Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 22 October 2015 00:00 - - {{hitsCtrl.values.hits}}

Union Bank’s third quarter financial results of 2015, highlights the bank’s continuing progress in its swift transition to a fully-fledged Commercial Bank with wider focus on retail, corporate and SME sectors. The impressive third quarter results reflect the success of the rapid expansion initiatives implemented by the Bank following the land mark investment from TPG, one of the largest global private investment firms.

Union Bank’s expansion initiatives highlighted remarkable upward momentum with the island-wide branch network increasing to 63 branches by the end of the third quarter. The bank’s fast growing ATM reach expanded across 13 new off-site ATM locations within the quarter, sizing up the total ATM reach of the bank to 94 ATMs delivering convenience of easy account access island-wide. In line with the bank’s mandate to deliver greater banking convenience to customers, 15 existing branches were remodelled within the three months ended in September 2015, unveiling a new look and providing a redefined banking experience to customers.

Enhancing and adding value to the bank’s product portfolio is an integral part of its development strategy. In the third quarter of 2015, the bank added yet another pragmatic feature to its fast growing retail portfolio, with the launch of the Union Bank VISA International Debit Card. Introduced in both Platinum and Classic, the Union Bank VISA Debit card incorporates an extensive range of features and benefits, enabling cardholders to access not only unique and attractive offers and discounts, but also making online shopping and bill payments absolutely convenient.

Marking another milestone in retail banking, Union Bank was conferred the ‘Speed to Market Award 2015’ at the Visa Client Forum India and South Asia in recognition of the speed and success of the Debit Card launch.

The focus of building a strong corporate and SME portfolio was accelerated on the back of many new customer relationships established in this quarter. Strengthening of credit under-writing processes, and centralisation of operational processes were also implemented during the quarter under review.

An integrated communication campaign launched mid-year, was continued within the third quarter as part of the strategy to build stronger corporate brand equity under the premise ‘Make the rest of your life the best of your life with Union Bank’. The campaign has continued to deliver greater brand awareness for the Bank and has supported the efforts to position Union Bank as a fully-fledged Commercial Bank serving financial needs of a diverse clientele.

Commenting on the performance of the bank, Union Bank Director/CEO Indrajit Wickramasinghe stated “We have continued to strengthen our growth impetus within the third quarter of 2015, while reaping benefits of investments made in strategic restructuring, operational efficiency and the implementation of strategic development initiatives. The impressive results of the bank are an affirmation of the rapid growth momentum the bank has gathered within this year, and signal continued progress along this growth trajectory towards becoming one of the leading private sector banking institutions in Sri Lanka. We will continue to invest in expanding customer reach, both through brick and mortar branches and alternate channels, bringing greater convenience and access.

“The bank will enhance its investment in building brand equity with a strong national presence, and a value added product range serving the diverse sectors of this economy. Union Bank is now poised for accelerated growth with which we hope to deliver continuous value propositions and benefits to our customers with novel products while continuing to deliver on our premise for greater convenience.”

Q3 financial performance highlights

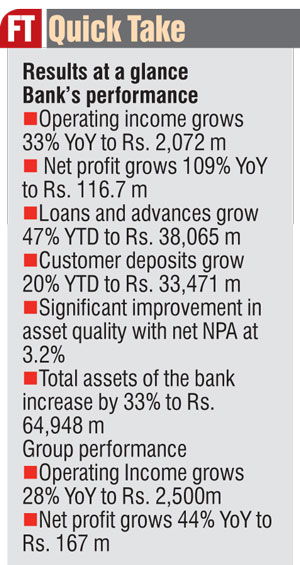

The bank recorded a significant increase in revenues for the period in comparison to the corresponding period in 2014. Total operating income grew by 33% year-on-year to Rs. 2,072 m. The primary reason being the focused growth in loans and advances, along with the better management of yields and the quality of the loan book.

Net interest income of the bank grew by 32% to report Rs. 1,537 m for the period. Fees and other operating income of the bank grew by 36% in comparison to the corresponding reporting period in 2014 to report Rs. 535 m.

The Group also recorded a significant increase in revenues for the period in comparison to the corresponding period in 2014. Total operating income of the Group grew by 28% year-on-year to Rs. 2,500 m. This is mainly due to the Group’s strong net interest income growth of 40% reported during the period.

Showing a significant improvement in the quality of the portfolio, impairment charges of the bank showed a reduction of 51% in comparison to the corresponding period. This is a reduction of Rs. 142 m in comparison to 2014 while the Group reported a 33% reduction in impairment charges for the period.

Operating expenses increased by 44% to Rs. 1,706 m; mainly due to investments in staff, customer reach expansion and technology; in keeping with the planned strategic initiatives that have taken place in the bank. Operating expenses of the Group showed a 40% increase due to similar reasons.

The bank reported a profit before tax and financial services VAT of Rs. 230 m for the period. This is a 141% increase in comparison to Rs. 95 m in 2014. Furthermore the bank reported a net profit after tax of Rs. 116.7 m for the period up 109% year-on-year. The Group reported a profit after tax of Rs. 167 m in comparison to Rs. 116 m in 2014. This is a 44% increase.

Loans and advances of the bank continued to show a strong growth and reported a year to date growth of 47%. Loan book stood at Rs. 38,065 m in comparison to Rs. 25,945 m in December 2014. As a result of this total assets of the bank grew by 33% to Rs. 64,948 m.

The customer deposits of the bank increased by 20% since December to Rs. 33,471 m. Total assets of the Group showed a 33% year-to-date increase to Rs. 69,650 m.

The shareholders’ funds of the bank stood at Rs. 16.9 b as at 30 September 2015. The bank is well capitalised and reported a core capital adequacy ratio of 28.29% and total capital adequacy ratio of 27.77% as at the reporting date.

The strong focus on portfolio quality and improved credit underwriting have resulted in a significant improvement in its asset quality, the bank’s net NPAs as at the reporting date stood at 3.2% in comparison to 7.44% in December 2014.