Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 17 April 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

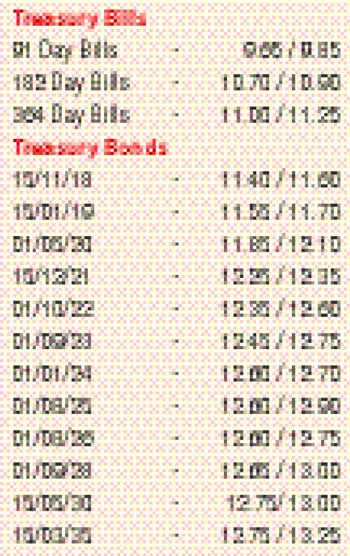

The shortened trading week ending 12 April 2017 saw bond yields increasing on the back of moderate volumes changing hands reversing a downward trend witnessed over the previous three weeks. Yields on the liquid maturities of 15.12.2021 and 01.01.2024 were seen increasing to weekly highs of 12.30% and 12.65% respectively driven by selling interest and profit taking while two way quotes on the rest of the curve were seen increasing as well, reflecting a parallel shift upwards for the first time in four weeks.

In money markets, liquidity was seen turning negative once again to record a net deficit of Rs. 6.31 billion on Thursday, 12 April 2017. Overnight call money and repo rates averaged 8.75% each respectively during the week. Meanwhile the Treasury bill stock of Central Bank was seen crossing the Rs. 300 billion physiological level once again to record Rs. 305.2 billion in book value terms on 12 April 2017.

The dollar rupee rate on active two weeks forward contracts closed the week mostly unchanged at Rs. 152.80/00 subsequent to dipping to an intraweek low of Rs. 153.30 on Tuesday.

Some of the forward dollar rates that prevailed in the market were one month – 153.60/90; three months – 155.50/80 and six months – 159.05/45.