer and the Government.

“Our goal is to rebuild the ‘Paradise of Entrepreneurs’ capitalising on the inborn business skills historically possessed by Sri Lankans. If Sri Lanka is to succeed in its journey forward, it is imperative that all Sri Lankans, not just the private sector, become stakeholders of the ‘Enterprise Sri Lanka’ initiative,” Samaraweera told parliament.

“Enterprise Sri Lanka” will facilitate not only the established private sector, the Minister insisted, but also the small time businessmen and the small retailer running a ‘kade’, self-employed three wheeler drivers, women who run small businesses and youths driving tech start-ups to be the engine of growth.

“It is true that not everyone may succeed in a competitive market environment, and those who do not succeed shall not be overlooked. Hence, the Government will ensure a robust social safety net mechanism that supports those who will be at risk.”

Credit and capital for Small and Medium Enterprises (SMEs) will be provided by the establishment of a Development Bank at a cost of Rs. 10 billion with an “EXIM window”. Eight new credit schemes are to be introduced to disburse a total of Rs. 15 billion with all existing and new schemes to be gathered under the “Enterprise Sri Lanka Credit Scheme”. As much as Rs. 2.2 billion will also be spent under the Grama Shakthi initiative to provide capital to small businesses and reduce poverty.

“IT and the IT related sectors have the potential to reach $ 5 billion in export earnings in the next five years. As such, to support this industry, specially the SME IT companies, we will launch, the ‘IT Initiative’, which is in effect the Government’s angel fund for the IT industry. This initiative will be operated through the EDB and we will invest Rs. 3 billion.”

The funds will be used for local start-ups and to attract foreign start-ups, small and medium-sized IT companies and to create the enabling environment by supporting the establishment of incubators, supporting the acquisition and augmentation of skills and knowhow in collaboration with local universities.

At the outset the IT Initiative will finance 50% of the rent expenditure for 24 months on the Hatch Incubator and similar support to any private ventures, Colombo, Moratuwa and SLIIT universities will conduct training courses in Artificial Intelligence, Robotics, Data Science, Machine Learning and Python Development in collaboration with the industry.

Assuring local companies’ removal of para-tariffs will not threaten their existence, Samaraweera noted para-tariffs applicable on the tariff lines, which do not at present carry any Customs duties, will be abolished within the next three years.

“Last year, we removed over 100 applicable para-tariffs on import items and this year we will remove almost another 1,200 para tariffs. However, while we will be phasing out the para-tariffs, which are also in line with our WTO commitments, such action will be followed by way of a trade adjustment program in the interim period that will provide relief and support to the local private sector.”

“We will also introduce anti-competitive laws addressing Mergers and Monopolies practices to ensure that the private sector can be better facilitated to grow through scale and yet ensure a level playing field,” he continued.

To push forward its liberalisation efforts, the Budget proposed to introduce an “Export Market Access Support” program as part of the Trade Adjustment program, which will support local companies that already have exports of less than $ 10 million per annum and potential new entrants to the export market to better access global value chains.

A proposed SME Guarantee Fund will enable SME Exporters who are in the CRIB but have the potential to export, yet have no access to finance its operations, to access financing from banks utilising the SME guarantees.

“The Sri Lanka Ports Authority Act No. 51 of 1979 and the Merchants Shipping Act No. 52 of 1971 will be amended to cater to the demands of the modern day logistics and marine industry. This will also ensure healthy competition. An independent ports regulator will be introduced. Restrictions on the foreign ownership on the shipping and the freight forwarding agencies will be lifted. This will enable major international shipping lines and logistics operators to base their operations in Sri Lanka,” Samaraweera said.

To assist coconut producers, NBT on domestic coconut oil and kernel products will be removed for a period of one year.

Moving on to tourism, the Finance Minister said Online Travel Agents (OTAs), both resident and non-resident, which derive their commission from the businesses carried out in Sri Lanka, will face a tax of 1% on the commission derived from local reservations.

As a measure to further promote the tourism industry, liquor licensing fee structure will be rationalised. The license issuance mechanism will be revamped with a view to promoting tourism, especially in guesthouses and boutique hotels. However, a tax file number will be one of the essential requirements when issuing these licenses.

In keeping with the vision to make Sri Lanka a shopping hub, a VAT refund scheme for foreign passport holders will be implemented at the Airports and Sea Ports with effect from 1 May 2018.

The Department of the Registrar of Companies, as part of its business reengineering process, will establish a One Stop Shop for business registration, to promote entrepreneurship.

“We will remove restrictions that limit the land ownership rights of listed companies with foreign ownership together with the restrictions on foreigners’ ability to purchase condominiums below the fourth floor.”

Budget 2018 also dusted off a previous proposal to allow Rojana Industries of Thailand to establish an Industrial Park in Milleniya with an investment of $ 500 million. The Government has already provided this venture with land and will also provide the necessary infrastructure. Similar support will be extended to the proposed Industrial Zones in Bingiriya and Charlemont Estate, Weligama. The Board of Investment, the relevant line agencies and the newly-established Public-Private Partnership (PPP) Unit will collaborate in facilitating such ventures with an allocation of Rs. 2.5 billion. PPP guidelines are to be issued shortly, the Minister assured.

The Budget also proposed to establish State medical faculties at Wayamba, Sabaragamuwa and Moratuwa universities to expand medical education. An independent quality assurance and accreditation mechanism to maintain standards and quality of the provision of higher education will also be established.

“Out of the total liquor consumption, almost 49% is from illicit sources while 85% consume hard liquor. However, in most countries, the tax structure is designed to discourage the consumption of hard liquor and is often proportionate to the alcohol content. We will rationalise the tax structure based on a formula linked to the alcohol content and type. Further, NBT will be imposed on liquor with effect from 1 April 2018.”

The Budget also earmarked billions of rupees for rural infrastructure that included housing. About 20,000 housing units will be built by 2020 for the low income segment at a cost of Rs. 17.5 billion. Rs.3 billion was allocated to build houses in the north and east and 25,000 houses for the plantation sector at a cost of Rs. 2 billion.

“Given our Government’s commitment to sustainable development and creating a modern sustainable urban hub, Rs. 24 billion will be allocated for URP: a multipurpose initiative, which includes an integrated flood mitigation mechanism to cover the Colombo city limits and its suburbs including the Weras Ganga project, relocation of the Manning Market to Peliyagoda, the Administrative City Development project, development of ancillary infrastructure for the Colombo Port City, the Transport Development project, Beira Lake Rehabilitation and Redevelopment project and the provision of road infrastructure for the tech city in Homagama.”

Improvement of the rural road network covering the entire country, including repairing roads affected by disasters, will be undertaken at a cost of Rs. 4 billion.