Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 8 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

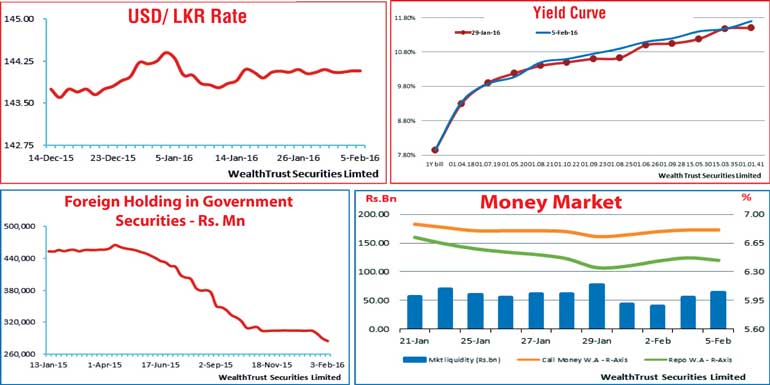

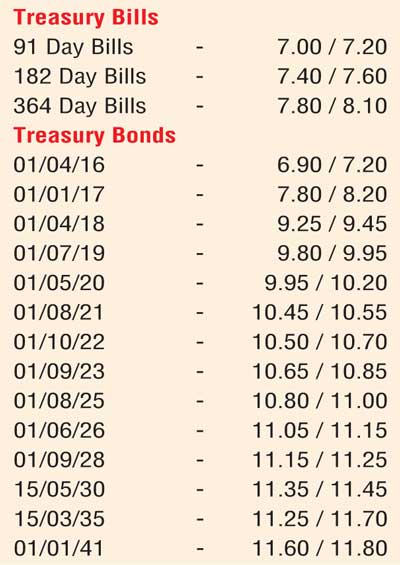

The week ending 5 February saw the secondary market bond yield curve mirroring a parallel shift upwards mainly on the belly end to the long end of the curve for a second consecutive week. As was the case the previous week, foreign selling in Rupee bonds coupled with primary auction weighted averages increasing at the Treasury bill auction and bond auctions was seen as the reasons behind this development. Selling interest on the two 2021 maturities (i.e. 01.05.2021 & 01.08.2021) saw its yields increase to weekly highs of 10.50% and 10.55% respectively against its weeks opening lows of 10.35% and 10.40%. In addition yields on the 01.08.2025, 01.06.2026 and 15.05.2030 maturities were seen increasing to weekly highs of 10.85%, 11.15% and 11.58% respectively, leading to the Treasury bond auctions against its opening lows of 10.80%, 11.05% and 11.25%. The steeper increase in yields on the belly end to the long end of the curve in comparison to the short end led to a further steepening of the yield curve for a second consecutive week as well. Meanwhile the foreign holding in Rupee bonds was seen reducing by a further Rs.4.5 billion for the week ending 3 February recording its fourth consecutive week of outflows.

At the Treasury bond auctions conducted on 5 February, the weighted averages on the 14.03 year maturity of 15.05.2030 and the 24.11 year maturity of 01.01.2041 were seen increasing by 13 basis points and 6 basis points respectively to 11.66% and 12.15% against its previously recorded averages while all bids received for the 4.10 year maturity of 15.12.2020 were rejected. A total amount of Rs 20.70 billion was accepted against its total offered amount of Rs 10 billion. However buying interest subsequent to the auction saw yields dip once again on the 15.05.2030 and 01.01.2041 maturities to 11.37% and 11.75% respectively.

In money markets, the overnight call money and repo rates remained mostly unchanged during the week to average at 6.79% and 6.43% respectively as surplus liquidity in system averaged at Rs.50.86 billion for the week. The OMO department of the Central Bank was seen draining out in total an amount of Rs.21.3 billion from the system through two outright auctions and a term repo auction at weighted averages of 6.48%, 6.65% and 6.41% respectively for durations of 14, 21 and 7 days.

Rupee stagnant during the week

In forex markets, the two way quote on spot contracts was seen stagnant during the week to close at Rs.143.95/20 as activity was at a standstill. However the active one week forward contract was seen appreciating to a weekly high of Rs.144.20/30 against its low of Rs.144.35/45. The daily USD/LKR average traded volume during the first three days of the week stood at US $ 51.16 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 144.75/00; 3 Months - 145.90/00 and 6 Months - 147.70/85.