Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 25 January 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

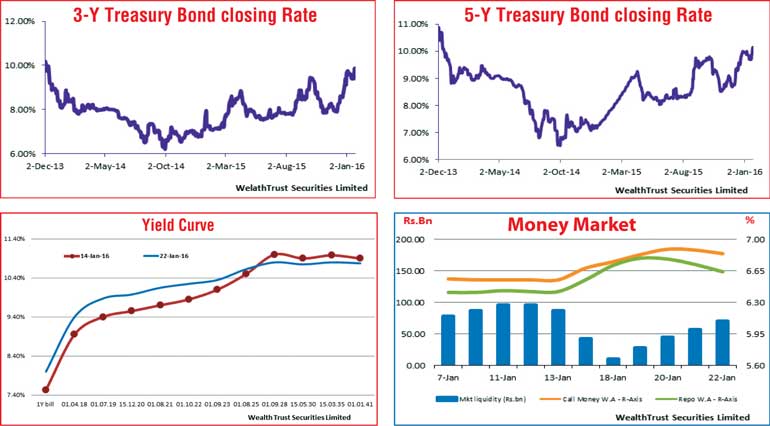

In a rare and unusual development, the secondary market bond yield curve witnessed an aggressive flattening out during the week ending 22 January, reversing a steepening trend witnessed over the previous few weeks.

In a rare and unusual development, the secondary market bond yield curve witnessed an aggressive flattening out during the week ending 22 January, reversing a steepening trend witnessed over the previous few weeks.

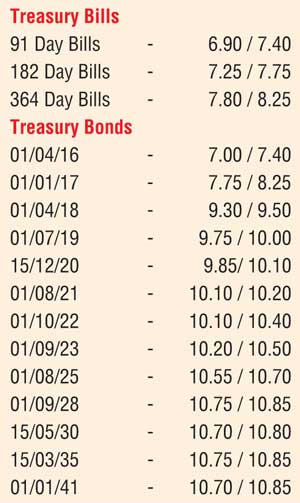

Selling interest on the short end to the belly end of the yield curve by foreign and local market participants saw yields increase by 45 basis points to 75 basis points while buying interest on the long end of the curve by a selected few parties and related parties saw yields dip by 10 to 25 basis points. The yields on the three year bond maturities of 2019’s and the five year maturities of 2021’s were seen hitting over two year highs of 9.99% and 10.15% respectively against its weeks opening lows of 9.45% and 9.65%.

The steep increase in the weighted averages at the weekly Treasury bill auction contributed to this development further. On the short end of the yield curve, April, June and August 2016 maturities were seen hitting weekly highs of 7.75%, 7.80% and 7.90% respectively.

In money markets, overnight call money and repo rates increased during the week ending 22 January, to average 6.84% and 6.73% respectively as average surplus liquidity stood at Rs. 42.29 billion for the week against its previous week’s average of Rs. 80.33 billion.

However, overnight rates decreased marginally towards the later part of the week as surplus liquidity was seen increasing gradually on the back of term repo maturities not been re auctioned.

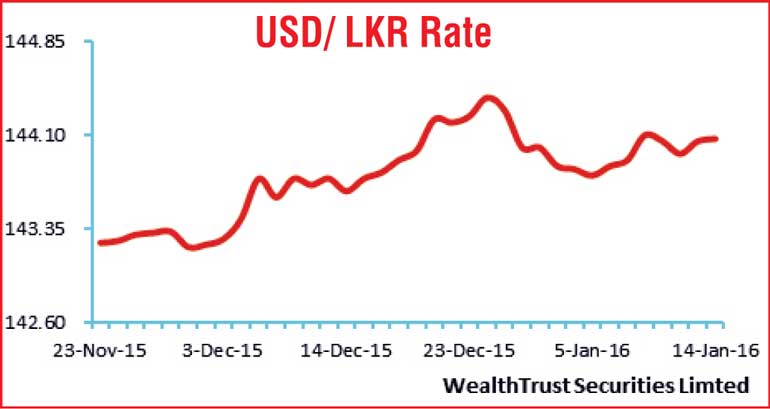

Rupee dips marginally during week

The USD/LKR rate on spot contracts was seen closing the week at Rs. 143.99/15 against its previous week’s closing of Rs. 143.85/95 on the back of foreign selling in Rupee bonds, importer demand and a slowdown in inward remittances. The daily USD/LKR average traded volume during the first four days of the week stood at $ 61.01 million. Given are some forward dollar rates that prevailed in the market:

1 month - 144.70/75

3 months - 145.80/00

6 months - 147.60/80