Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 11 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

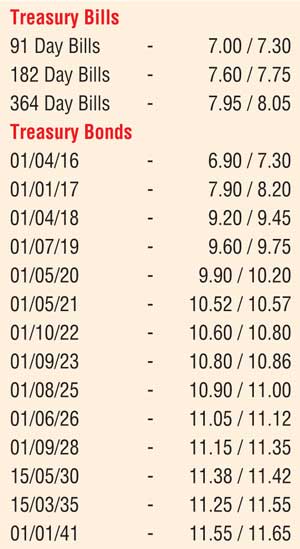

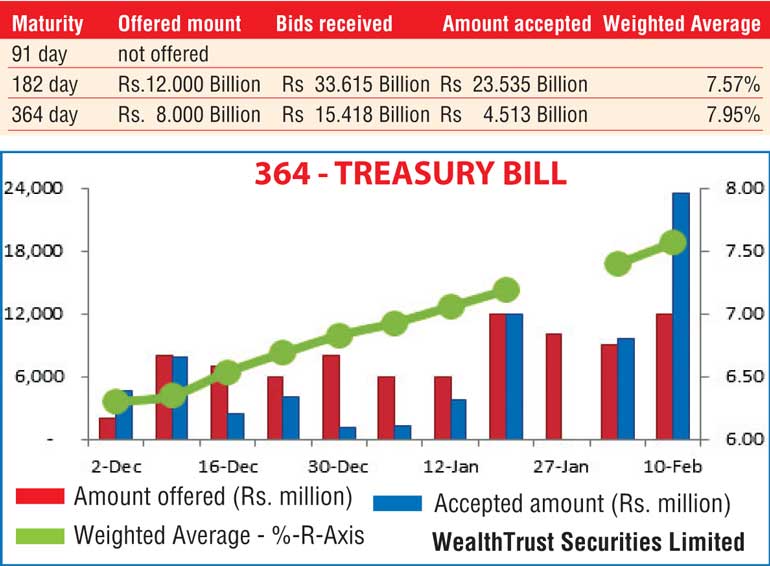

The weighted averages at yesterday’s weekly Treasury bill auction continued to increase for a ninth consecutive week as its total accepted amount exceeded Rs.28 billion for a second consecutive week. It was the 182 day bill which reflected the highest accepted amount of Rs.23.53 billion or 84% of the total accepted amount with its weighted average increasing by 17 basis points to 7.57% as the 91 day bill was not on offer. The weighted average on the 364 day maturity increased by 08 basis points to 7.95%.

In the secondary bond market yesterday, foreign selling interest on the two 2021 maturities (I.e. 01.05.2021 & 01.08.2021) and the 01.09.2023 maturity saw its yields increase to intraday highs of 10.53% each and 10.85% respectively against its days opening lows of 10.45% each and 10.78%. However continued buying interest on the long end of the curve saw the 01.06.2026 and 15.05.2030 maturities change hands within the range of 11.03% to 11.08% and 11.37% to 11.43% respectively as well. In secondary bill markets, the 182 day and 364 day bills were quoted at levels of 7.60/75 and 7.95/05 respectively, post auction.

Meanwhile in money markets, the surplus liquidity of Rs.48.16 billion saw overnight call money and repo rates averaging at 6.81% and 6.37% respectively yesterday.

One week forward contracts edge down further

The USD/LKR rate on one week forward contracts was seen edging down further yesterday to Rs.144.35/40 against its previous day’s closing of Rs.144.32/35 on the back of continued importer demand whiles the spot rate remained steady to close the day at Rs.143.95/20. The total USD/LKR traded volume for the 09th of February 2016 was US $ 50.51 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.80/85; 3 Months - 145.00/25 and 6 Months - 147.70/90.