Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 11 January 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

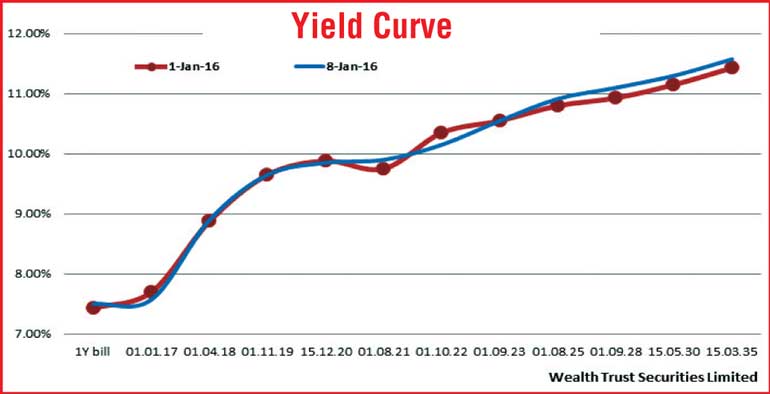

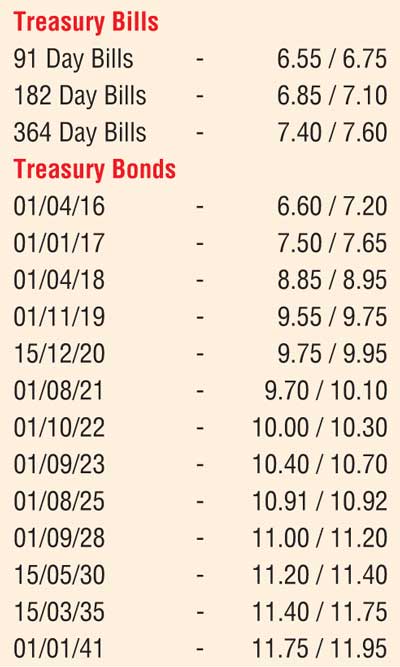

The yield curve during the week ending 8 January was seen steepening further as primary market yields on long tenure durations were seen increasing at a faster pace than the shorter tenure durations. At last Friday’s bond auctions, the weighted averages on the 14.04 year maturity of 15.05.2030 and the 9.07 year maturity of 01.08.2025 was seen increasing by 46 basis points and 11 basis points respectively to 11.46% and 11.05% against its previously recorded averages while the newly issued 25 year maturity recorded a weighted average of 12.09%.

All bids received for the 4.11 year maturity of 15.12.2020 were rejected. This was in comparison to the increases recorded at the weekly Treasury bill auction of 14 basis points on the 91 day bill, 10 basis points on the 182 day bill and 12 basis points on the 364 day bill. The Treasury bond auctions drew Rs. 39.2 billion in successful bids against a total offered amount of Rs. 20 billion.

Activity returned back into secondary bond markets towards the latter part of the week, as fresh buying interest subsequent to the bond auction results saw yields on the 01.08.2025, 15.05.2030 and the 01.01.2041 maturities dip below its weighted averages to 10.92%, 11.30% and 11.85% respectively. However, this was higher than the weeks opening lows of 10.75% and 11.20% on the 2025 and the 2030. In addition, a limited amount of activity was seen on the 01.11.2019, 15.12.2020 and 01.10.2022 maturities as well during the week within the range of 9.55% to 9.65%, 9.75% to 9.85% and 10.07% to 10.17% respectively.

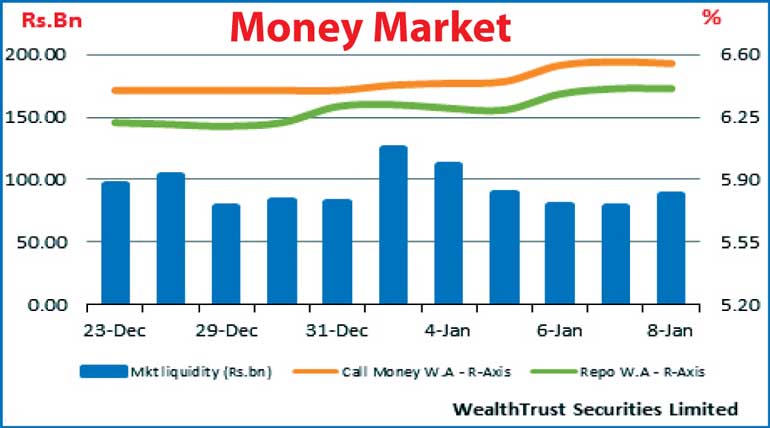

In money markets, the overnight call money and Repo rates increased during the week to hit three month highs and averaged 6.51% and 6.36% respectively for the week against its previous week averages of 6.41% and 6.25%. The continuous drain out of liquidity from the system by way of Repo auctions conducted by the OMO (Open Market Operations) department of Central Bank was seen as the main reason behind this according to market sources. The average surplus liquidly in the market stood at Rs. 89.24 billion for the week.

Rupee appreciates during the week

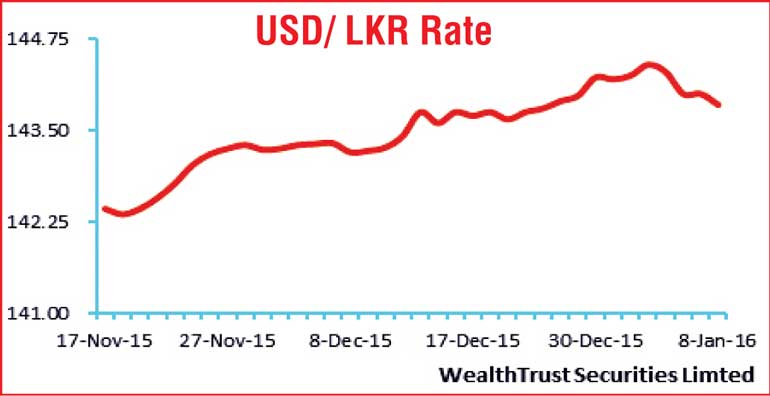

The USD/LKR on spot contracts lost ground during the early part of the week to reach a new historical low of Rs. 144.30 against its previous weeks closing level of Rs. 144.20/30 before bouncing back once again to hit a two week high of Rs. 143.80 during the latter part of the week on selling interest on forward dollar contracts. The daily USD/LKR average traded volume for the first four days of the week stood at $ 92.85 million.

Some of the forward dollar rates that prevailed in the market were one month – 144.45/50; three months – 145.65/75 and six months – 147.45/65.