Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 5 December 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

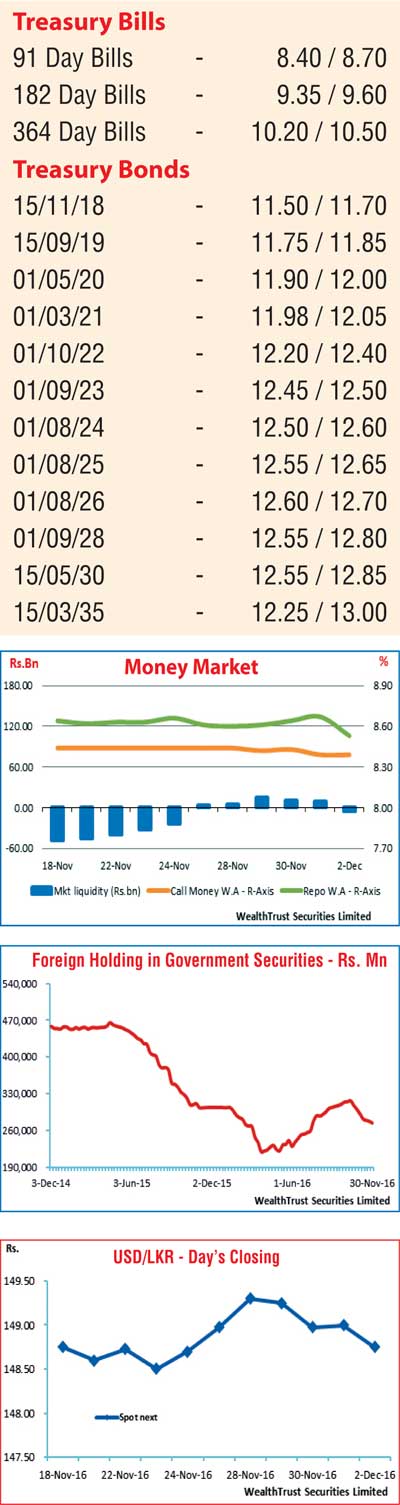

The week ending 2 December saw secondary market bond yields see saw, decreasing during the early part of the week and increasing once again towards the later part on the back of continued foreign selling interest. Buying interest flew into markets following Central Banks monetary policy decision, at where policy rates were kept unchanged for a fourth consecutive month which led to yields on the liquid maturities of 15.09.19, 01.08.24 and 01.08.25 decreasing to weekly lows of 11.60%, 12.50% and 12.58% respectively.

This trend was further supported by the outcome of the weekly Treasury bills auction at where weighted averages declined for the first time in four weeks. However foreign selling interest mainly on the short end maturities of 2018, 2019 and 2021 to highs of 11.60%, 11.85% and 12.19% on the back of considerable volumes changing hands led to secondary market yields increasing once again towards the later part of the week.

The foreign holding in Rupee bonds was seen reducing by Rs. 3.1 billion during the week ending 30 November, recording its seventh consecutive week of outflows.

In money markets, the overnight call money and repo rates remained mostly unchanged to average at 8.41% and 8.61% respectively for the week as market liquidity increased to a net surplus of Rs. 6.90 billion for the week against its last week shortfall of Rs. 27.57 billion. The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka continued to mop up liquidity by way of overnight repo auctions at weighted averages of 7.40% to 7.50%.

Rupee closes stronger

The active spot next contracts were seen dipping to lows of Rs. 149.25/35 during the week against its previous weeks closing level of Rs. 148.95/00 before bouncing once again to close the week at Rs. 148.70/80. The daily USD/LKR average traded volume for the first four days of the week stood at $ 56.39 million.

Some of forward dollar rates that prevailed in the market were one month – 149.85/90; three months – 151.10/30 and six months – 153.45/55.