Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Monday, 8 May 2017 00:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

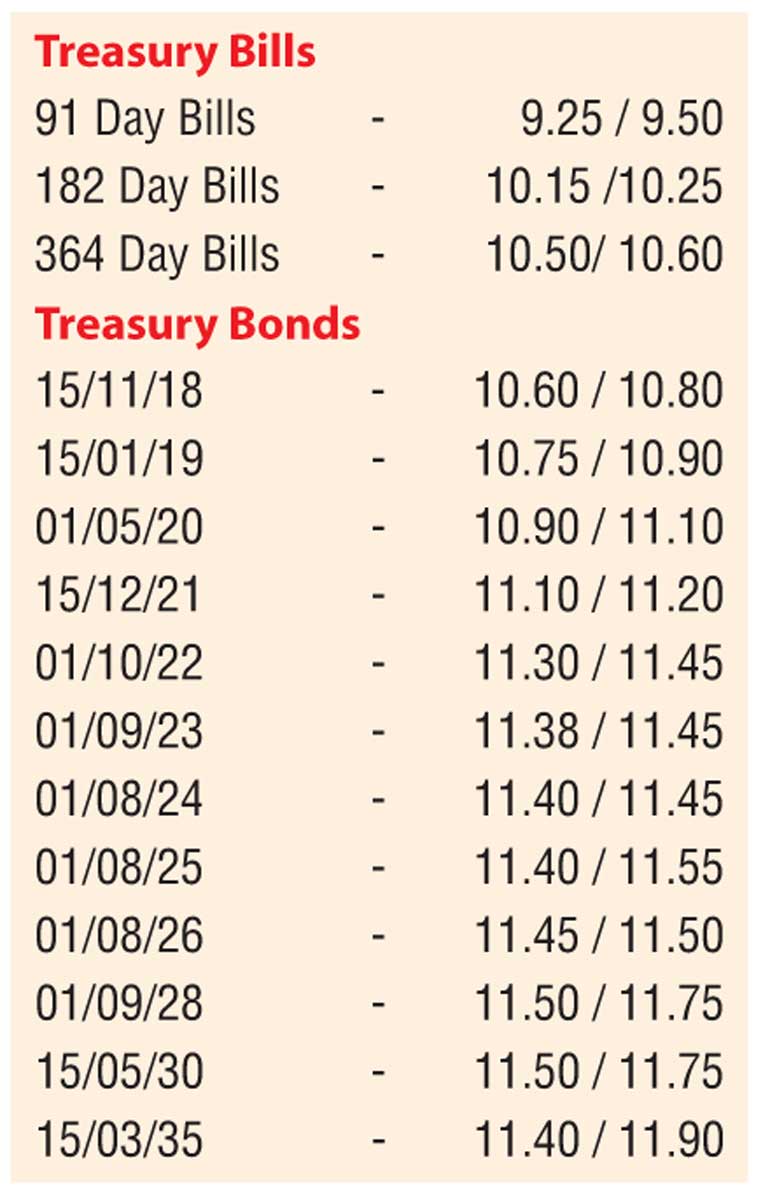

The downward trend in secondary market bond yields witnessed over the past two weeks continued throughout the week ending 5 May as well, with the successful launch and pricing of a Sri Lanka dollar denominated sovereign bond issue for $ 1.5 billion at 6.2% for a period of 10 years.

This was followed by the news that a staff level agreement has been reached on the second review of Sri Lanka’s Extended Fund Facility with the IMF and further dollar inflows from syndicated loans. The downward trend was evenly supported by the outcome of the weekly Treasury bill auction where the weighted averages dipped for a second consecutive week, by 17 and 19 basis points respectively to 10.53% and 10.83% on the 182 day and 364 day maturities.

The overall yield curve witnessed a parallel shift downward for a third consecutive week with the liquid maturities of 15.01.19, 15.12.21, 01.09.23, 01.08.24, 01.08.25, 01.08.26 and 15.05.30 decreasing by 50, 62, 60, 65, 62, 75 and 65 basis points respectively week on week to hit seven-month lows of 10.85%, 11.10%, 11.35%, 11.40%, 11.45%, 11.35% and 11.70% when compared against the previous weeks closing levels. Furthermore, two-way quotes on the rest of the yield curve were also seen decreasing.

This week’s Treasury bill auction due on Monday will have on offer a total amount of Rs. 30.5 billion, consisting of Rs. 15.0 billion of the 182 day maturity and Rs. 15.5 billion of the 364 day maturity. Meanwhile, the foreign holding in Sri Lankan rupee bonds recorded an outflow once again to the value of Rs. 1.904 billion during the week ending 3 May.

The daily secondary market Treasury bond transacted volumes for the first three days of the week averaged Rs. 14.02 billion.

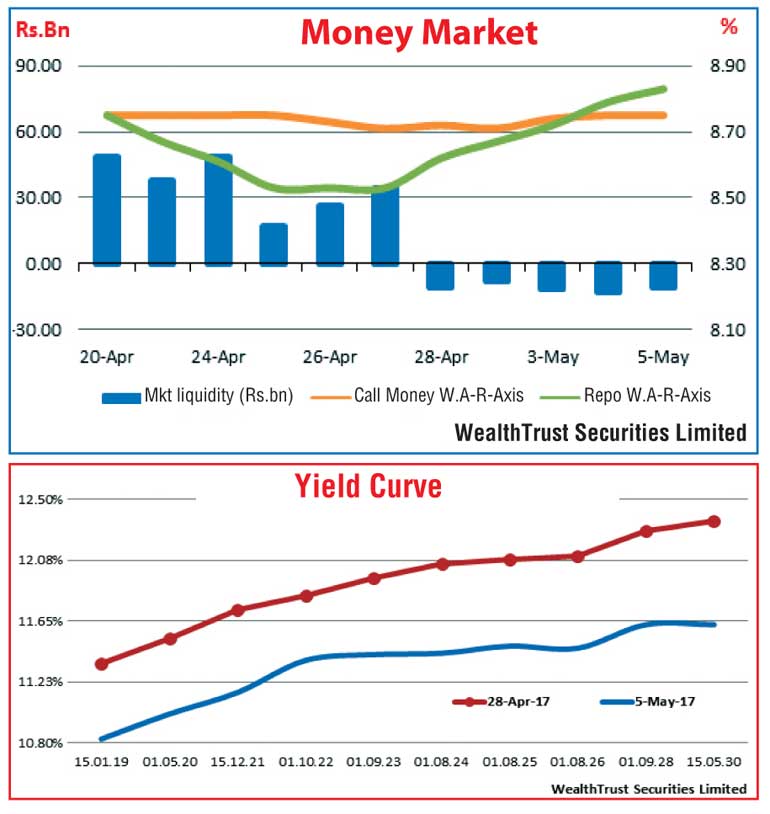

In money markets, overnight call money and repo rates averaged at 8.74% and 8.75% respectively for the week as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen injecting liquidity during the week by way of overnight reverse repo auctions at a weighted average of 8.75%. The average net liquidity shortage for the week stood at Rs. 10.79 billion.

Rupee gains during the week

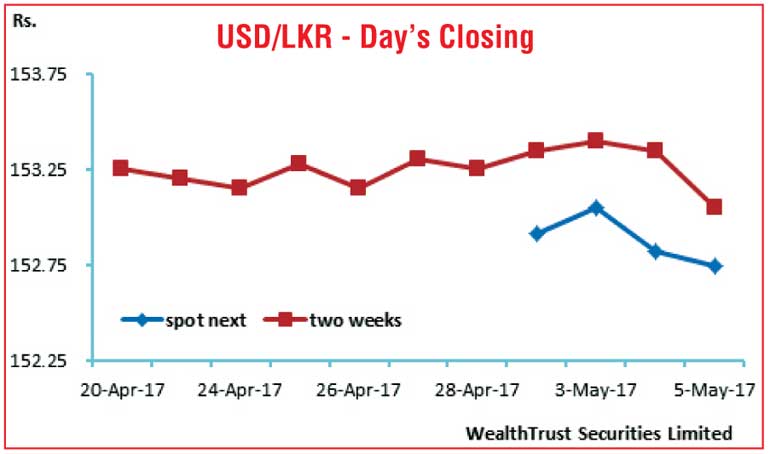

The rupee on spot next contracts closed the week higher at Rs. 152.60/75 against its week’s opening levels of Rs. 152.90/93 on the back of expected dollar inflows.

The daily USD/LKR average traded volume for the three days of the week stood at $ 75.26 million.

Some of the forward dollar rates that prevailed in the market were one month - 153.35/50; three months - 155.30/50 and six months - 158.20/30.