Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 17 August 2017 00:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

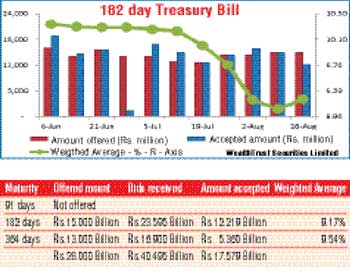

The weekly weighted averages were seen increasing for the first time in 17 weeks yesterday, reversing a downward trend witnessed previously.

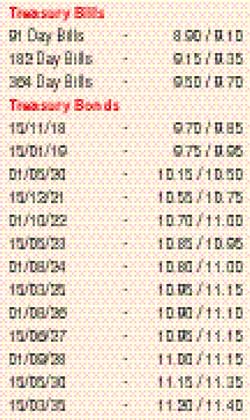

The 364-day bill recorded the highest increase of 16 basis points to 9.54%, closely followed by the 182-day bill by 15 basis points to 9.17%. The total accepted amount was seen dipping to a seven-week low of Rs. 17.57 billion as the bids to offer ratio were seen hitting a 22-week low of 1.45:1.

The selling interest witnessed in the secondary bond market over the previous few days continued yesterday as well, driving yields up which was further backed by the outcome of the weekly auction. A limited amount of activity was witnessed on the maturities of 15.11.18, 01.03.21 and 01.05.21 within the range of 9.65%-9.70%, 10.45%-10.50% and 10.60%-10.68% with quotes widening towards the latter part of the day. The total secondary market Treasury bond transacted volume for 15 August was Rs. 15.15 billion.

In money markets, overnight call money and repo rates averaged 8.58% and 8.42% respectively as the net surplus liquidity in the system stood at Rs. 11.58 billion yesterday. The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka drained out an amount of Rs. 0.07 billion on an overnight basis at a weighted average of 7.28%.

Rupee appreciates marginally

The USD/LKR rate on spot contracts was seen gaining to close the day at Rs. 153.15/22 against its previous day’s closing of Rs. 153.15/25 on the back of export conversions outpacing importer demand. The total USD/LKR traded volume for 15 August was $ 14.75 million.