Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 22 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

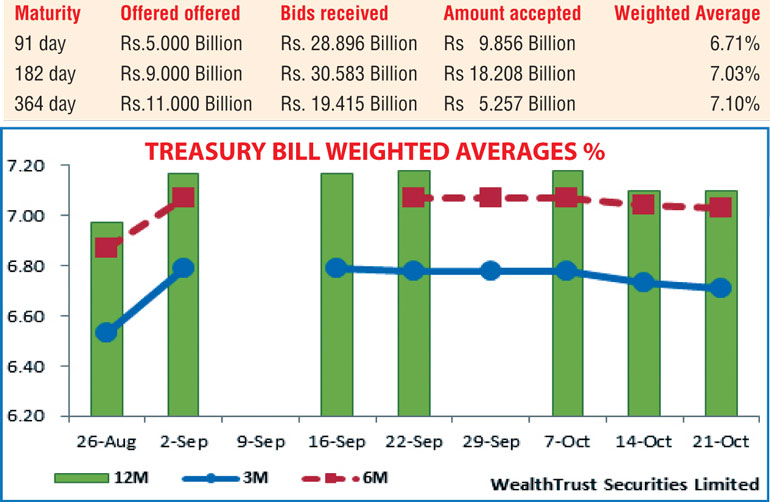

The weighted averages (W.Avg) at yesterday’s Treasury bill auction dipped for a second consecutive week with the 91 day reflecting a two basis point (bp) drop to 6.71% while the 182 day dipped by one bp to 7.03%.

The W.Avg on the 364 day bill remained unchanged at 7.10% as the total accepted amount was seen exceeding the total offered amount for the first time in four weeks. Furthermore, the total accepted amount was seen hitting a 23-week high of Rs 33.32 billion with the 182 day bill representing 54.62% of this volume.

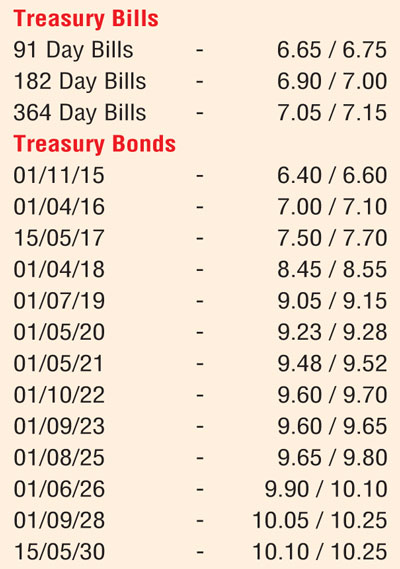

In secondary bond markets, activity remained high within a narrow range as yields were seen dipping in morning hours of trading mainly on the two 2018s (i.e. 1 April 2018 and 15 November 2018), the two 2019s (i.e. 1 July 2019 and 15 September 2019), the 1 May 2020, the two 2021s (i.e. 1 Ma

y 2021 and 1 August 2021), the 01.10.22 and the 01.09.23 to daily lows of 8.50%, 8.65%, 9.10%, 9.08%, 9.18%, 9.45% each, 9.60% and 9.55% respectively. However, profit taking at these levels post auction saw yields increase once again to daily highs of 8.55%, 8.75%, 9.13%, 9.15%, 9.25%, 9.51%, 9.50%, 9.65% and 9.60%.

y 2021 and 1 August 2021), the 01.10.22 and the 01.09.23 to daily lows of 8.50%, 8.65%, 9.10%, 9.08%, 9.18%, 9.45% each, 9.60% and 9.55% respectively. However, profit taking at these levels post auction saw yields increase once again to daily highs of 8.55%, 8.75%, 9.13%, 9.15%, 9.25%, 9.51%, 9.50%, 9.65% and 9.60%.

Meanwhile in money markets, overnight call money and repo rates decreased to average 6.35% and 6.28% respectively as surplus liquidity stood at Rs. 66.74 b yesterday.

Rupee remains steady

The dollar/rupee rate remained mostly unchanged within the range of Rs. 141.00/10 yesterday as markets were at equilibrium. The total USD/LKR traded volume for 20 October was $ 68.60 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 141.60/65; three months – 142.65/80 and six months – 144.25/40.