Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 16 December 2015 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weighted average at yesterday’s 19.03 year bond auction of 15.03.2035 was seen increasing by 36 basis points (bp) to 10.86% against its previously recorded average while the weighted average on the 9.07 year maturity of 01.08.2025 was seen recording 10.36%, higher than market expectations but 2 bp lower than its previous average. All bids received for the five year maturity of 15.12.2020 were rejected while a total amount of Rs. 15.5 billion was accepted at the auction against a total offered amount of Rs. 10 billion on all three maturities. The total bids to offer ratio (Total bids received against total offered amount) was at 5.26:1 against 5.98:1 recorded at the previous auction round on 27 November.

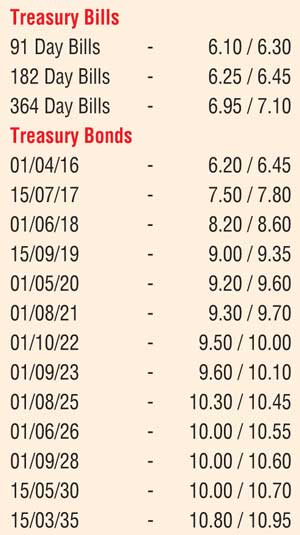

In secondary market bonds yesterday, two-way quotes on the belly end of the curve was seen widening further yesterday following the outcome of the bond auctions while the two auctioned maturities saw more active and narrower quotes. Transactions were at a standstill ahead of today’s weekly Treasury bill auction at where a total amount of Rs. 20 billion will be on offer consisting of Rs. 3 billion on the 91 day, Rs. 7 billion on the 182 day and Rs. 10 billion on the 364 day maturities. At last week’s auction, weighted averages increased across the board to record 6.10%, 6.35% and 6.92% respectively.

Meanwhile in money markets, surplus liquidity increased to Rs. 75.65 billion yesterday as call money and repo rates were seen increasing marginally to 6.35% and 6.07% respectively. Furthermore, Central Bank’s Standing Lending Facility Rate (SLFR) of 7.50% was seen been accessed for the first time yesterday since 2 October for an amount of Rs. 1.38 billion.

The USD/LKR rate in Forex markets on spot contracts was seen closing the day at levels of Rs. 143.40/80 against its previous day’s closing level of Rs. 143.60/90 subsequent opening high of Rs. 143.75/95. The total USD/LKR traded volume for 14 December was US $ 27.35 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.00/30; 3 Months - 145.00/20 and 6 Months - 146.10/30.