Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 30 November 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

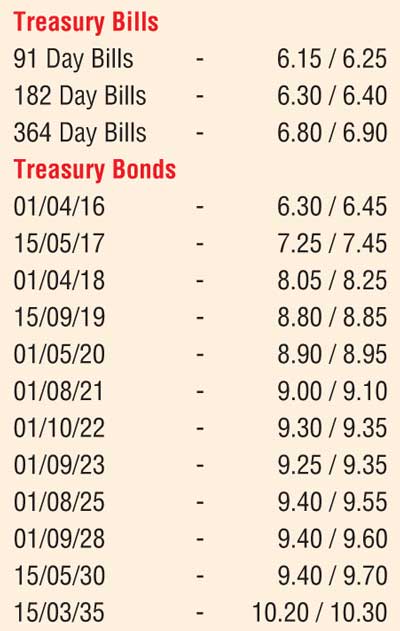

The week ending 27 November saw secondary market bond yields see saw, increasing during the early part of the week and dipping once again towards the latter part on back of the bullish outcomes at the primary auctions. Selling interest during the early part of the week saw yields on the liquid maturities of 15.09.2019, 01.05.2020, 01.08.2021, 01.10.2022 and 01.09.2023 increase to weekly highs of 8.95%, 9.05%, 9.15% and 9.50% each respectively.

However following the outcome of the weekly Treasury bill auction and the Treasury bond auctions, at where weighted averages declined in comparison to its previously recorded averages, secondary market yields declined on the back of buying interest once again. This in turn saw yields dip to weekly lows of 8.80%, 8.90%, 9.05%, 9.35% and 9.30% respectively on the above given liquid maturities. In addition on the long end of the curve, the 15.03.2035 maturity was seen changing hands within a weekly low of 9.90% to a high of 10.35%.

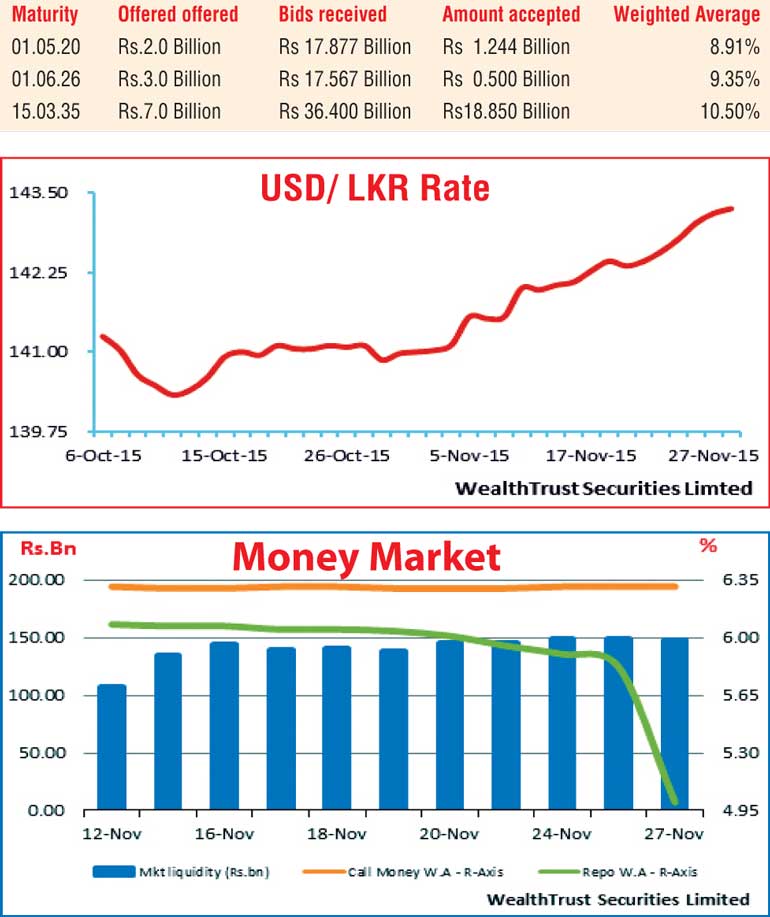

At the Treasury bond auctions conducted on Friday, the 4.05 year maturity of 01.05.2020, the 10.06 year maturity of 01.06.2026 and the 19.03 year maturity of 15.03.2035 saw its weighted averages dip by 08 basis points (bp), 99 bp and 63 bp respectively to 8.91%, 9.35% and 10.50% respectively against its previously recorded weighted averages. A total sum of Rs 20.50 billion was accepted against its total offered amount of Rs. 12 billion. In addition, continued demand for secondary market bills saw the 182 day bill change hands within the range of 6.30% to 6.35% and the 364 day bills within 6.85% to 6.90% during the week.

Meanwhile in money markets, the overnight repo rate decreased further to average 5.67% for the week ending 27 November in comparison to its previous week’s average of 6.04% as average surplus liquidity increased further to Rs. 148.12 billion. The overnight call money rate remained steady to average 6.31%.

Rupee hits fresh low during the week

In Forex markets during the week, the rupee rate on spot contracts depreciated further to hit a fresh low of Rs. 143.10 during the week against its previous week’s closing of Rs. 142.50/60 on the back of continued importer demand. The daily USD/LKR average traded volume for the first three days of the week stood at $ 52.26 million.

Some of the forward dollar rates that prevailed in the market were one month – 143.60/70; three months – 144.30/50 and six months – 145.50/80.