Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 5 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

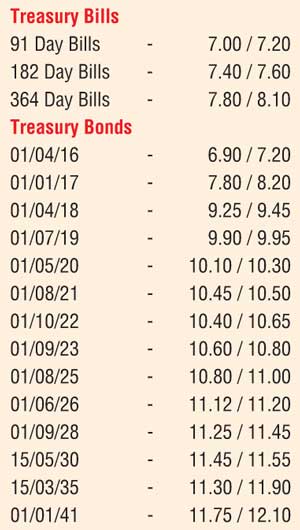

The secondary bond market yields remained broadly unchanged on Wednesday as activity moderated ahead of the Treasury bond auctions due today(Friday).

A limited amount of activity was seen on the liquid two maturities of 2021 (i.e. 1 May 2021 and 1 August 2021) within the range of 10.45% to 10.48% and on the 15.05.2030 maturity within the range of 10.48% to 10.52%. In addition, the 1 July 2019 maturity was seen changing hands at 9.90% as well.

Today’s (Friday) Treasury bond auctions for a total amount of Rs.10 billion will consist of Rs.2 billion on a 4.10 year maturity of 15 December 2020, Rs.3 billion on a 14.03 year maturity of 15 May 2030 and Rs.5 billion on a 24.11 year maturity of 1 January 2041. The previously recorded weighted averages on these maturities were 9.79%, 11.53% and 12.09% respectively.

Meanwhile in money markets, the OMO department of Central Bank was seen draining out in total an amount of Rs.17.8 billion by way of two outright sales of Treasury bills at weighted average rates of 6.48% and 6.65% for 14 and 21 days respectively. Surplus liquidity in the system increased once gain to Rs.55.71 billion yesterday on the back of term repo maturities. The overnight call money repo rates averaged at 6.81% and 6.47% respectively.

Rupee remains stagnant

In forex markets, the USD/LKR rate on spot contracts remained still at Rs.143.95/144.10 for a tenth consecutive day whiles the active one week forward contract closed the day steady at Rs.144.25/35 on Wednesday. The total USD/LKR traded volume for 2 February was $ 59.50 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 144.75/00; three months – 145.90/10; and six months – 147.65/80.