Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 22 December 2015 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

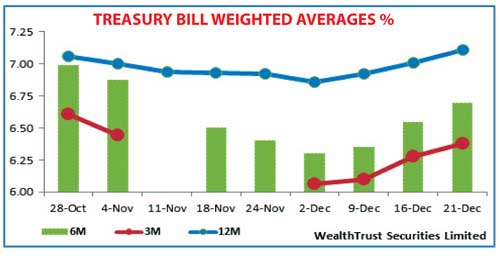

The upward trend in weighted averages at the weekly Treasury bill auction continued for a third consecutive week, with the 182 day bill recording the highest increase of 15 basis points to 6.69%. The 91 day and 364 day maturities increased by 10 basis points each to 6.38% and 7.11% respectively. As witnessed over the last three weeks, the 91 day bill continued to lead the auction as it represented 43.76% of the total accepted amount of Rs. 9.9 billion, which in turn was Rs. 10.1 billion below the total offered amount of Rs. 20 billion.

Meanwhile, in secondary bills markets, the November 2016 bills were offered at highs of 7.15% subsequent to the auction results.

In secondary bond markets, activity remained dull with most market participants being on the sidelines.

In the money market, overnight call money and repo rates remained mostly unchanged to average 6.40% and 6.23% respectively as  surplus liquidity stood at Rs. 73.11 billion. The Open Market Operations (OMO) department of the Central Bank was seen mopping up an amount of Rs. 1.52 billion on an overnight basis at a weighted average of 6.13%. Rupee remains mostly unchanged.

surplus liquidity stood at Rs. 73.11 billion. The Open Market Operations (OMO) department of the Central Bank was seen mopping up an amount of Rs. 1.52 billion on an overnight basis at a weighted average of 6.13%. Rupee remains mostly unchanged.

The USD/LKR on spot contracts remained broadly steady to close the day at Rs. 143.60/70.

The total USD/LKR traded volume for 18 December was US $ 93.55 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.25/35; 3 Months - 145.15/30 and 6 Months - 146.30/50.