Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 3 August 2017 00:43 - - {{hitsCtrl.values.hits}}

Secondary market bond yields follow suit

By Wealth Trust Securities

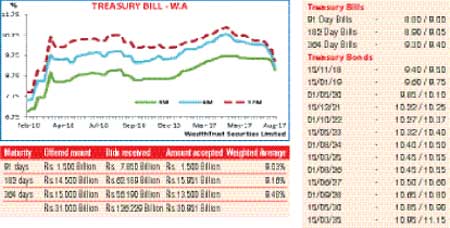

The weighted averages at yesterday’s weekly Treasury bill auction were seen decreasing significantly to 17-month lows on the 182 day and 364 maturities while continuing its declining trend for a fifth consecutive week.

The 182-day bill recorded the sharpest decline of 55 basis points to 9.16% while the 91-day and 364-day bills decreased by 41 and 51 basis points respectively to 9.03% and 9.48%. The total offered amount of Rs. 31 billion was almost met at the auction as the bid to offer ratio stood at 4.07:1.

Activity in the secondary bond market continued to remain high yesterday as yields on the liquid maturities of the three 2021’s (i.e. 01.03.21, 01.08.21 and 15.12.21), 01.07.22, 15.05.23, 15.03.25, 01.08.26 and 15.05.30 were seen decreasing to hit intraday lows of 10.19%, 10.21%, 10.20%, 10.35%, 10.32%, 10.47%, 10.48% and 10.83% respectively on the back of increased buying interest. In secondary market bills, January and July 2018 bills were seen trading at lows of 9.00% and 9.35% to 9.40% respectively subsequent to auction results.

This was ahead of today’s monetary policy announcement, due at 7.30 am and its fifth for the year 2017. The Central Bank of Sri Lanka last increased its policy rates by 25 basis points at the monetory policy meeting held in March 2017.

The total secondary market Treasury bond transacted volume for 1 August 2017 was Rs. 11.96 billion.

In the money market, the OMO Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 4.7 billion at a weighted average of 7.38%, by way of an overnight repo auction as the net surplus liquidity in the system increased further to Rs. 27.13 billion. The overnight call money and repo rates remained mostly unchanged to average 8.72% and 8.78% respectively.

Rupee remains

mostly unchanged

The USD/LKR rate on spot contracts remained mostly unchanged yesterday to close the day at Rs. 153.45/55.

The total USD/LKR traded volume for 1 August 2017 was $ 92.15 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 154.25/35; three months - 155.75/85 and six months - 158.75/85.