Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 27 December 2019 00:18 - - {{hitsCtrl.values.hits}}

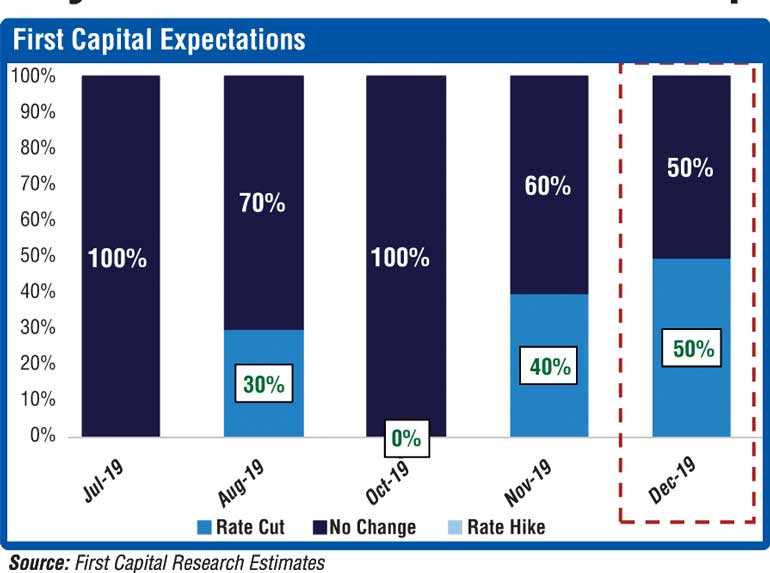

Ahead of the last monetary policy announcement for the year, First Capital Research has said there is a 50% probability of the Central Bank cutting its policy rates, slashing its earlier projection in half due to the stimulus package and other policy measures announced by the Government earlier this month.

Releasing its latest report, the organisation said, considering the recent major policy changes, First Capital Research was trimming down its rate cut probability to 50% from the previous expectation of 100% probability, specifically due to the tax benefits, moratorium on loans and easing of capital adequacy to stimulate the consumer demand and revive growth in the economy.

“Foreign outflow is not considered a major concern considering the lower level of foreign holding in the Government securities market. However, we are of the view that 50% probability exists for a ‘No Change’ in Monetary Policy as well due to the major benefits. We continue to maintain that Statutory Reserve Ratio (SRR) is likely to be maintained at the current level,” the report said.

The Central Bank maintained its policy rates in November 2019 at current levels immediately following the tax revisions with the belief that it would support higher economic growth in the short term. However, the Central Bank was of the view that greater clarity with regard to the medium-term fiscal path of the Government is required to assess the impact on the economy over the medium term.

“In our previous pre-policy (report) published on 26 November, we mentioned that the door is open for a further policy easing in December. We are maintaining the same stance; however lowering the easing probability to 50% in December, considering the recent hefty tax benefits, moratorium to SMEs and relaxation of capital adequacy requirements declared by the Government and Central Bank. We believe that benefits given may partly compensate an expectation of a rate cut to address the prevailing sluggish economic growth.”

On 27 November, the Government announced hefty tax relief with the expectation of increasing the consumer spending while boosting the economic growth of the country. First Capital expects measures such as reduction of VAT to 8%, removal of NBT and revisions to PAYE tax to increase disposable income of consumers, thereby boosting consumer spending in the economy.

“However, the Government’s ability to bridge the revenue loss due to the recent tax revisions will be a concern leading to a risk in 2020. The stimulus package may potentially lead to fiscal slippage, reducing the possibility of further monetary easing in the near term.”

Three weeks after the hefty tax cuts, Finance Ministry on 20 December announced a moratorium on loans for SMEs for one year and an extension of the moratorium of the tourism industry till December 2020 which could be considered an additional support to boost the growth in the economy.

The Central Bank has also taken measures to ease the capital adequacy requirement for banks on 20 December, which First Capital believes is an added measure to relax constraints of the banks’ capacity to lend.

On the external front, the US Fed left rates unchanged and signalled it would stay on hold through 2020. The move illustrates an end to Fed’s monetary easing cycle, but also suggests no change to policy rates throughout 2020 which is a favourable stance for Sri Lanka.

However, Fitch’s recent downgrade of SL’s Long-Term Foreign-Currency rating outlook to ‘Negative’ from ‘Stable’ signal a potential credit rating downgrade in the future.

The Sri Lanka Government bond market witnessed an outflow of Rs. 16.9 billion since 27 November resulting in foreign holdings in Government securities declining below 2%. Though policy easing in the current scenario enhances foreign outflows, the historical low level of foreign holding significantly reduces risk of further outflows, the report added.

“Foreign reserves dipped to $ 7.5 billion in November 2019, dipping from $7.8 billion in October, and continues to remain at comfortable levels. However, the present Government has delayed the planned $ 500 million Samurai bond creating some concern on the back of foreign project loan repayments.”

Sri Lanka’s economy grew by 2.7% in the 3Q2019, higher than its expectation of 2.2%, indicating a gradual recovery relative to 2Q2019 growth of 1.6%. Private sector credit growth recorded an increase of Rs 26 billion in Oct 2019, illustrating a positive credit growth for the third consecutive month with Jan-Oct 2019 growth at 2.6%, closing in, on the credit growth target of 5% for 2019 end.

Despite the recovery in growth, credit and economic growth thus far remains below par, leaving room for possible aggressive action on monetary easing. Tax cuts moratorium on loans and easing of capital adequacy levels could be considered as part of the measures, First Capital Research said.