Monday Mar 09, 2026

Monday Mar 09, 2026

Monday, 23 November 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

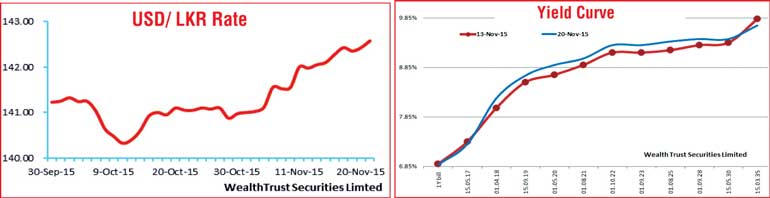

The sentiment in secondary bond markets turned bearish during the week ending 20 November as yields were seen increasing on the belly end of the curve leading to the budget speech. This was despite the impressive outcome at the weekly Treasury bill auction, at where the 182 day bill weighted average was seen dipping by 37 basis points to a fifteen week low of 6.50%. Selling interest in liquid maturities of 15.09.19, 01.05.20, 01.08.21, 01.10.22 and 01.09.23 saw is yields hit intraweek highs of 8.78%, 8.95%, 9.05%, 9.30% and 9.35% respectively against its previous weeks closing levels of 8.50/60, 8.65/75, 8.85/95 and 9.10/20 each reflecting an upward shift on the belly end of the curve for a second consecutive week. However, buying interest on the long end of the curve saw the maturities of 01.09.28, 15.05.30 and 15.03.35 change hands within weekly lows of 9.30% each and 9.65% respectively to highs of 9.50%, 9.40% and 9.85%. This led to the belly end to the long end of the yield curve flatting out or bunching up which is a rare phenomenon. In secondary market bills, continued demand saw bills maturating in February 2016 changing hands within the range of 6.25% to 6.30%, April 2016 bills within the range of 6.30% to 6.35% and May 2016 bills within the range of 6.35% to 6.40%.

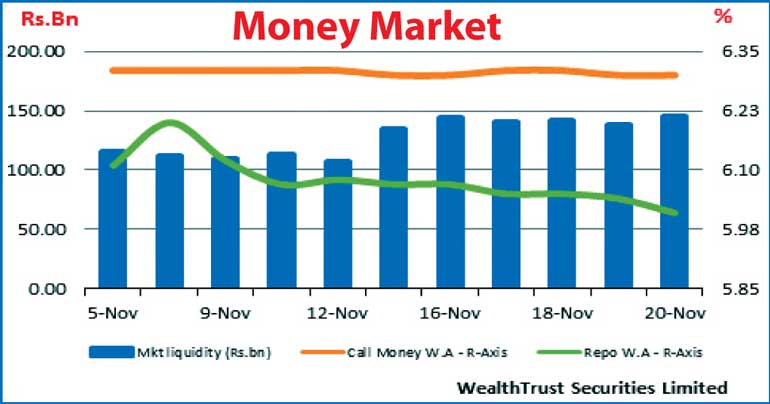

Meanwhile in money markets, the overnight repo rate decreased marginally to average 6.04% for the week ending 20 November as the average surplus liquidity increased to Rs. 141.86 billion against its previous weeks of Rs. 116.20 billion. The overnight call money rate remained steady to average 6.30%.

Rupee continues depreciating trend

In Forex markets during the week, the rupee rate on spot contracts depreciated further to close the week at Rs. 142.50/65 against its previous week’s closing of Rs. 142.00/20 on the back of continued importer demand. The daily USD/LKR average traded volume for the first four days of the week stood at $ 78.48 million.

Some of the forward dollar rates that prevailed in the market were one month – 142.82/92; three months – 143.60/80 and six months – 144.90/00.