Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 15 December 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

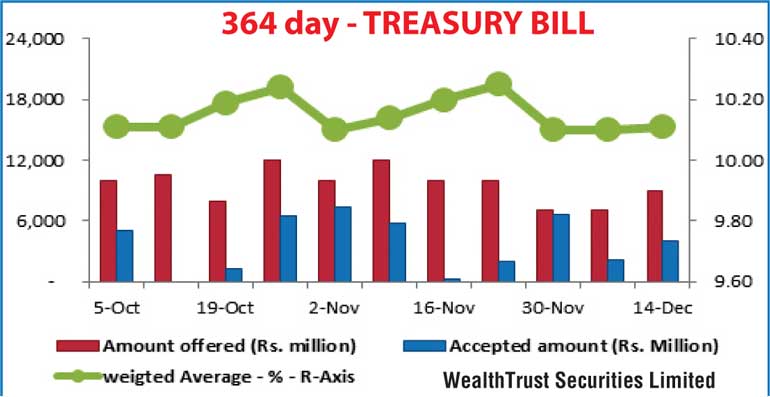

Continuing with the recent trend, the total accepted amount was seen falling short of the total offered amount for an eleventh consecutive week at the weekly Treasury bill auction held yesterday. The shortfall on the accepted amount was Rs.17.8 billion against its total offered amount of Rs.24 billion.

The 364 day bill weighted average was seen increasing by 01 basis point to 10.11% while the average on the 182 day bill remained unchanged at 9.56%. All bids received on the 91 day bill were rejected. The total bids to offer ratio was seen dipping to a three week low of 1:1.70 once again.

Meanwhile, activity in secondary bond market continued to remain broadly dull with a limited amount of movement witnessed on the two 2024 maturities (i.e. 01.01.24 and 01.08.24) as its yields were seen edging up from a daily low of 12.48% and 12.45% respectively to a high of 12.55% each. In money markets, the overnight call money and repo rates increased marginally to average 8.42% and 8.66% respectively as the net liquidity shortfall stood at Rs.18.17 billion yesterday. The OMO department of Central Bank was seen injecting in total an amount of Rs.3.50 billion by way of three outright purchase of Treasury bills at weighted average rates of 9.67%, 9.95%, and 9.79% for durations of 239, 246 and 260 days respectively.

Rupee remains mostly unchanged

Meanwhile in Forex markets yesterday, the USD/LKR rate on spot next contracts were seen trading within the range of Rs.148.95 to Rs.149.00 against its previous day’s closing levels of 148.90/92. The total USD/LKR traded volume for 9 November was $ 162.93 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 149.70/80; three months – 151.15/35; six months - 153.45/70.